- China

- /

- Electrical

- /

- SZSE:300763

3 Asian Growth Companies With Insider Ownership Expecting Up To 126% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate the complexities of trade negotiations and economic uncertainties, Asian equities have shown resilience, with key indices like China's CSI 300 and Japan's Nikkei 225 posting gains amid positive trade developments. In this environment, growth companies with high insider ownership in Asia present intriguing opportunities, as they often reflect strong internal confidence and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Sineng ElectricLtd (SZSE:300827) | 36% | 29.0% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.3% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 44.2% |

| Schooinc (TSE:264A) | 26.6% | 68.9% |

| M31 Technology (TPEX:6643) | 30.8% | 63.4% |

| Oscotec (KOSDAQ:A039200) | 21.1% | 85.9% |

| giftee (TSE:4449) | 34.5% | 67.1% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

| Techwing (KOSDAQ:A089030) | 18.8% | 65% |

Let's uncover some gems from our specialized screener.

TUHU Car (SEHK:9690)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: TUHU Car Inc. operates as an integrated online and offline platform for automotive services in China, with a market cap of approximately HK$15.16 billion.

Operations: The company generates revenue from its online retailers segment, amounting to CN¥14.76 billion.

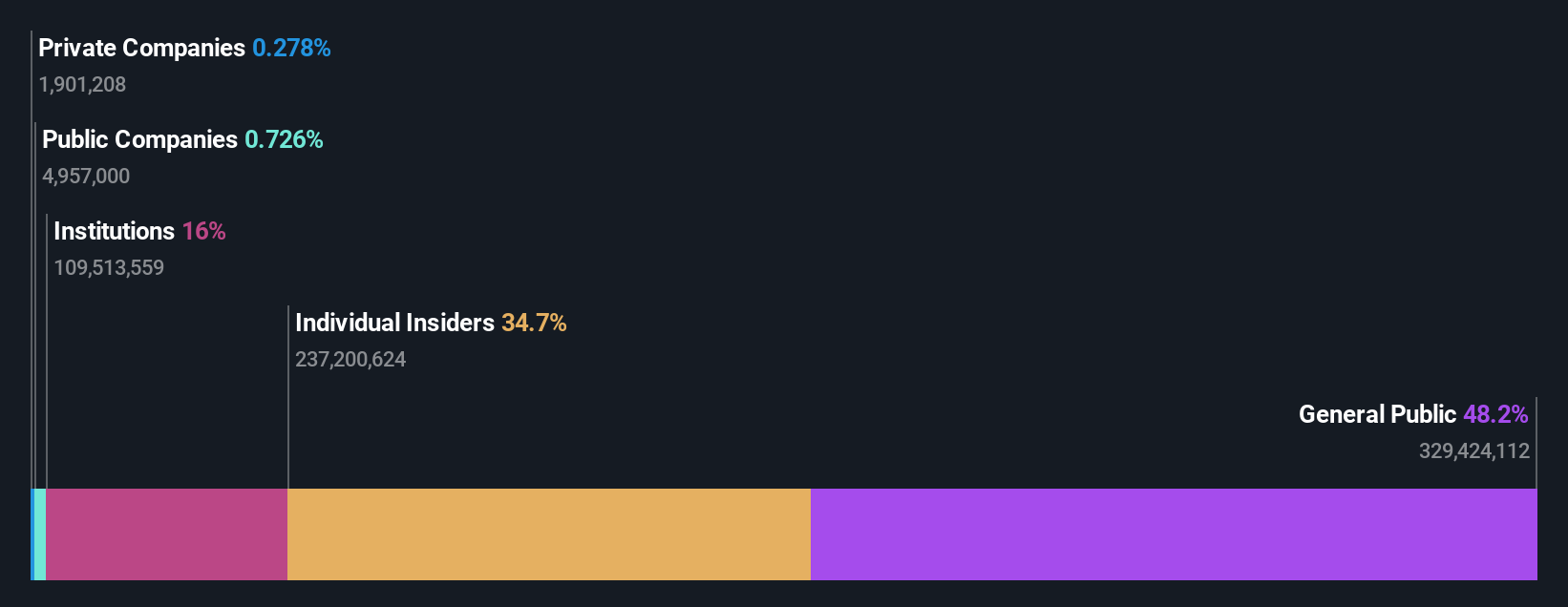

Insider Ownership: 16.1%

Earnings Growth Forecast: 24.1% p.a.

TUHU Car's earnings are forecast to grow significantly at 24.1% annually, outpacing the Hong Kong market. However, its revenue growth is expected to be moderate at 9.3% per year. The company's stock trades well below its estimated fair value, suggesting potential upside for investors. Despite a sharp decline in profit margins and net income over the past year, insiders have not engaged in substantial buying or selling recently, indicating stability in insider sentiment.

- Unlock comprehensive insights into our analysis of TUHU Car stock in this growth report.

- Our valuation report here indicates TUHU Car may be overvalued.

Jiangsu Lopal Tech (SHSE:603906)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Lopal Tech Co., Ltd. focuses on the R&D, production, and sale of lithium iron phosphate cathode materials and environmental protection fine chemicals for vehicles, with a market cap of CN¥6.99 billion.

Operations: The company's revenue primarily stems from its involvement in the development and sale of lithium iron phosphate cathode materials and vehicle-related environmental protection fine chemicals.

