- Hong Kong

- /

- Commercial Services

- /

- SEHK:6677

Some Confidence Is Lacking In Sino-Ocean Service Holding Limited's (HKG:6677) P/S

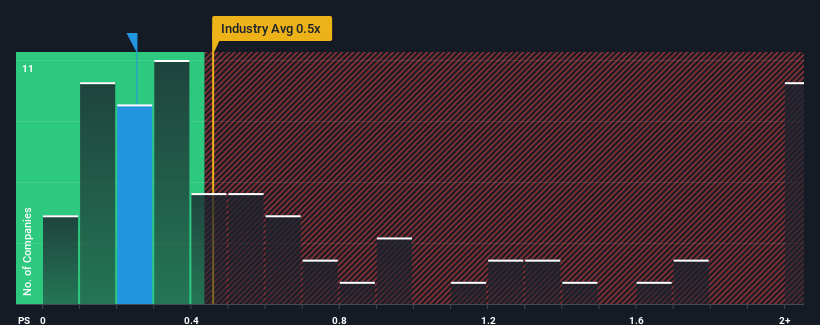

With a median price-to-sales (or "P/S") ratio of close to 0.5x in the Commercial Services industry in Hong Kong, you could be forgiven for feeling indifferent about Sino-Ocean Service Holding Limited's (HKG:6677) P/S ratio of 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Sino-Ocean Service Holding

How Has Sino-Ocean Service Holding Performed Recently?

Sino-Ocean Service Holding's negative revenue growth of late has neither been better nor worse than most other companies. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value. In saying that, existing shareholders probably aren't too pessimistic about the share price if the company's revenue continues tracking the industry.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sino-Ocean Service Holding.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sino-Ocean Service Holding's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period has seen an excellent 70% overall rise in revenue, in spite of its uninspiring short-term performance. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Shifting to the future, estimates from the lone analyst covering the company suggest revenue growth is heading into negative territory, declining 2.2% over the next year. Meanwhile, the broader industry is forecast to expand by 9.1%, which paints a poor picture.

With this in consideration, we think it doesn't make sense that Sino-Ocean Service Holding's P/S is closely matching its industry peers. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Sino-Ocean Service Holding's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Sino-Ocean Service Holding that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6677

Sino-Ocean Service Holding

An investment holding company, engages in the provision of property management and value-added services in the People’s Republic of China.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives