- Hong Kong

- /

- Commercial Services

- /

- SEHK:1845

Weigang Environmental Technology Holding Group Limited (HKG:1845) May Have Run Too Fast Too Soon With Recent 28% Price Plummet

Weigang Environmental Technology Holding Group Limited (HKG:1845) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. Indeed, the recent drop has reduced its annual gain to a relatively sedate 6.6% over the last twelve months.

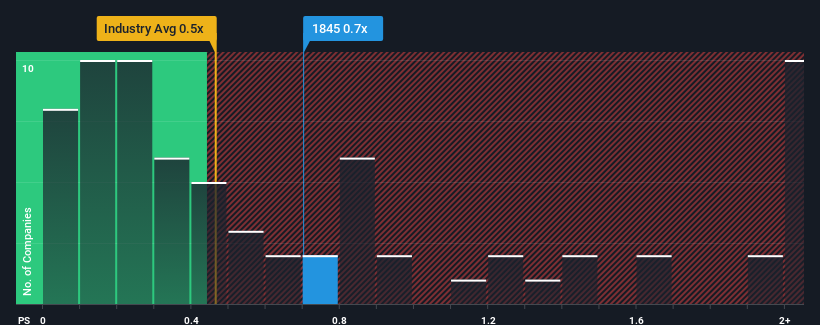

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Weigang Environmental Technology Holding Group's P/S ratio of 0.7x, since the median price-to-sales (or "P/S") ratio for the Commercial Services industry in Hong Kong is also close to 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

Check out our latest analysis for Weigang Environmental Technology Holding Group

What Does Weigang Environmental Technology Holding Group's Recent Performance Look Like?

Weigang Environmental Technology Holding Group has been doing a good job lately as it's been growing revenue at a solid pace. It might be that many expect the respectable revenue performance to wane, which has kept the P/S from rising. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Although there are no analyst estimates available for Weigang Environmental Technology Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is Weigang Environmental Technology Holding Group's Revenue Growth Trending?

In order to justify its P/S ratio, Weigang Environmental Technology Holding Group would need to produce growth that's similar to the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.4% last year. Ultimately though, it couldn't turn around the poor performance of the prior period, with revenue shrinking 57% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Comparing that to the industry, which is predicted to deliver 4.5% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

With this information, we find it concerning that Weigang Environmental Technology Holding Group is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company are way less bearish than recent times would indicate and aren't willing to let go of their stock right now. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

What Does Weigang Environmental Technology Holding Group's P/S Mean For Investors?

Weigang Environmental Technology Holding Group's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

The fact that Weigang Environmental Technology Holding Group currently trades at a P/S on par with the rest of the industry is surprising to us since its recent revenues have been in decline over the medium-term, all while the industry is set to grow. Even though it matches the industry, we're uncomfortable with the current P/S ratio, as this dismal revenue performance is unlikely to support a more positive sentiment for long. If recent medium-term revenue trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Weigang Environmental Technology Holding Group (1 is concerning) you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Weigang Environmental Technology Holding Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1845

Weigang Environmental Technology Holding Group

Engages in the research, design, integration, and commissioning solid waste treatment systems primarily for hazardous waste incineration in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives