- Hong Kong

- /

- Commercial Services

- /

- SEHK:436

Shareholders Will Probably Hold Off On Increasing New Universe Environmental Group Limited's (HKG:436) CEO Compensation For The Time Being

In the past three years, the share price of New Universe Environmental Group Limited (HKG:436) has struggled to grow and now shareholders are sitting on a loss. Per share earnings growth is also lacking, despite revenue growth. The AGM coming up on 18 June 2021 will be an opportunity for shareholders to have their concerns addressed by the board and for them to exercise their influence on management through voting on resolutions such as executive remuneration. We think shareholders may be cautious of approving a pay rise for the CEO at the moment, based on our analysis below.

See our latest analysis for New Universe Environmental Group

How Does Total Compensation For Yu Xi Compare With Other Companies In The Industry?

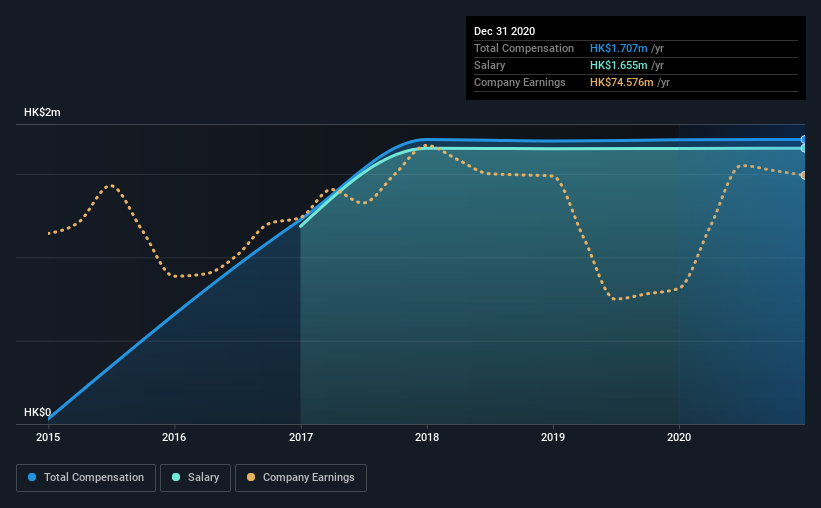

According to our data, New Universe Environmental Group Limited has a market capitalization of HK$850m, and paid its CEO total annual compensation worth HK$1.7m over the year to December 2020. That is, the compensation was roughly the same as last year. We note that the salary portion, which stands at HK$1.66m constitutes the majority of total compensation received by the CEO.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.5m. This suggests that New Universe Environmental Group remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$1.7m | HK$1.7m | 97% |

| Other | HK$52k | HK$52k | 3% |

| Total Compensation | HK$1.7m | HK$1.7m | 100% |

Talking in terms of the industry, salary represented approximately 91% of total compensation out of all the companies we analyzed, while other remuneration made up 9% of the pie. New Universe Environmental Group has gone down a largely traditional route, paying Yu Xi a high salary, giving it preference over non-salary benefits. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

New Universe Environmental Group Limited's Growth

New Universe Environmental Group Limited has reduced its earnings per share by 4.0% a year over the last three years. In the last year, its revenue is up 32%.

Investors would be a bit wary of companies that have lower EPS But on the other hand, revenue growth is strong, suggesting a brighter future. In conclusion we can't form a strong opinion about business performance yet; but it's one worth watching. While we don't have analyst forecasts for the company, shareholders might want to examine this detailed historical graph of earnings, revenue and cash flow.

Has New Universe Environmental Group Limited Been A Good Investment?

The return of -50% over three years would not have pleased New Universe Environmental Group Limited shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

New Universe Environmental Group pays its CEO a majority of compensation through a salary. The loss to shareholders over the past three years is certainly concerning and possibly has something to do with the fact that the company's earnings haven't grown. In the upcoming AGM, shareholders will get the opportunity to discuss any issues with the board, including those related to CEO remuneration and assess if the board's plan is in line with their expectations.

While it is important to pay attention to CEO remuneration, investors should also consider other elements of the business. We've identified 1 warning sign for New Universe Environmental Group that investors should be aware of in a dynamic business environment.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if New Universe Environmental Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:436

New Universe Environmental Group

An investment holding company, primarily provides environmental treatment and disposal services in the People's Republic of China.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives