- Hong Kong

- /

- Trade Distributors

- /

- SEHK:936

Unpleasant Surprises Could Be In Store For Kaisa Capital Investment Holdings Limited's (HKG:936) Shares

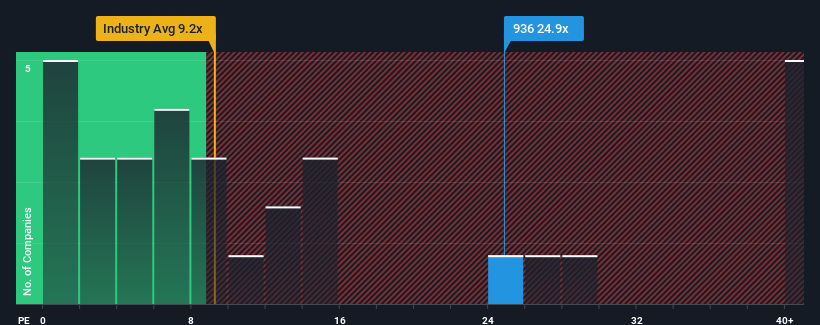

Kaisa Capital Investment Holdings Limited's (HKG:936) price-to-earnings (or "P/E") ratio of 24.9x might make it look like a strong sell right now compared to the market in Hong Kong, where around half of the companies have P/E ratios below 9x and even P/E's below 5x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

We'd have to say that with no tangible growth over the last year, Kaisa Capital Investment Holdings' earnings have been unimpressive. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Kaisa Capital Investment Holdings

Does Growth Match The High P/E?

Kaisa Capital Investment Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. The longer-term trend has been no better as the company has no earnings growth to show for over the last three years either. Therefore, it's fair to say that earnings growth has definitely eluded the company recently.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 22% shows it's noticeably less attractive on an annualised basis.

With this information, we find it concerning that Kaisa Capital Investment Holdings is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Kaisa Capital Investment Holdings revealed its three-year earnings trends aren't impacting its high P/E anywhere near as much as we would have predicted, given they look worse than current market expectations. Right now we are increasingly uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Kaisa Capital Investment Holdings (1 shouldn't be ignored) you should be aware of.

You might be able to find a better investment than Kaisa Capital Investment Holdings. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Kaisa Capital Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:936

Kaisa Capital Investment Holdings

An investment holding company specializing in the trade of construction machinery and spare parts in Hong Kong, Singapore, and the People’s Republic of China.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives