- Hong Kong

- /

- Commercial Services

- /

- SEHK:1397

Baguio Green Group (HKG:1397) Has A Pretty Healthy Balance Sheet

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Baguio Green Group Limited (HKG:1397) does use debt in its business. But the more important question is: how much risk is that debt creating?

When Is Debt Dangerous?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Baguio Green Group

What Is Baguio Green Group's Net Debt?

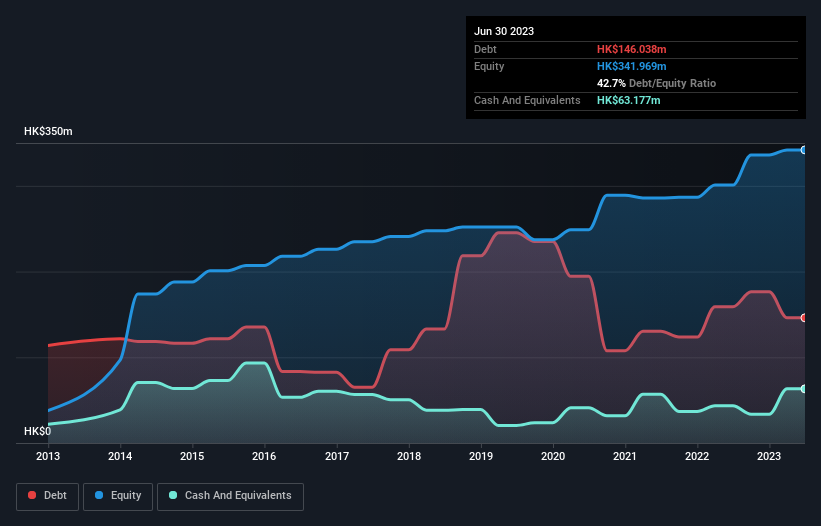

The image below, which you can click on for greater detail, shows that Baguio Green Group had debt of HK$146.0m at the end of June 2023, a reduction from HK$158.9m over a year. However, because it has a cash reserve of HK$63.2m, its net debt is less, at about HK$82.9m.

A Look At Baguio Green Group's Liabilities

According to the last reported balance sheet, Baguio Green Group had liabilities of HK$506.0m due within 12 months, and liabilities of HK$68.0m due beyond 12 months. On the other hand, it had cash of HK$63.2m and HK$443.5m worth of receivables due within a year. So its liabilities total HK$67.3m more than the combination of its cash and short-term receivables.

This deficit isn't so bad because Baguio Green Group is worth HK$269.8m, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

While Baguio Green Group's low debt to EBITDA ratio of 0.60 suggests only modest use of debt, the fact that EBIT only covered the interest expense by 6.7 times last year does give us pause. But the interest payments are certainly sufficient to have us thinking about how affordable its debt is. Even more impressive was the fact that Baguio Green Group grew its EBIT by 176% over twelve months. That boost will make it even easier to pay down debt going forward. When analysing debt levels, the balance sheet is the obvious place to start. But it is future earnings, more than anything, that will determine Baguio Green Group's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So it's worth checking how much of that EBIT is backed by free cash flow. Looking at the most recent two years, Baguio Green Group recorded free cash flow of 43% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

The good news is that Baguio Green Group's demonstrated ability to grow its EBIT delights us like a fluffy puppy does a toddler. And that's just the beginning of the good news since its net debt to EBITDA is also very heartening. When we consider the range of factors above, it looks like Baguio Green Group is pretty sensible with its use of debt. That means they are taking on a bit more risk, in the hope of boosting shareholder returns. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Case in point: We've spotted 2 warning signs for Baguio Green Group you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Valuation is complex, but we're here to simplify it.

Discover if Baguio Green Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1397

Baguio Green Group

An investment holding company, provides environmental and related services in Hong Kong, Mainland China, and Southeast Asia.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives