- Hong Kong

- /

- Commercial Services

- /

- SEHK:1162

We Think Lumina Group (HKG:1162) Can Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. Indeed, Lumina Group (HKG:1162) stock is up 108% in the last year, providing strong gains for shareholders. But the harsh reality is that very many loss making companies burn through all their cash and go bankrupt.

So notwithstanding the buoyant share price, we think it's well worth asking whether Lumina Group's cash burn is too risky. In this report, we will consider the company's annual negative free cash flow, henceforth referring to it as the 'cash burn'. Let's start with an examination of the business' cash, relative to its cash burn.

View our latest analysis for Lumina Group

When Might Lumina Group Run Out Of Money?

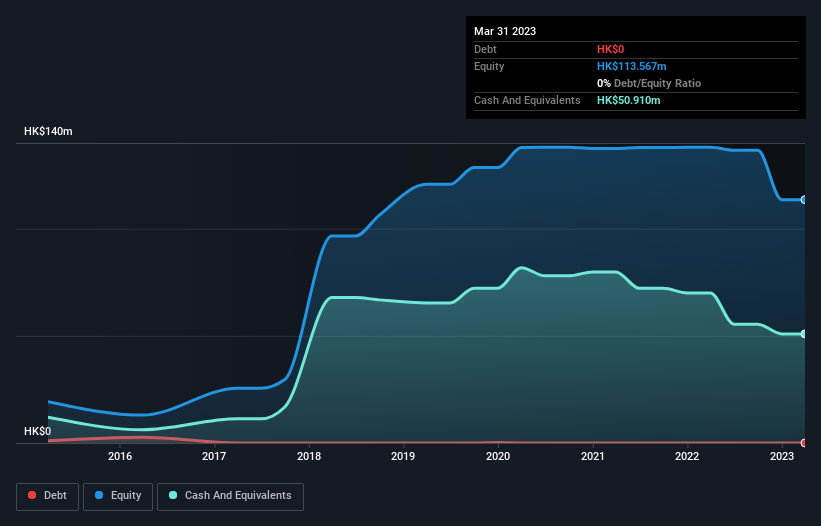

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2023, Lumina Group had HK$51m in cash, and was debt-free. In the last year, its cash burn was HK$14m. So it had a cash runway of about 3.5 years from March 2023. There's no doubt that this is a reassuringly long runway. The image below shows how its cash balance has been changing over the last few years.

How Well Is Lumina Group Growing?

One thing for shareholders to keep front in mind is that Lumina Group increased its cash burn by 1,554% in the last twelve months. That's not ideal, but we're made even more nervous given that operating revenue was flat over the same period. Considering these two factors together makes us nervous about the direction the company seems to be heading. In reality, this article only makes a short study of the company's growth data. You can take a look at how Lumina Group has developed its business over time by checking this visualization of its revenue and earnings history.

How Easily Can Lumina Group Raise Cash?

Even though it seems like Lumina Group is developing its business nicely, we still like to consider how easily it could raise more money to accelerate growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Lumina Group's cash burn of HK$14m is about 8.9% of its HK$162m market capitalisation. Given that is a rather small percentage, it would probably be really easy for the company to fund another year's growth by issuing some new shares to investors, or even by taking out a loan.

So, Should We Worry About Lumina Group's Cash Burn?

Even though its increasing cash burn makes us a little nervous, we are compelled to mention that we thought Lumina Group's cash runway was relatively promising. While we're the kind of investors who are always a bit concerned about the risks involved with cash burning companies, the metrics we have discussed in this article leave us relatively comfortable about Lumina Group's situation. On another note, Lumina Group has 3 warning signs (and 1 which is concerning) we think you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1162

Lumina Group

An investment holding company, provides fire safety services in Hong Kong and the People’s Republic of China.

Flawless balance sheet with low risk.

Market Insights

Community Narratives