- Hong Kong

- /

- Commercial Services

- /

- SEHK:3997

Don't Race Out To Buy Telecom Service One Holdings Limited (HKG:3997) Just Because It's Going Ex-Dividend

It looks like Telecom Service One Holdings Limited (HKG:3997) is about to go ex-dividend in the next 4 days. Investors can purchase shares before the 9th of March in order to be eligible for this dividend, which will be paid on the 19th of March.

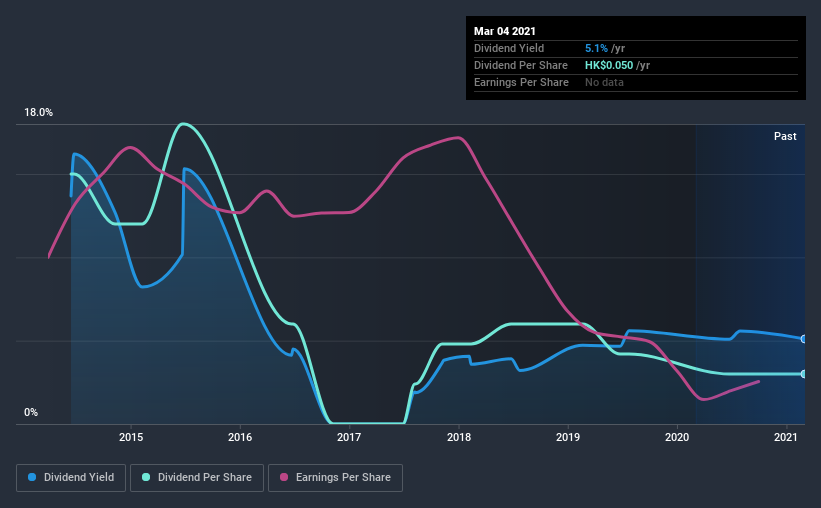

Telecom Service One Holdings's next dividend payment will be HK$0.01 per share. Last year, in total, the company distributed HK$0.05 to shareholders. Based on the last year's worth of payments, Telecom Service One Holdings stock has a trailing yield of around 5.1% on the current share price of HK$0.98. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! So we need to investigate whether Telecom Service One Holdings can afford its dividend, and if the dividend could grow.

See our latest analysis for Telecom Service One Holdings

Dividends are typically paid from company earnings. If a company pays more in dividends than it earned in profit, then the dividend could be unsustainable. Last year, Telecom Service One Holdings paid out 235% of its profit to shareholders in the form of dividends. This is not sustainable behaviour and requires a closer look on behalf of the purchaser. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out more than three-quarters (80%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's good to see that while Telecom Service One Holdings's dividends were not covered by profits, at least they are affordable from a cash perspective. If executives were to continue paying more in dividends than the company reported in profits, we'd view this as a warning sign. Very few companies are able to sustainably pay dividends larger than their reported earnings.

Click here to see how much of its profit Telecom Service One Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If earnings fall far enough, the company could be forced to cut its dividend. Telecom Service One Holdings's earnings have collapsed faster than Wile E Coyote's schemes to trap the Road Runner; down a tremendous 30% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Telecom Service One Holdings has seen its dividend decline 21% per annum on average over the past seven years, which is not great to see. While it's not great that earnings and dividends per share have fallen in recent years, we're encouraged by the fact that management has trimmed the dividend rather than risk over-committing the company in a risky attempt to maintain yields to shareholders.

The Bottom Line

From a dividend perspective, should investors buy or avoid Telecom Service One Holdings? It's never fun to see a company's earnings per share in retreat. Additionally, Telecom Service One Holdings is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that in mind though, if the poor dividend characteristics of Telecom Service One Holdings don't faze you, it's worth being mindful of the risks involved with this business. For example, Telecom Service One Holdings has 5 warning signs (and 1 which is potentially serious) we think you should know about.

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Telecom Service One Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Telecom Service One Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3997

Telecom Service One Holdings

An investment holding company, provides repair and refurbishment services for mobile phones and other personal electronic products in Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success