- Hong Kong

- /

- Trade Distributors

- /

- SEHK:990

With EPS Growth And More, Theme International Holdings (HKG:990) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

In contrast to all that, I prefer to spend time on companies like Theme International Holdings (HKG:990), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Theme International Holdings

How Fast Is Theme International Holdings Growing Its Earnings Per Share?

Over the last three years, Theme International Holdings has grown earnings per share (EPS) like young bamboo after rain; fast, and from a low base. So I don't think the percent growth rate is particularly meaningful. As a result, I'll zoom in on growth over the last year, instead. Like a firecracker arcing through the night sky, Theme International Holdings's EPS shot from HK$0.038 to HK$0.074, over the last year. Year on year growth of 97% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

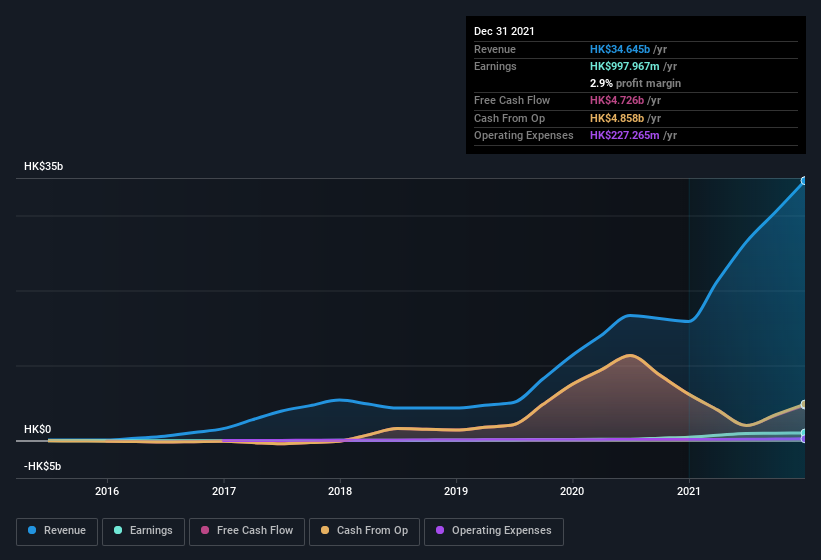

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Theme International Holdings's EBIT margins were flat over the last year, revenue grew by a solid 118% to HK$35b. That's a real positive.

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Theme International Holdings's balance sheet strength, before getting too excited.

Are Theme International Holdings Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

One gleaming positive for Theme International Holdings, in the last year, is that a certain insider has buying shares with ample enthusiasm. Indeed, Bing Liu has accumulated shares over the last year, paying a total of HK$199m at an average price of about HK$0.75. It doesn't get much better than that, in terms of large investments from insiders.

The good news, alongside the insider buying, for Theme International Holdings bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they have a glittering mountain of wealth invested in it, currently valued at HK$985m. I would find that kind of skin in the game quite encouraging, if I owned shares, since it would ensure that the leaders of the company would also experience my success, or failure, with the stock.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Jiang Jiang, is paid less than the median for similar sized companies. For companies with market capitalizations between HK$7.8b and HK$25b, like Theme International Holdings, the median CEO pay is around HK$4.8m.

The Theme International Holdings CEO received HK$2.8m in compensation for the year ending . That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO compensation is hardly the most important aspect of a company to consider, but when its reasonable that does give me a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Is Theme International Holdings Worth Keeping An Eye On?

Theme International Holdings's earnings per share growth have been levitating higher, like a mountain goat scaling the Alps. The incing on the cake is that insiders own a large chunk of the company and one has even been buying more shares. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Theme International Holdings deserves timely attention. It is worth noting though that we have found 1 warning sign for Theme International Holdings that you need to take into consideration.

As a growth investor I do like to see insider buying. But Theme International Holdings isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:990

Deep Source Holdings

An investment holding company, engages in the processing, distribution, and trading of bulk commodities and related products in the People’s Republic of China, Hong Kong, and Singapore.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives