- Hong Kong

- /

- Commercial Services

- /

- SEHK:1481

The recent 18% gain must have brightened Top Key Executive Ho Lun Ng's week, Smart Globe Holdings Limited's (HKG:1481) most bullish insider

Key Insights

- Smart Globe Holdings' significant insider ownership suggests inherent interests in company's expansion

- Ho Lun Ng owns 74% of the company

- Using data from company's past performance alongside ownership research, one can better assess the future performance of a company

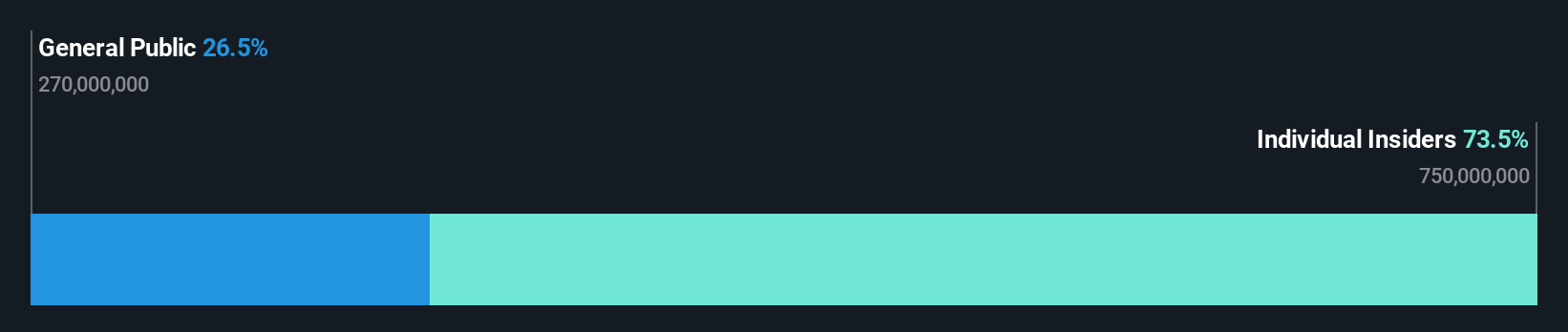

A look at the shareholders of Smart Globe Holdings Limited (HKG:1481) can tell us which group is most powerful. The group holding the most number of shares in the company, around 74% to be precise, is individual insiders. In other words, the group stands to gain the most (or lose the most) from their investment into the company.

Clearly, insiders benefitted the most after the company's market cap rose by HK$194m last week.

In the chart below, we zoom in on the different ownership groups of Smart Globe Holdings.

See our latest analysis for Smart Globe Holdings

What Does The Lack Of Institutional Ownership Tell Us About Smart Globe Holdings?

Institutional investors often avoid companies that are too small, too illiquid or too risky for their tastes. But it's unusual to see larger companies without any institutional investors.

There could be various reasons why no institutions own shares in a company. Typically, small, newly listed companies don't attract much attention from fund managers, because it would not be possible for large fund managers to build a meaningful position in the company. It is also possible that fund managers don't own the stock because they aren't convinced it will perform well. Smart Globe Holdings' earnings and revenue track record (below) may not be compelling to institutional investors -- or they simply might not have looked at the business closely.

Smart Globe Holdings is not owned by hedge funds. Our data suggests that Ho Lun Ng, who is also the company's Top Key Executive, holds the most number of shares at 74%. When an insider holds a sizeable amount of a company's stock, investors consider it as a positive sign because it suggests that insiders are willing to have their wealth tied up in the future of the company.

Researching institutional ownership is a good way to gauge and filter a stock's expected performance. The same can be achieved by studying analyst sentiments. As far as we can tell there isn't analyst coverage of the company, so it is probably flying under the radar.

Insider Ownership Of Smart Globe Holdings

While the precise definition of an insider can be subjective, almost everyone considers board members to be insiders. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

I generally consider insider ownership to be a good thing. However, on some occasions it makes it more difficult for other shareholders to hold the board accountable for decisions.

Our most recent data indicates that insiders own the majority of Smart Globe Holdings Limited. This means they can collectively make decisions for the company. That means they own HK$923m worth of shares in the HK$1.3b company. That's quite meaningful. It is good to see this level of investment. You can check here to see if those insiders have been buying recently.

General Public Ownership

The general public, who are usually individual investors, hold a 26% stake in Smart Globe Holdings. While this group can't necessarily call the shots, it can certainly have a real influence on how the company is run.

Next Steps:

I find it very interesting to look at who exactly owns a company. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 2 warning signs for Smart Globe Holdings you should be aware of, and 1 of them can't be ignored.

Of course this may not be the best stock to buy. Therefore, you may wish to see our free collection of interesting prospects boasting favorable financials.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1481

Smart Globe Holdings

An investment holding company, engages in production, distribution, and printing of books, and novelty and packaging products.

Excellent balance sheet with questionable track record.

Market Insights

Community Narratives