- Hong Kong

- /

- Real Estate

- /

- SEHK:674

China Tangshang Holdings Limited's (HKG:674) P/S Is Still On The Mark Following 28% Share Price Bounce

China Tangshang Holdings Limited (HKG:674) shares have continued their recent momentum with a 28% gain in the last month alone. The last month tops off a massive increase of 176% in the last year.

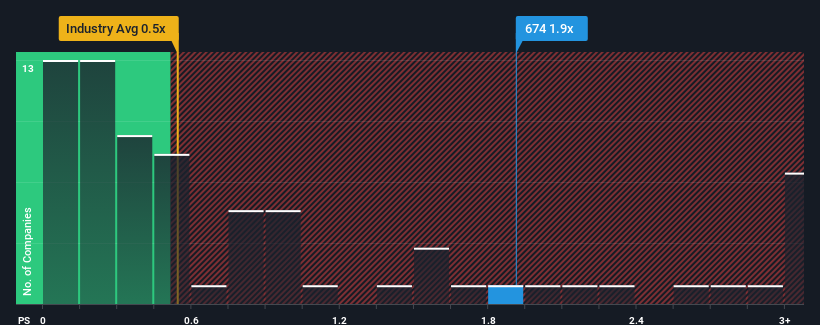

Since its price has surged higher, you could be forgiven for thinking China Tangshang Holdings is a stock not worth researching with a price-to-sales ratios (or "P/S") of 1.9x, considering almost half the companies in Hong Kong's Commercial Services industry have P/S ratios below 0.5x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

View our latest analysis for China Tangshang Holdings

How Has China Tangshang Holdings Performed Recently?

As an illustration, revenue has deteriorated at China Tangshang Holdings over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on China Tangshang Holdings' earnings, revenue and cash flow.How Is China Tangshang Holdings' Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as China Tangshang Holdings' is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 54% decrease to the company's top line. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, despite the drawbacks experienced in the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

Comparing that recent medium-term revenue trajectory with the industry's one-year growth forecast of 4.9% shows it's noticeably more attractive.

With this in consideration, it's not hard to understand why China Tangshang Holdings' P/S is high relative to its industry peers. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On China Tangshang Holdings' P/S

China Tangshang Holdings' P/S is on the rise since its shares have risen strongly. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of China Tangshang Holdings revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. In the eyes of shareholders, the probability of a continued growth trajectory is great enough to prevent the P/S from pulling back. Barring any significant changes to the company's ability to make money, the share price should continue to be propped up.

You need to take note of risks, for example - China Tangshang Holdings has 3 warning signs (and 1 which is concerning) we think you should know about.

If you're unsure about the strength of China Tangshang Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:674

China Tangshang Holdings

An investment holding company, engages in the property investment, development, and sub-leasing activities in Hong Kong and the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives