- Hong Kong

- /

- Commercial Services

- /

- SEHK:8383

Does Linocraft Holdings (HKG:8383) Have A Healthy Balance Sheet?

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies Linocraft Holdings Limited (HKG:8383) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

Check out our latest analysis for Linocraft Holdings

How Much Debt Does Linocraft Holdings Carry?

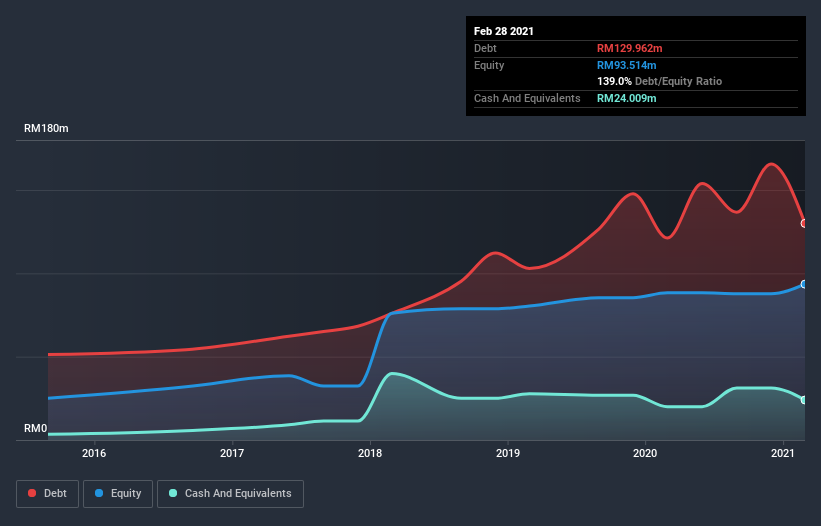

The image below, which you can click on for greater detail, shows that at February 2021 Linocraft Holdings had debt of RM130.0m, up from RM121.2m in one year. However, because it has a cash reserve of RM24.0m, its net debt is less, at about RM106.0m.

How Healthy Is Linocraft Holdings' Balance Sheet?

We can see from the most recent balance sheet that Linocraft Holdings had liabilities of RM149.8m falling due within a year, and liabilities of RM46.3m due beyond that. On the other hand, it had cash of RM24.0m and RM73.7m worth of receivables due within a year. So its liabilities total RM98.5m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of RM67.8m, we think shareholders really should watch Linocraft Holdings's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

Weak interest cover of 1.7 times and a disturbingly high net debt to EBITDA ratio of 5.6 hit our confidence in Linocraft Holdings like a one-two punch to the gut. The debt burden here is substantial. Investors should also be troubled by the fact that Linocraft Holdings saw its EBIT drop by 14% over the last twelve months. If things keep going like that, handling the debt will about as easy as bundling an angry house cat into its travel box. There's no doubt that we learn most about debt from the balance sheet. But it is Linocraft Holdings's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. During the last three years, Linocraft Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both Linocraft Holdings's net debt to EBITDA and its track record of converting EBIT to free cash flow make us rather uncomfortable with its debt levels. And furthermore, its interest cover also fails to instill confidence. We think the chances that Linocraft Holdings has too much debt a very significant. To us, that makes the stock rather risky, like walking through a dog park with your eyes closed. But some investors may feel differently. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. Case in point: We've spotted 4 warning signs for Linocraft Holdings you should be aware of, and 1 of them can't be ignored.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

When trading Linocraft Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8383

Linocraft Holdings

Linocraft Holdings Limited, an investment holding company, provides integrated offset printing and packaging solutions to direct customers and contract manufacturers in Malaysia, Singapore, and the Philippines.

Good value with mediocre balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success