- Hong Kong

- /

- Trade Distributors

- /

- SEHK:936

Some Confidence Is Lacking In Kaisa Capital Investment Holdings Limited's (HKG:936) P/E

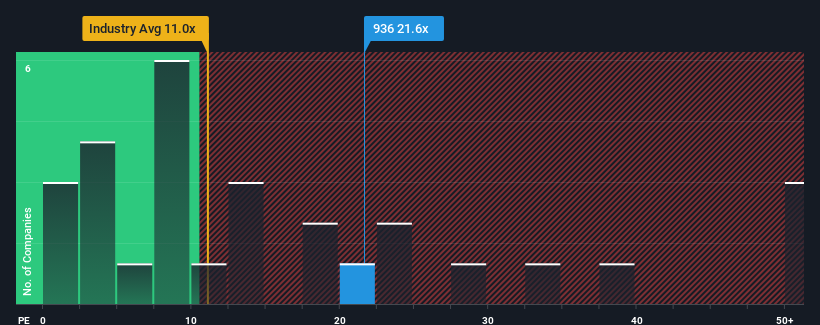

With a price-to-earnings (or "P/E") ratio of 21.6x Kaisa Capital Investment Holdings Limited (HKG:936) may be sending very bearish signals at the moment, given that almost half of all companies in Hong Kong have P/E ratios under 10x and even P/E's lower than 6x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

The earnings growth achieved at Kaisa Capital Investment Holdings over the last year would be more than acceptable for most companies. One possibility is that the P/E is high because investors think this respectable earnings growth will be enough to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Kaisa Capital Investment Holdings

How Is Kaisa Capital Investment Holdings' Growth Trending?

Kaisa Capital Investment Holdings' P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

If we review the last year of earnings growth, the company posted a worthy increase of 9.3%. Pleasingly, EPS has also lifted 31% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has done a great job of growing earnings over that time.

This is in contrast to the rest of the market, which is expected to grow by 19% over the next year, materially higher than the company's recent medium-term annualised growth rates.

In light of this, it's alarming that Kaisa Capital Investment Holdings' P/E sits above the majority of other companies. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Final Word

Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Kaisa Capital Investment Holdings currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Kaisa Capital Investment Holdings (at least 1 which is concerning), and understanding these should be part of your investment process.

Of course, you might also be able to find a better stock than Kaisa Capital Investment Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kaisa Capital Investment Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:936

Kaisa Capital Investment Holdings

An investment holding company specializing in the trade of construction machinery and spare parts in Hong Kong, Singapore, and the People’s Republic of China.

Acceptable track record and slightly overvalued.

Market Insights

Community Narratives