- Hong Kong

- /

- Commercial Services

- /

- SEHK:1790

Optimistic Investors Push TIL Enviro Limited (HKG:1790) Shares Up 34% But Growth Is Lacking

TIL Enviro Limited (HKG:1790) shareholders have had their patience rewarded with a 34% share price jump in the last month. Looking further back, the 10% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

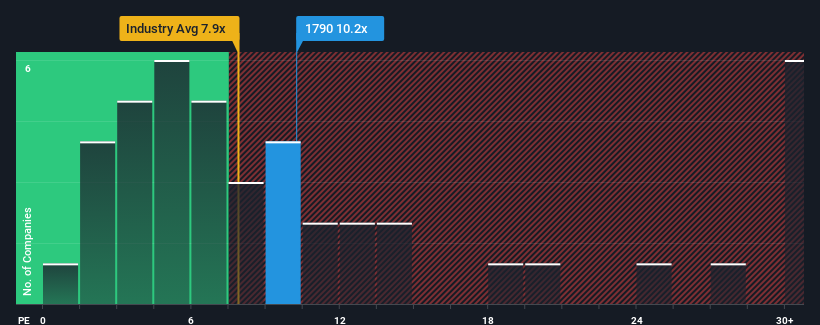

In spite of the firm bounce in price, it's still not a stretch to say that TIL Enviro's price-to-earnings (or "P/E") ratio of 10.2x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 9x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

Earnings have risen firmly for TIL Enviro recently, which is pleasing to see. One possibility is that the P/E is moderate because investors think this respectable earnings growth might not be enough to outperform the broader market in the near future. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

View our latest analysis for TIL Enviro

What Are Growth Metrics Telling Us About The P/E?

The only time you'd be comfortable seeing a P/E like TIL Enviro's is when the company's growth is tracking the market closely.

If we review the last year of earnings growth, the company posted a worthy increase of 7.5%. Still, lamentably EPS has fallen 42% in aggregate from three years ago, which is disappointing. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

In contrast to the company, the rest of the market is expected to grow by 18% over the next year, which really puts the company's recent medium-term earnings decline into perspective.

With this information, we find it concerning that TIL Enviro is trading at a fairly similar P/E to the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with the recent negative growth rates.

What We Can Learn From TIL Enviro's P/E?

Its shares have lifted substantially and now TIL Enviro's P/E is also back up to the market median. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of TIL Enviro revealed its shrinking earnings over the medium-term aren't impacting its P/E as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

Having said that, be aware TIL Enviro is showing 4 warning signs in our investment analysis, and 2 of those can't be ignored.

If these risks are making you reconsider your opinion on TIL Enviro, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if TIL Enviro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1790

TIL Enviro

Provides wastewater treatment in the People’s Republic of China.

Flawless balance sheet and good value.

Market Insights

Community Narratives