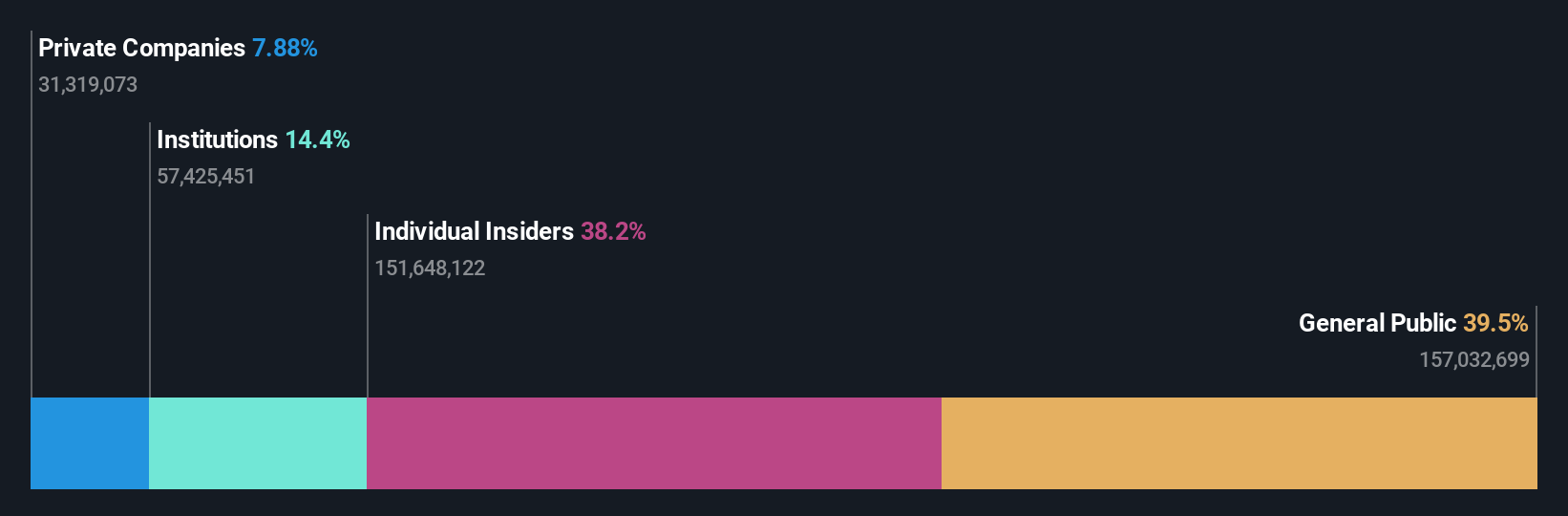

Insider Ownership: 35.8%

Earnings Growth Forecast: 126.4% p.a.

Jiangsu Lopal Tech is projected to achieve robust revenue growth of 29% annually, surpassing the Chinese market average. Despite recent losses, earnings are expected to grow significantly at 126.4% per year, with profitability anticipated within three years. The company trades at a favorable valuation compared to peers. Recent auditor changes and accounting policy updates align with national standards, ensuring compliance without impacting financial stability or shareholder interests significantly.

- Delve into the full analysis future growth report here for a deeper understanding of Jiangsu Lopal Tech.

- Insights from our recent valuation report point to the potential undervaluation of Jiangsu Lopal Tech shares in the market.

Ginlong Technologies (SZSE:300763)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Ginlong Technologies Co., Ltd. is involved in the research, development, production, service, and sale of string inverters worldwide and has a market cap of CN¥22.76 billion.

Operations: Ginlong Technologies Co., Ltd. generates revenue primarily through its global activities in the research, development, production, service, and sale of string inverters.

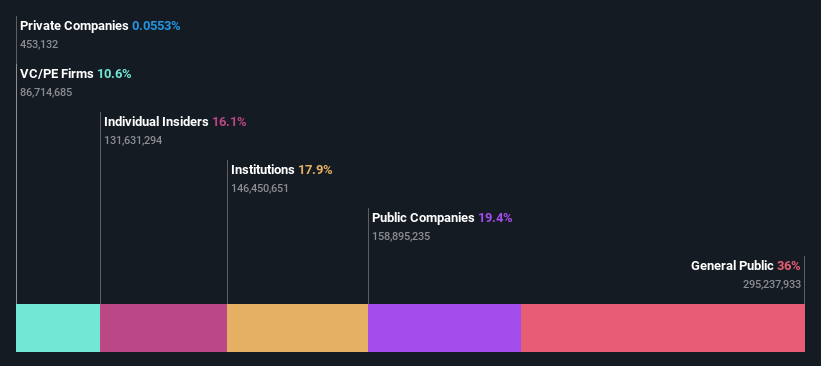

Insider Ownership: 38.2%

Earnings Growth Forecast: 23.6% p.a.

Ginlong Technologies demonstrates strong growth potential with earnings increasing by 82% last year and forecasted to grow at 23.6% annually, outpacing the Chinese market. Despite a high debt level, it trades at a favorable price-to-earnings ratio of 26.3x compared to the market's 37.7x. Recent earnings reported net income of CNY 194.7 million, significantly up from CNY 20.29 million the previous year, indicating robust financial performance amidst insider ownership stability.

- Take a closer look at Ginlong Technologies' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Ginlong Technologies is trading behind its estimated value.

Seize The Opportunity

- Click this link to deep-dive into the 616 companies within our Fast Growing Asian Companies With High Insider Ownership screener.

- Looking For Alternative Opportunities? This technology could replace computers: discover the 22 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300763

Ginlong Technologies

Engages in the research, development, production, service, and sale of string inverters worldwide.

Solid track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives