- Hong Kong

- /

- Commercial Services

- /

- SEHK:1955

Hong Kong Johnson Holdings Co., Ltd. (HKG:1955) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

Hong Kong Johnson Holdings Co., Ltd. (HKG:1955) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 18% share price drop.

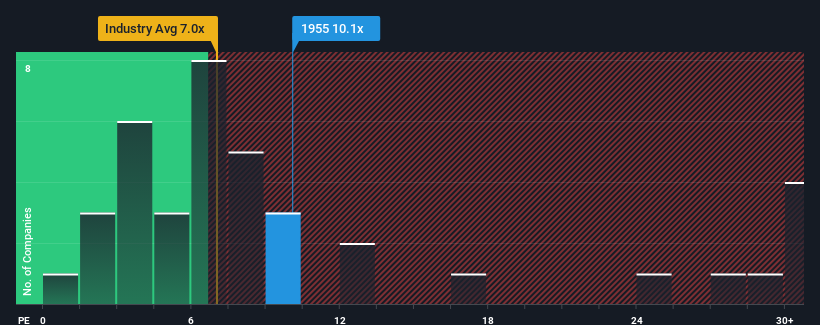

In spite of the heavy fall in price, it's still not a stretch to say that Hong Kong Johnson Holdings' price-to-earnings (or "P/E") ratio of 10.1x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 10x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been quite advantageous for Hong Kong Johnson Holdings as its earnings have been rising very briskly. It might be that many expect the strong earnings performance to wane, which has kept the P/E from rising. If that doesn't eventuate, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

View our latest analysis for Hong Kong Johnson Holdings

What Are Growth Metrics Telling Us About The P/E?

There's an inherent assumption that a company should be matching the market for P/E ratios like Hong Kong Johnson Holdings' to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 169% last year. Despite this strong recent growth, it's still struggling to catch up as its three-year EPS frustratingly shrank by 90% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Weighing that medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's an unpleasant look.

With this information, we find it concerning that Hong Kong Johnson Holdings is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

The Bottom Line On Hong Kong Johnson Holdings' P/E

Hong Kong Johnson Holdings' plummeting stock price has brought its P/E right back to the rest of the market. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Hong Kong Johnson Holdings currently trades on a higher than expected P/E since its recent earnings have been in decline over the medium-term. Right now we are uncomfortable with the P/E as this earnings performance is unlikely to support a more positive sentiment for long. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Plus, you should also learn about these 2 warning signs we've spotted with Hong Kong Johnson Holdings (including 1 which shouldn't be ignored).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Valuation is complex, but we're here to simplify it.

Discover if Hong Kong Johnson Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1955

Hong Kong Johnson Holdings

An investment holding company, engages in the provision of cleaning, janitorial, and other related services for government and non-government sector in Hong Kong.

Excellent balance sheet low.

Market Insights

Community Narratives