- Hong Kong

- /

- Commercial Services

- /

- SEHK:8320

Allied Sustainability and Environmental Consultants Group Limited's (HKG:8320) Stock is Soaring But Financials Seem Inconsistent: Will The Uptrend Continue?

Allied Sustainability and Environmental Consultants Group (HKG:8320) has had a great run on the share market with its stock up by a significant 53% over the last week. But the company's key financial indicators appear to be differing across the board and that makes us question whether or not the company's current share price momentum can be maintained. Particularly, we will be paying attention to Allied Sustainability and Environmental Consultants Group's ROE today.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

Check out our latest analysis for Allied Sustainability and Environmental Consultants Group

How Do You Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Allied Sustainability and Environmental Consultants Group is:

1.4% = HK$988k ÷ HK$72m (Based on the trailing twelve months to September 2020).

The 'return' is the income the business earned over the last year. That means that for every HK$1 worth of shareholders' equity, the company generated HK$0.01 in profit.

Why Is ROE Important For Earnings Growth?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don’t share these attributes.

Allied Sustainability and Environmental Consultants Group's Earnings Growth And 1.4% ROE

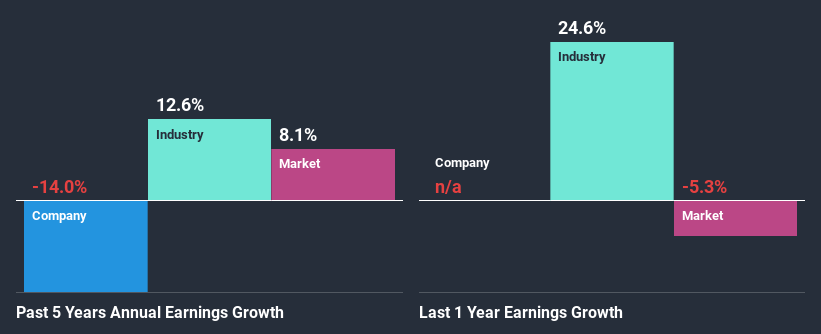

It is quite clear that Allied Sustainability and Environmental Consultants Group's ROE is rather low. Even compared to the average industry ROE of 10.0%, the company's ROE is quite dismal. For this reason, Allied Sustainability and Environmental Consultants Group's five year net income decline of 14% is not surprising given its lower ROE. However, there could also be other factors causing the earnings to decline. Such as - low earnings retention or poor allocation of capital.

However, when we compared Allied Sustainability and Environmental Consultants Group's growth with the industry we found that while the company's earnings have been shrinking, the industry has seen an earnings growth of 13% in the same period. This is quite worrisome.

Earnings growth is a huge factor in stock valuation. It’s important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). This then helps them determine if the stock is placed for a bright or bleak future. One good indicator of expected earnings growth is the P/E ratio which determines the price the market is willing to pay for a stock based on its earnings prospects. So, you may want to check if Allied Sustainability and Environmental Consultants Group is trading on a high P/E or a low P/E, relative to its industry.

Is Allied Sustainability and Environmental Consultants Group Making Efficient Use Of Its Profits?

Summary

Overall, we have mixed feelings about Allied Sustainability and Environmental Consultants Group. While the company does have a high rate of reinvestment, the low ROE means that all that reinvestment is not reaping any benefit to its investors, and moreover, its having a negative impact on the earnings growth. Wrapping up, we would proceed with caution with this company and one way of doing that would be to look at the risk profile of the business. To know the 3 risks we have identified for Allied Sustainability and Environmental Consultants Group visit our risks dashboard for free.

If you’re looking to trade Allied Sustainability and Environmental Consultants Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:8320

Allied Sustainability and Environmental Consultants Group

An investment holding company, provides green building and environmental consulting services in Hong Kong, the People’s Republic of China, and Macau.

Excellent balance sheet with very low risk.

Market Insights

Community Narratives

Recently Updated Narratives

No miracle in sight

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success