Stock Analysis

- Hong Kong

- /

- Commercial Services

- /

- SEHK:8128

China Geothermal Industry Development Group (HKG:8128) Shareholders Have Enjoyed A 93% Share Price Gain

China Geothermal Industry Development Group Limited (HKG:8128) shareholders have seen the share price descend 18% over the month. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 93%.

See our latest analysis for China Geothermal Industry Development Group

Because China Geothermal Industry Development Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Over the last twelve months, China Geothermal Industry Development Group's revenue grew by 62%. That's stonking growth even when compared to other loss-making stocks. The solid 93% share price gain goes down pretty well, but it's not necessarily as good as you might expect given the top notch revenue growth. So quite frankly it could be a good time to investigate China Geothermal Industry Development Group in some detail. Human beings have trouble conceptualizing (and valuing) exponential growth. Is that what we're seeing here?

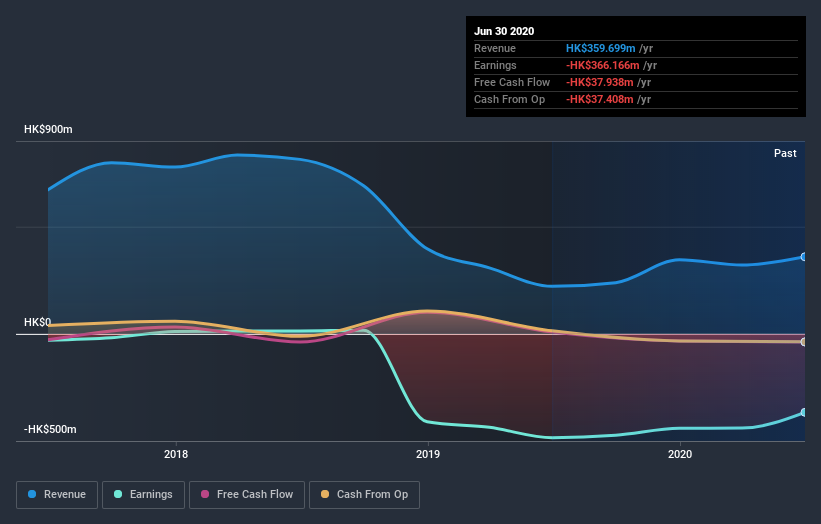

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between China Geothermal Industry Development Group's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Its history of dividend payouts mean that China Geothermal Industry Development Group's TSR of 93% over the last year is better than the share price return.

A Different Perspective

We're pleased to report that China Geothermal Industry Development Group shareholders have received a total shareholder return of 93% over one year. There's no doubt those recent returns are much better than the TSR loss of 11% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with China Geothermal Industry Development Group (at least 1 which is significant) , and understanding them should be part of your investment process.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of growing companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.

If you’re looking to trade China Geothermal Industry Development Group, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're helping make it simple.

Find out whether CHYY Development Group is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:8128

CHYY Development Group

An investment holding company, engages in the research, development, and promotion of geothermal energy as alternative energy for building’s heating applications in Mainland China.

Excellent balance sheet and fair value.