- Hong Kong

- /

- Commercial Services

- /

- SEHK:6677

Sino-Ocean Service Holding Limited's (HKG:6677) 46% Share Price Surge Not Quite Adding Up

Sino-Ocean Service Holding Limited (HKG:6677) shareholders are no doubt pleased to see that the share price has bounced 46% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 80% share price drop in the last twelve months.

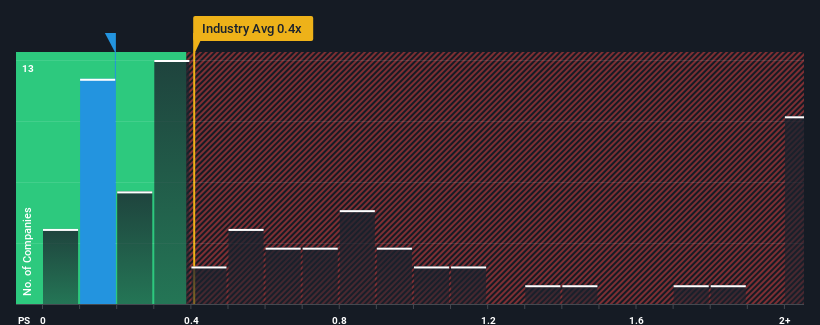

Even after such a large jump in price, you could still be forgiven for feeling indifferent about Sino-Ocean Service Holding's P/S ratio of 0.2x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Hong Kong is also close to 0.4x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Sino-Ocean Service Holding

What Does Sino-Ocean Service Holding's Recent Performance Look Like?

Sino-Ocean Service Holding's negative revenue growth of late has neither been better nor worse than most other companies. The P/S ratio is probably moderate because investors think the company's revenue trend will continue to follow the rest of the industry. If you still like the company, you'd want its revenue trajectory to turn around before making any decisions. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Keen to find out how analysts think Sino-Ocean Service Holding's future stacks up against the industry? In that case, our free report is a great place to start.How Is Sino-Ocean Service Holding's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Sino-Ocean Service Holding's to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. However, a few strong years before that means that it was still able to grow revenue by an impressive 70% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Looking ahead now, revenue is anticipated to slump, contracting by 5.0% during the coming year according to the sole analyst following the company. With the industry predicted to deliver 6.6% growth, that's a disappointing outcome.

With this information, we find it concerning that Sino-Ocean Service Holding is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

The Key Takeaway

Its shares have lifted substantially and now Sino-Ocean Service Holding's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

While Sino-Ocean Service Holding's P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the poor revenue outlook tells us one thing, it's that these current price levels could be unsustainable.

You need to take note of risks, for example - Sino-Ocean Service Holding has 3 warning signs (and 1 which is a bit unpleasant) we think you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:6677

Sino-Ocean Service Holding

An investment holding company, engages in the provision of property management and value-added services in the People’s Republic of China.

Flawless balance sheet and fair value.

Market Insights

Community Narratives