- Hong Kong

- /

- Professional Services

- /

- SEHK:8462

Omnibridge Holdings Limited (HKG:8462) Might Not Be As Mispriced As It Looks After Plunging 27%

Omnibridge Holdings Limited (HKG:8462) shareholders that were waiting for something to happen have been dealt a blow with a 27% share price drop in the last month. Indeed, the recent drop has reduced its annual gain to a relatively sedate 5.2% over the last twelve months.

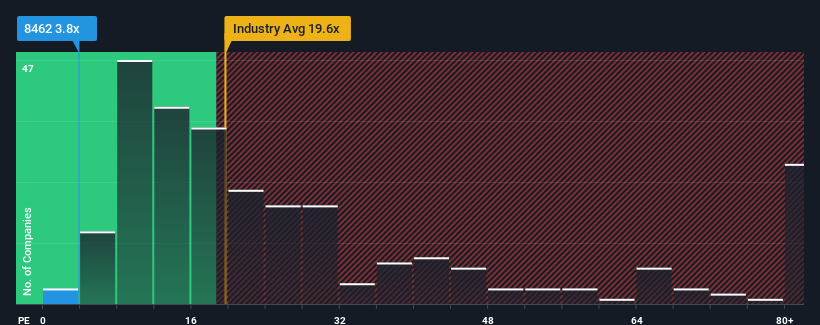

In spite of the heavy fall in price, Omnibridge Holdings may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 3.8x, since almost half of all companies in Hong Kong have P/E ratios greater than 10x and even P/E's higher than 19x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

The earnings growth achieved at Omnibridge Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/E is low because investors think this respectable earnings growth might actually underperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

See our latest analysis for Omnibridge Holdings

Does Growth Match The Low P/E?

Omnibridge Holdings' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 15% last year. This was backed up an excellent period prior to see EPS up by 163% in total over the last three years. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

In light of this, it's peculiar that Omnibridge Holdings' P/E sits below the majority of other companies. Apparently some shareholders believe the recent performance has exceeded its limits and have been accepting significantly lower selling prices.

The Key Takeaway

Omnibridge Holdings' P/E looks about as weak as its stock price lately. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Omnibridge Holdings currently trades on a much lower than expected P/E since its recent three-year growth is higher than the wider market forecast. There could be some major unobserved threats to earnings preventing the P/E ratio from matching this positive performance. It appears many are indeed anticipating earnings instability, because the persistence of these recent medium-term conditions would normally provide a boost to the share price.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Omnibridge Holdings (1 is concerning!) that you need to be mindful of.

If you're unsure about the strength of Omnibridge Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8462

Omnibridge Holdings

An investment holding company, provides human resources outsourcing and recruitment services to public and private sectors in Singapore and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success