- Hong Kong

- /

- Construction

- /

- SEHK:9998

Subdued Growth No Barrier To Kwan Yong Holdings Limited (HKG:9998) With Shares Advancing 33%

Kwan Yong Holdings Limited (HKG:9998) shares have had a really impressive month, gaining 33% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 12% in the last twelve months.

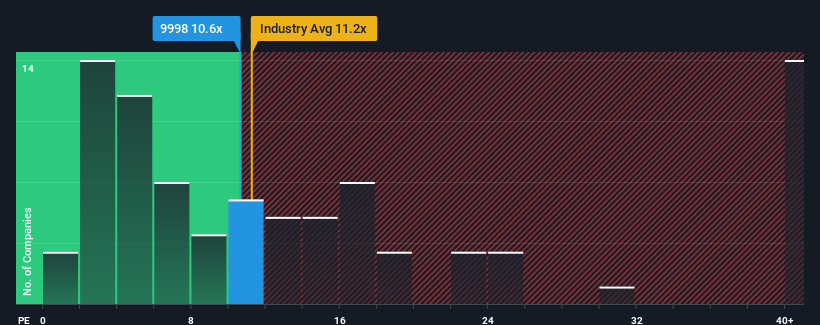

Although its price has surged higher, you could still be forgiven for feeling indifferent about Kwan Yong Holdings' P/E ratio of 10.6x, since the median price-to-earnings (or "P/E") ratio in Hong Kong is also close to 10x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

For instance, Kwan Yong Holdings' receding earnings in recent times would have to be some food for thought. It might be that many expect the company to put the disappointing earnings performance behind them over the coming period, which has kept the P/E from falling. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

See our latest analysis for Kwan Yong Holdings

How Is Kwan Yong Holdings' Growth Trending?

Kwan Yong Holdings' P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 32%. This has erased any of its gains during the last three years, with practically no change in EPS being achieved in total. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably less attractive on an annualised basis.

In light of this, it's curious that Kwan Yong Holdings' P/E sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited recent growth rates and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as a continuation of recent earnings trends is likely to weigh down the shares eventually.

The Final Word

Its shares have lifted substantially and now Kwan Yong Holdings' P/E is also back up to the market median. Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Kwan Yong Holdings revealed its three-year earnings trends aren't impacting its P/E as much as we would have predicted, given they look worse than current market expectations. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the moderate P/E lower. Unless the recent medium-term conditions improve, it's challenging to accept these prices as being reasonable.

You always need to take note of risks, for example - Kwan Yong Holdings has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Kwan Yong Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Kwan Yong Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:9998

Kwan Yong Holdings

An investment holding company, engages in the provision of general building and construction services in Singapore.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives