- Hong Kong

- /

- Construction

- /

- SEHK:711

How Does Asia Allied Infrastructure Holdings' (HKG:711) CEO Pay Compare With Company Performance?

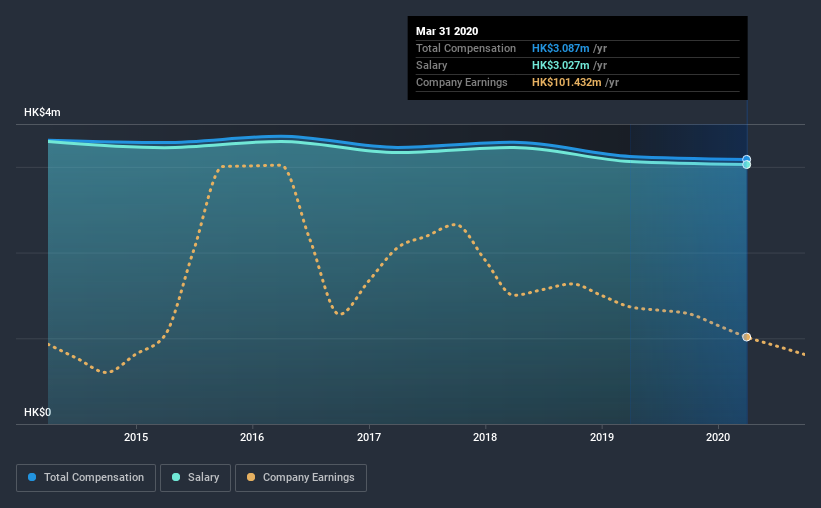

This article will reflect on the compensation paid to Derrick, JP Pang who has served as CEO of Asia Allied Infrastructure Holdings Limited (HKG:711) since 2017. This analysis will also evaluate the appropriateness of CEO compensation when taking into account the earnings and shareholder returns of the company.

Check out our latest analysis for Asia Allied Infrastructure Holdings

Comparing Asia Allied Infrastructure Holdings Limited's CEO Compensation With the industry

Our data indicates that Asia Allied Infrastructure Holdings Limited has a market capitalization of HK$1.1b, and total annual CEO compensation was reported as HK$3.1m for the year to March 2020. This means that the compensation hasn't changed much from last year. Notably, the salary which is HK$3.03m, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under HK$1.6b, the reported median total CEO compensation was HK$1.9m. This suggests that Derrick, JP Pang is paid more than the median for the industry. What's more, Derrick, JP Pang holds HK$4.4m worth of shares in the company in their own name, indicating that they have a lot of skin in the game.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | HK$3.0m | HK$3.1m | 98% |

| Other | HK$60k | HK$60k | 2% |

| Total Compensation | HK$3.1m | HK$3.1m | 100% |

On an industry level, roughly 91% of total compensation represents salary and 8.7% is other remuneration. Asia Allied Infrastructure Holdings pays a high salary, concentrating more on this aspect of compensation in comparison to non-salary pay. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

Asia Allied Infrastructure Holdings Limited's Growth

Over the last three years, Asia Allied Infrastructure Holdings Limited has shrunk its earnings per share by 33% per year. In the last year, its revenue is down 8.6%.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has Asia Allied Infrastructure Holdings Limited Been A Good Investment?

Given the total shareholder loss of 31% over three years, many shareholders in Asia Allied Infrastructure Holdings Limited are probably rather dissatisfied, to say the least. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Derrick, JP receives almost all of their compensation through a salary. As previously discussed, Derrick, JP is compensated more than what is normal for CEOs of companies of similar size, and which belong to the same industry. Unfortunately, this doesn't look great when you see shareholder returns have been negative over the last three years. Arguably worse, we've been waiting for positive EPS growth for the last three years. Understandably, the company's shareholders might have some questions about the CEO's remuneration, given the disappointing performance.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 5 warning signs for Asia Allied Infrastructure Holdings (of which 2 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Important note: Asia Allied Infrastructure Holdings is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

If you decide to trade Asia Allied Infrastructure Holdings, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SEHK:711

Asia Allied Infrastructure Holdings

An investment holding company, engages in civil engineering, electrical and mechanical engineering, and foundation and building construction work businesses in Hong Kong, the United Arab Emirates, and internationally.

Fair value second-rate dividend payer.

Market Insights

Weekly Picks

MicroVision will explode future revenue by 380.37% with a vision towards success

The Indispensable Artery for a New North American Economy

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026