- Hong Kong

- /

- Professional Services

- /

- SEHK:1486

These 4 Measures Indicate That C Cheng Holdings (HKG:1486) Is Using Debt Reasonably Well

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that C Cheng Holdings Limited (HKG:1486) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for C Cheng Holdings

How Much Debt Does C Cheng Holdings Carry?

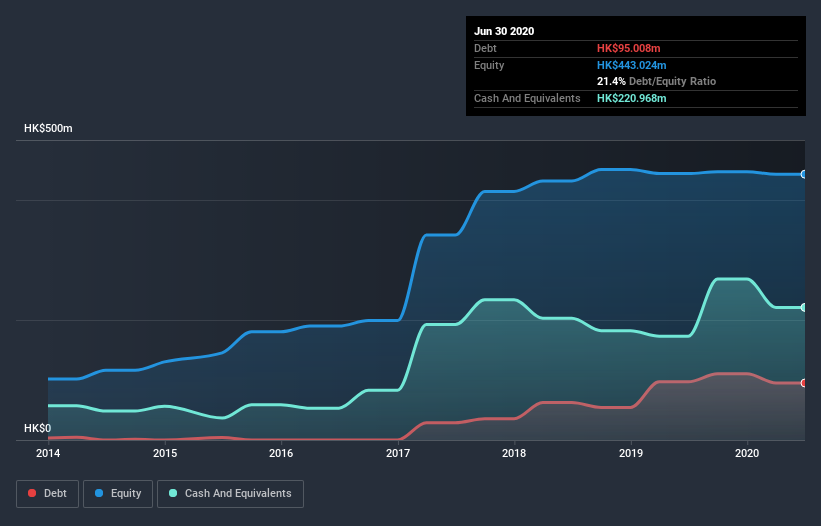

As you can see below, C Cheng Holdings had HK$95.0m of debt, at June 2020, which is about the same as the year before. You can click the chart for greater detail. However, it does have HK$221.0m in cash offsetting this, leading to net cash of HK$126.0m.

How Healthy Is C Cheng Holdings's Balance Sheet?

We can see from the most recent balance sheet that C Cheng Holdings had liabilities of HK$271.9m falling due within a year, and liabilities of HK$85.0m due beyond that. Offsetting this, it had HK$221.0m in cash and HK$373.8m in receivables that were due within 12 months. So it can boast HK$237.9m more liquid assets than total liabilities.

This surplus liquidity suggests that C Cheng Holdings's balance sheet could take a hit just as well as Homer Simpson's head can take a punch. On this view, lenders should feel as safe as the beloved of a black-belt karate master. Simply put, the fact that C Cheng Holdings has more cash than debt is arguably a good indication that it can manage its debt safely.

Importantly, C Cheng Holdings's EBIT fell a jaw-dropping 95% in the last twelve months. If that decline continues then paying off debt will be harder than selling foie gras at a vegan convention. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since C Cheng Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While C Cheng Holdings has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. Looking at the most recent three years, C Cheng Holdings recorded free cash flow of 24% of its EBIT, which is weaker than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While we empathize with investors who find debt concerning, you should keep in mind that C Cheng Holdings has net cash of HK$126.0m, as well as more liquid assets than liabilities. So we don't have any problem with C Cheng Holdings's use of debt. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with C Cheng Holdings (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

When trading C Cheng Holdings or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SEHK:1486

C Cheng Holdings

An investment holding company, provides architectural services in Mainland China, Hong Kong, the Middle East and North Africa, Macau, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives