- Hong Kong

- /

- Professional Services

- /

- SEHK:8462

Benign Growth For Omnibridge Holdings Limited (HKG:8462) Underpins Stock's 33% Plummet

Omnibridge Holdings Limited (HKG:8462) shares have had a horrible month, losing 33% after a relatively good period beforehand. Longer-term, the stock has been solid despite a difficult 30 days, gaining 16% in the last year.

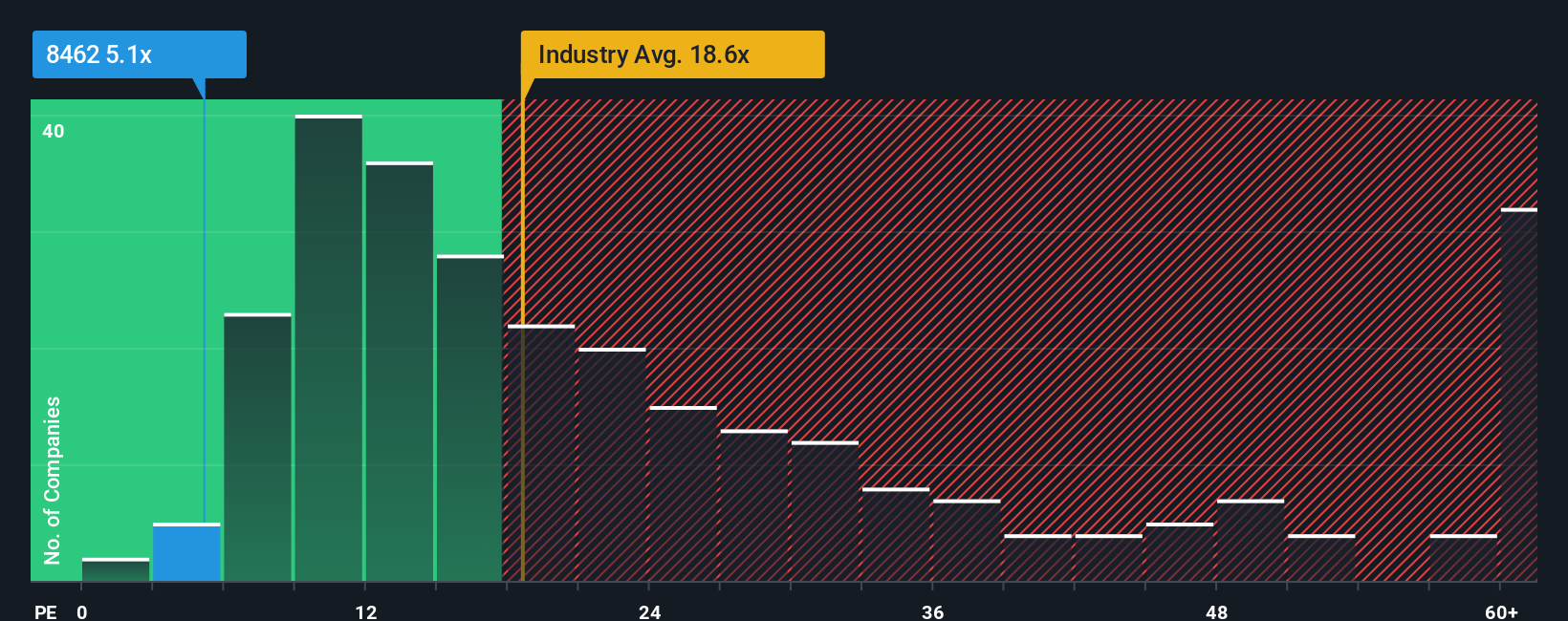

Even after such a large drop in price, given about half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") above 13x, you may still consider Omnibridge Holdings as a highly attractive investment with its 5.1x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Earnings have risen at a steady rate over the last year for Omnibridge Holdings, which is generally not a bad outcome. It might be that many expect the respectable earnings performance to degrade, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Omnibridge Holdings

How Is Omnibridge Holdings' Growth Trending?

Omnibridge Holdings' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 4.1%. However, this wasn't enough as the latest three year period has seen an unpleasant 15% overall drop in EPS. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 19% shows it's an unpleasant look.

With this information, we are not surprised that Omnibridge Holdings is trading at a P/E lower than the market. However, we think shrinking earnings are unlikely to lead to a stable P/E over the longer term, which could set up shareholders for future disappointment. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

What We Can Learn From Omnibridge Holdings' P/E?

Having almost fallen off a cliff, Omnibridge Holdings' share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Omnibridge Holdings maintains its low P/E on the weakness of its sliding earnings over the medium-term, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. If recent medium-term earnings trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 3 warning signs for Omnibridge Holdings (2 are concerning!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8462

Omnibridge Holdings

An investment holding company, provides human resources outsourcing and recruitment services to public and private sectors in Singapore and Hong Kong.

Flawless balance sheet and good value.

Market Insights

Community Narratives