Leadership Changes and Strong Earnings Could Be a Game Changer for Sany Heavy Equipment (SEHK:631)

Reviewed by Sasha Jovanovic

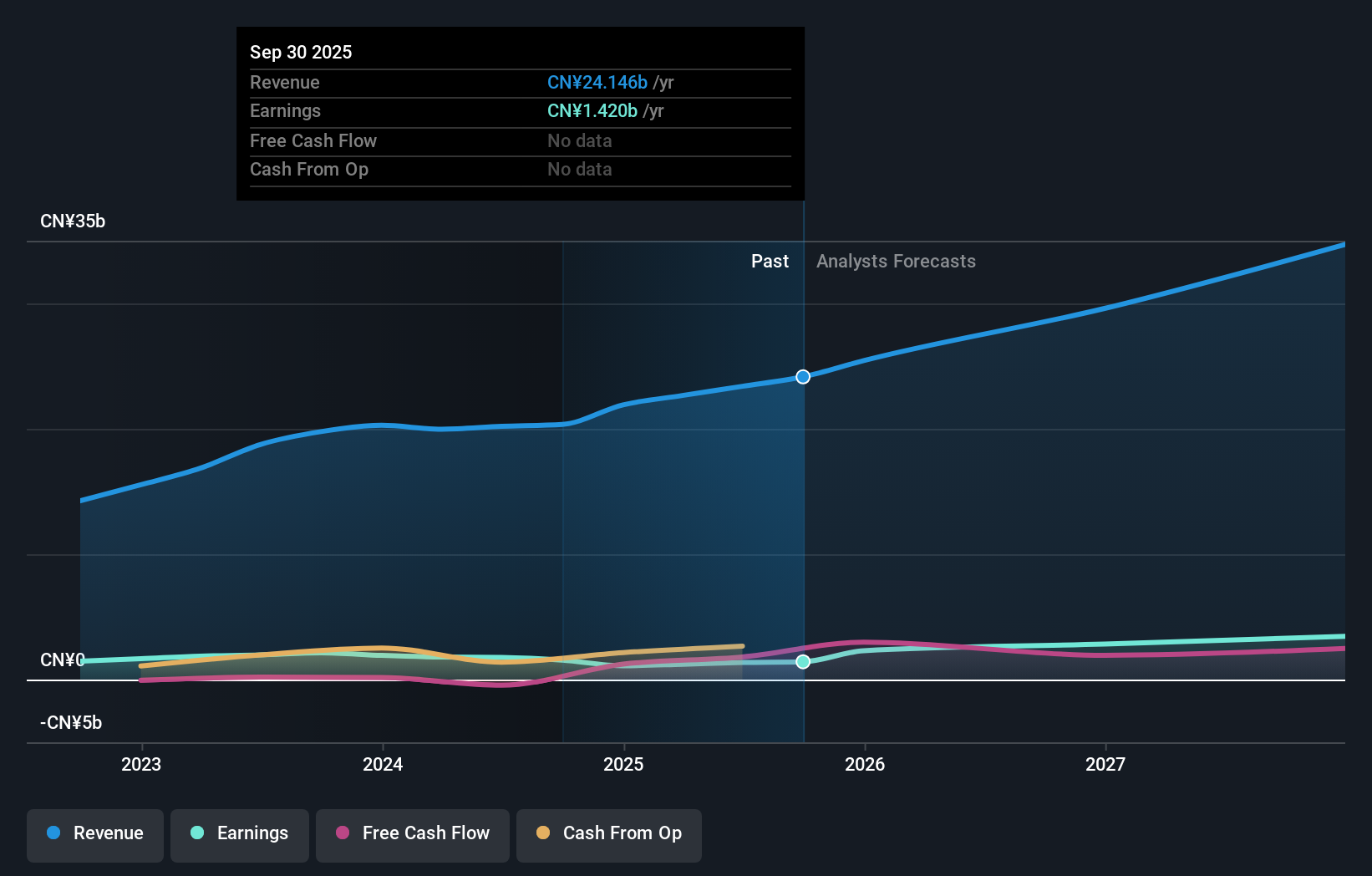

- Sany Heavy Equipment International Holdings announced executive and board changes effective October 31, 2025, including the appointment of Mr. Zhou Fugui as chairman and the release of third quarter results showing higher sales and net income compared to last year.

- The leadership transition brings extensive industry experience to the board, while the company’s strong earnings highlight operational momentum through the first nine months of 2025.

- We'll explore how the combination of enhanced leadership and robust earnings informs Sany Heavy Equipment's overall investment narrative moving forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Sany Heavy Equipment International Holdings' Investment Narrative?

For shareholders in Sany Heavy Equipment, the big picture has often revolved around strong revenue and profit growth, underpinned by the group’s focus on operational excellence and experienced leadership. The recent appointment of Mr. Zhou Fugui as chairman consolidates significant industry expertise and a long-standing connection to the company’s parent, but also marks a transition at the top during a period of healthy earnings momentum. In the short term, this leadership change is unlikely to meaningfully disrupt current catalysts, such as robust earnings growth and improving sales. However, investors remain attentive to how board and committee reshuffling could affect ongoing strategy and execution, especially as several agreements and partnerships have recently been modified or terminated. Key risks like relatively low return on equity and higher price-to-earnings ratios by industry standards remain in focus and may be re-assessed as new leadership beds in.

But with new faces at the top, how the strategic direction may shift is something investors should watch closely. Sany Heavy Equipment International Holdings' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore another fair value estimate on Sany Heavy Equipment International Holdings - why the stock might be worth just HK$8.51!

Build Your Own Sany Heavy Equipment International Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sany Heavy Equipment International Holdings research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sany Heavy Equipment International Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sany Heavy Equipment International Holdings' overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:631

Sany Heavy Equipment International Holdings

Manufactures and sells mining and logistics equipment, electricity, power station project products, petroleum and new energy manufacturing equipment, spare parts, and related services.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives