- Hong Kong

- /

- Professional Services

- /

- SEHK:6113

UTS Marketing Solutions Holdings Limited (HKG:6113) Is Yielding 8.5% - But Is It A Buy?

Dividend paying stocks like UTS Marketing Solutions Holdings Limited (HKG:6113) tend to be popular with investors, and for good reason - some research suggests a significant amount of all stock market returns come from reinvested dividends. Yet sometimes, investors buy a popular dividend stock because of its yield, and then lose money if the company's dividend doesn't live up to expectations.

So you may wish to consider our analysis of UTS Marketing Solutions Holdings's financial health, here.

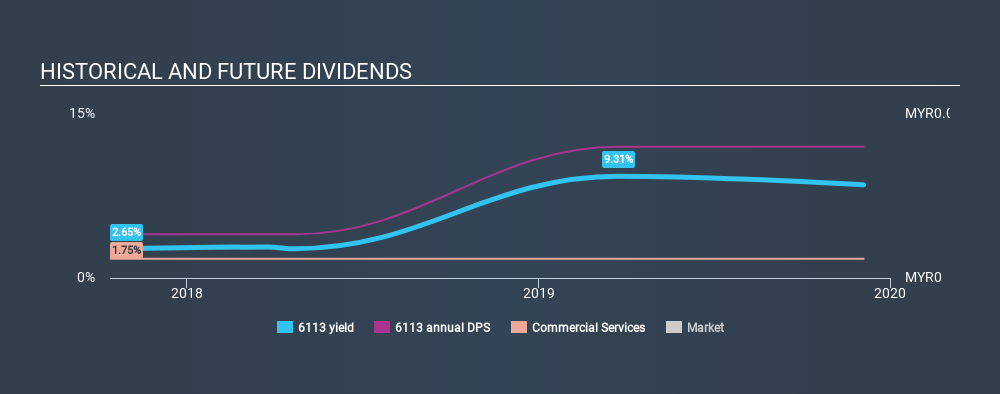

UTS Marketing Solutions Holdings pays a 8.5% dividend yield, and has been paying dividends for the past two years. A high yield probably looks enticing, but investors are likely wondering about the short payment history. When buying stocks for their dividends, you should always run through the checks below, to see if the dividend looks sustainable.

Explore this interactive chart for our latest analysis on UTS Marketing Solutions Holdings!

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. As a result, we should always investigate whether a company can afford its dividend, measured as a percentage of a company's net income after tax. In the last year, UTS Marketing Solutions Holdings paid out 200% of its profit as dividends. A payout ratio above 100% is definitely an item of concern, unless there are some other circumstances that would justify it.

In addition to comparing dividends against profits, we should inspect whether the company generated enough cash to pay its dividend. UTS Marketing Solutions Holdings paid out 141% of its free cash flow last year, suggesting the dividend is poorly covered by cash flow. Paying out more than 100% of your free cash flow in dividends is generally not a long-term, sustainable state of affairs, so we think shareholders should watch this metric closely. As UTS Marketing Solutions Holdings's dividend was not well covered by either earnings or cash flow, we would be concerned that this dividend could be at risk over the long term.

While the above analysis focuses on dividends relative to a company's earnings, we do note UTS Marketing Solutions Holdings's strong net cash position, which will let it pay larger dividends for a time, should it choose.

Dividend Volatility

From the perspective of an income investor who wants to earn dividends for many years, there is not much point buying a stock if its dividend is regularly cut or is not reliable. The company has been paying a stable dividend for a few years now, but we'd like to see more evidence of consistency over a longer period. During the past two-year period, the first annual payment was RM0.02 in 2017, compared to RM0.06 last year. This works out to be a compound annual growth rate (CAGR) of approximately 73% a year over that time.

The dividend has been growing pretty quickly, which could be enough to get us interested even though the dividend history is relatively short. Further research may be warranted.

Dividend Growth Potential

While dividend payments have been relatively reliable, it would also be nice if earnings per share (EPS) were growing, as this is essential to maintaining the dividend's purchasing power over the long term. Strong earnings per share (EPS) growth might encourage our interest in the company despite fluctuating dividends, which is why it's great to see UTS Marketing Solutions Holdings has grown its earnings per share at 336% per annum over the past five years. The company has been growing its EPS at a very rapid rate, while paying out virtually all of its income as dividends. While EPS could grow fast enough to make the dividend sustainable, in this type of situation, we'd want to pay extra attention to any fragilities in the company's balance sheet.

We'd also point out that UTS Marketing Solutions Holdings issued a meaningful number of new shares in the past year. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Conclusion

To summarise, shareholders should always check that UTS Marketing Solutions Holdings's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're a bit uncomfortable with UTS Marketing Solutions Holdings paying out a high percentage of both its cashflow and earnings. We were also glad to see it growing earnings, although its dividend history is not as long as we'd like. In summary, UTS Marketing Solutions Holdings has a number of shortcomings that we'd find it hard to get past. Things could change, but we think there are likely more attractive alternatives out there.

You can also discover whether shareholders are aligned with insider interests by checking our visualisation of insider shareholdings and trades in UTS Marketing Solutions Holdings stock.

Looking for more high-yielding dividend ideas? Try our curated list of dividend stocks with a yield above 3%.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SEHK:6113

UTS Marketing Solutions Holdings

An investment holding company, engages in the provision of outbound telemarketing services and contact center facilities for promotion of financial products in Malaysia.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives