- Hong Kong

- /

- Commercial Services

- /

- SEHK:3316

Investors Could Be Concerned With Binjiang Service Group's (HKG:3316) Returns On Capital

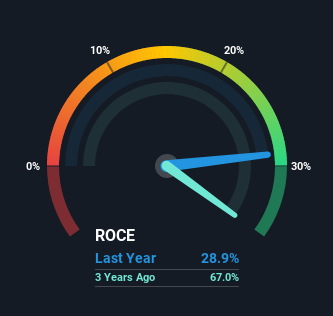

If you're looking for a multi-bagger, there's a few things to keep an eye out for. Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. This shows us that it's a compounding machine, able to continually reinvest its earnings back into the business and generate higher returns. So when we looked at Binjiang Service Group (HKG:3316), they do have a high ROCE, but we weren't exactly elated from how returns are trending.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. The formula for this calculation on Binjiang Service Group is:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.29 = CN¥249m ÷ (CN¥1.5b - CN¥643m) (Based on the trailing twelve months to December 2020).

So, Binjiang Service Group has an ROCE of 29%. That's a fantastic return and not only that, it outpaces the average of 9.2% earned by companies in a similar industry.

See our latest analysis for Binjiang Service Group

In the above chart we have measured Binjiang Service Group's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Binjiang Service Group here for free.

The Trend Of ROCE

On the surface, the trend of ROCE at Binjiang Service Group doesn't inspire confidence. To be more specific, while the ROCE is still high, it's fallen from 46% where it was five years ago. Although, given both revenue and the amount of assets employed in the business have increased, it could suggest the company is investing in growth, and the extra capital has led to a short-term reduction in ROCE. If these investments prove successful, this can bode very well for long term stock performance.

On a side note, Binjiang Service Group has done well to pay down its current liabilities to 43% of total assets. That could partly explain why the ROCE has dropped. Effectively this means their suppliers or short-term creditors are funding less of the business, which reduces some elements of risk. Since the business is basically funding more of its operations with it's own money, you could argue this has made the business less efficient at generating ROCE. Keep in mind 43% is still pretty high, so those risks are still somewhat prevalent.

The Bottom Line

In summary, despite lower returns in the short term, we're encouraged to see that Binjiang Service Group is reinvesting for growth and has higher sales as a result. And long term investors must be optimistic going forward because the stock has returned a huge 155% to shareholders in the last year. So while investors seem to be recognizing these promising trends, we would look further into this stock to make sure the other metrics justify the positive view.

One more thing, we've spotted 1 warning sign facing Binjiang Service Group that you might find interesting.

If you want to search for more stocks that have been earning high returns, check out this free list of stocks with solid balance sheets that are also earning high returns on equity.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Binjiang Service Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:3316

Binjiang Service Group

Provides property management and related services in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives