- Hong Kong

- /

- Commercial Services

- /

- SEHK:3718

Beijing Enterprises Urban Resources Group's (HKG:3718) Dividend Will Be Increased To CN¥0.018

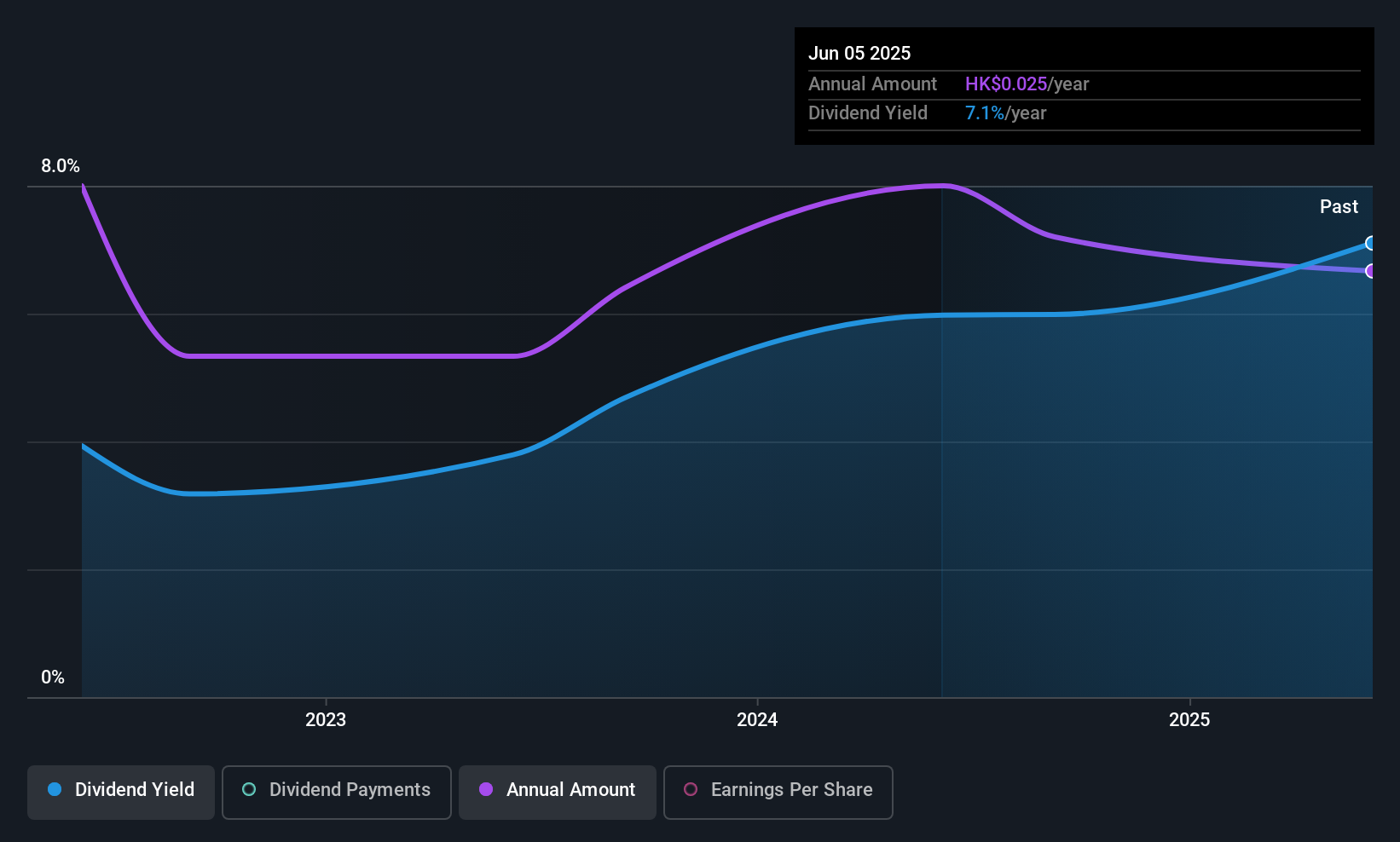

The board of Beijing Enterprises Urban Resources Group Limited (HKG:3718) has announced that it will be paying its dividend of CN¥0.018 on the 8th of October, an increased payment from last year's comparable dividend. This takes the annual payment to 6.3% of the current stock price, which is about average for the industry.

Beijing Enterprises Urban Resources Group's Distributions May Be Difficult To Sustain

While it is always good to see a solid dividend yield, we should also consider whether the payment is feasible. Beijing Enterprises Urban Resources Group isn't generating any profits, and it is paying out a very high proportion of the cash it is earning. This makes us feel that the dividend will be hard to maintain.

Analysts expect the EPS to grow by 54.6% over the next 12 months. The company seems to be going down the right path, but it will take a little bit longer than a year to cross over into profitability. Unfortunately, for the dividend to continue at current levels the company definitely needs to get there sooner rather than later.

Check out our latest analysis for Beijing Enterprises Urban Resources Group

Beijing Enterprises Urban Resources Group's Dividend Has Lacked Consistency

Even in its short history, we have seen the dividend cut. Since 2022, the dividend has gone from CN¥0.0243 total annually to CN¥0.0228. Doing the maths, this is a decline of about 2.1% per year. A company that decreases its dividend over time generally isn't what we are looking for.

The Dividend Has Limited Growth Potential

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Over the past five years, it looks as though Beijing Enterprises Urban Resources Group's EPS has declined at around 30% a year. This steep decline can indicate that the business is going through a tough time, which could constrain its ability to pay a larger dividend each year in the future. On the bright side, earnings are predicted to gain some ground over the next year, but until this turns into a pattern we wouldn't be feeling too comfortable.

We're Not Big Fans Of Beijing Enterprises Urban Resources Group's Dividend

In summary, investors will like to be receiving a higher dividend, but we have some questions about whether it can be sustained over the long term. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. We don't think that this is a great candidate to be an income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. As an example, we've identified 2 warning signs for Beijing Enterprises Urban Resources Group that you should be aware of before investing. If you are a dividend investor, you might also want to look at our curated list of high yield dividend stocks.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enterprises Urban Resources Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:3718

Beijing Enterprises Urban Resources Group

Operates as a waste management solution service provider in Chinese Mainland and Hong Kong.

Undervalued with adequate balance sheet.

Market Insights

Community Narratives