- Hong Kong

- /

- Commercial Services

- /

- SEHK:1272

Datang Environment (SEHK:1272) Margin Decline Challenges Bullish Value Narrative Despite Five-Year Earnings Growth

Reviewed by Simply Wall St

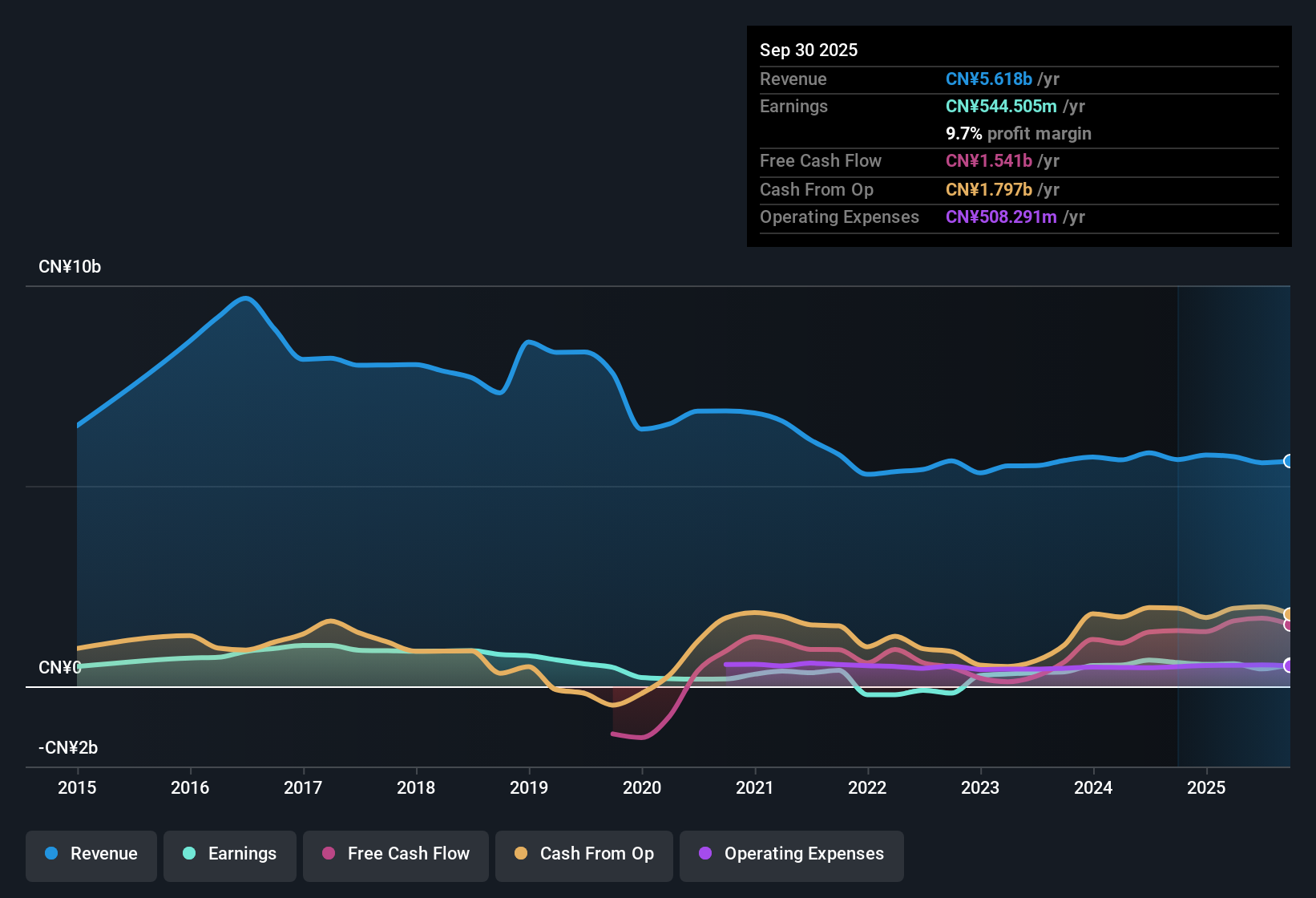

Datang Environment Industry Group (SEHK:1272) reported net profit margins of 9.7% for the latest period, slightly down from 10.5% a year ago. While earnings declined over the past year and are not comparable to the company’s five-year average, Datang has maintained an impressive annual earnings growth rate of 26.2% over the last five years. This highlights its strong long-term performance. Investors may find the combination of attractive valuation metrics and robust multi-year growth encouraging, despite recent margin compression and tougher earnings trends.

See our full analysis for Datang Environment Industry Group.Next, we will see how these headline numbers compare with the widely discussed narratives in the market and what that means for Datang's story going forward.

Curious how numbers become stories that shape markets? Explore Community Narratives

DCF Fair Value Signals Major Discount

- Datang’s current share price is HK$1.20, trading far below its DCF fair value of HK$7.09. This represents an approximately 83% discount to modeled intrinsic worth.

- Bulls highlight that

- trading at a price-to-earnings ratio of just 6x versus the peer average of 25.6x, Datang is positioned as a value buy within its sector,

- the substantial five-year annual earnings growth of 26.2% adds weight to the case that the market may be overlooking the durability of the company’s business model and long-term profit potential.

Peer Multiple Gap Stands Out

- Datang's P/E ratio of 6x is below both the Hong Kong Commercial Services industry average of 9.5x and the broader peer average of 25.6x, highlighting a meaningful valuation gap versus competitors.

- What’s surprising is

- despite negative earnings growth in the past year, the lack of significant risks flagged in the latest filings suggests that recent margin pressure may be more cyclical than structural,

- and the large peer valuation gap may draw attention if sector momentum improves or margin trends stabilize.

Five-Year Earnings Growth Outpaces Sector

- Datang’s five-year earnings have compounded at an annual growth rate of 26.2%, a track record that stands out against flat or modest growth seen in many sector peers.

- The prevailing market view notes

- stable operational updates and continued government policy support underpin a positive baseline for future growth,

- yet, some investors question whether intensified competition and recent margin compression could limit upside unless Datang secures higher-margin projects or breakthrough wins.

Stay tuned as we track whether this valuation gap persists or closes in future results, and keep an eye on company updates for fresh catalysts.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Datang Environment Industry Group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

Despite Datang’s impressive long-term growth rate, investors face uncertainty because of recent margin compression and negative earnings momentum over the past year.

If you want steadier performance, use our stable growth stocks screener (2099 results) selection to discover companies that consistently deliver reliable revenue and earnings growth through the ups and downs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1272

Datang Environment Industry Group

Datang Environment Industry Group Co., Ltd.

Flawless balance sheet and good value.

Market Insights

Community Narratives