- Hong Kong

- /

- Commercial Services

- /

- SEHK:8320

If You Like EPS Growth Then Check Out Allied Sustainability and Environmental Consultants Group (HKG:8320) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Allied Sustainability and Environmental Consultants Group (HKG:8320), which has not only revenues, but also profits. Now, I'm not saying that the stock is necessarily undervalued today; but I can't shake an appreciation for the profitability of the business itself. Loss-making companies are always racing against time to reach financial sustainability, but time is often a friend of the profitable company, especially if it is growing.

View our latest analysis for Allied Sustainability and Environmental Consultants Group

How Fast Is Allied Sustainability and Environmental Consultants Group Growing Its Earnings Per Share?

In a capitalist society capital chases profits, and that means share prices tend rise with earnings per share (EPS). So like the hint of a smile on a face that I love, growing EPS generally makes me look twice. It is therefore awe-striking that Allied Sustainability and Environmental Consultants Group's EPS went from HK$0.0013 to HK$0.0054 in just one year. Even though that growth rate is unlikely to be repeated, that looks like a breakout improvement.

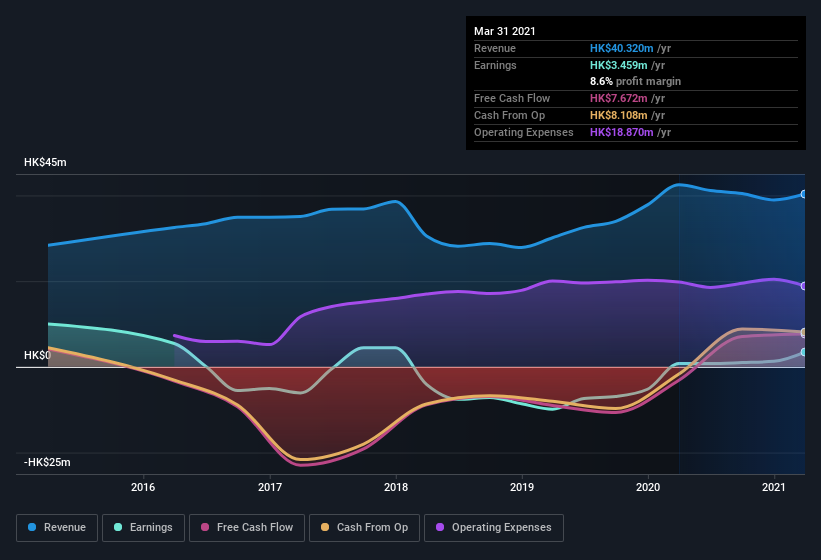

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Unfortunately, Allied Sustainability and Environmental Consultants Group's revenue dropped 5.1% last year, but the silver lining is that EBIT margins improved from 2.6% to 5.2%. That's not ideal.

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Since Allied Sustainability and Environmental Consultants Group is no giant, with a market capitalization of HK$76m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are Allied Sustainability and Environmental Consultants Group Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. Because oftentimes, the purchase of stock is a sign that the buyer views it as undervalued. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

We haven't seen any insiders selling Allied Sustainability and Environmental Consultants Group shares, in the last year. With that in mind, it's heartening that Pak kit Wu, the Executive Vice Chairman of the Board of the company, paid HK$68k for shares at around HK$0.14 each.

Should You Add Allied Sustainability and Environmental Consultants Group To Your Watchlist?

Allied Sustainability and Environmental Consultants Group's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. Growth investors should find it difficult to look past that strong EPS move. And indeed, it could be a sign that the business is at an inflection point. For me, this situation certainly piques my interest. You still need to take note of risks, for example - Allied Sustainability and Environmental Consultants Group has 4 warning signs (and 1 which can't be ignored) we think you should know about.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Allied Sustainability and Environmental Consultants Group, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

When trading stocks or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8320

Allied Sustainability and Environmental Consultants Group

An investment holding company, provides green building and environmental consulting services in Hong Kong, the People’s Republic of China, and Macau.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success