- Hong Kong

- /

- Commercial Services

- /

- SEHK:8169

There's No Escaping Eco-Tek Holdings Limited's (HKG:8169) Muted Earnings Despite A 35% Share Price Rise

Eco-Tek Holdings Limited (HKG:8169) shares have had a really impressive month, gaining 35% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 30% in the last year.

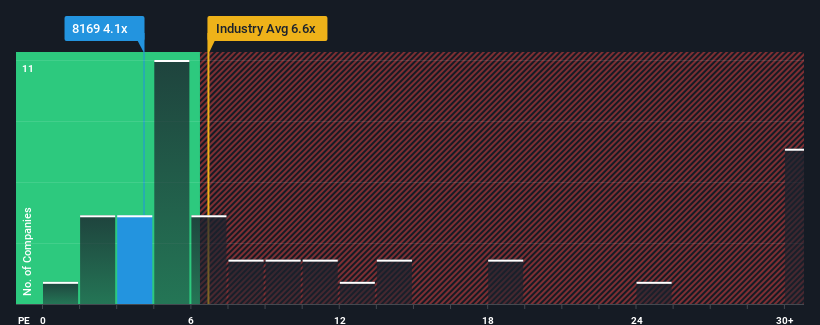

Even after such a large jump in price, Eco-Tek Holdings' price-to-earnings (or "P/E") ratio of 4.1x might still make it look like a strong buy right now compared to the market in Hong Kong, where around half of the companies have P/E ratios above 10x and even P/E's above 19x are quite common. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Eco-Tek Holdings has been doing a good job lately as it's been growing earnings at a solid pace. It might be that many expect the respectable earnings performance to degrade substantially, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Eco-Tek Holdings

How Is Eco-Tek Holdings' Growth Trending?

Eco-Tek Holdings' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Retrospectively, the last year delivered an exceptional 28% gain to the company's bottom line. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 21% shows it's noticeably less attractive on an annualised basis.

In light of this, it's understandable that Eco-Tek Holdings' P/E sits below the majority of other companies. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

The Final Word

Even after such a strong price move, Eco-Tek Holdings' P/E still trails the rest of the market significantly. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Eco-Tek Holdings maintains its low P/E on the weakness of its recent three-year growth being lower than the wider market forecast, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

There are also other vital risk factors to consider and we've discovered 2 warning signs for Eco-Tek Holdings (1 is concerning!) that you should be aware of before investing here.

If you're unsure about the strength of Eco-Tek Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eco-Tek Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:8169

Eco-Tek Holdings

An investment holding company, engages in the research, development, marketing, sale, and servicing of environmental-friendly products in Hong Kong and the People’s Republic of China.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives