Stock Analysis

Some Sany Heavy Equipment International Holdings Company Limited (HKG:631) shareholders are probably rather concerned to see the share price fall 43% over the last three months. But that scarcely detracts from the really solid long term returns generated by the company over five years. Indeed, the share price is up an impressive 157% in that time. We think it's more important to dwell on the long term returns than the short term returns. Only time will tell if there is still too much optimism currently reflected in the share price.

While the stock has fallen 4.8% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

Check out our latest analysis for Sany Heavy Equipment International Holdings

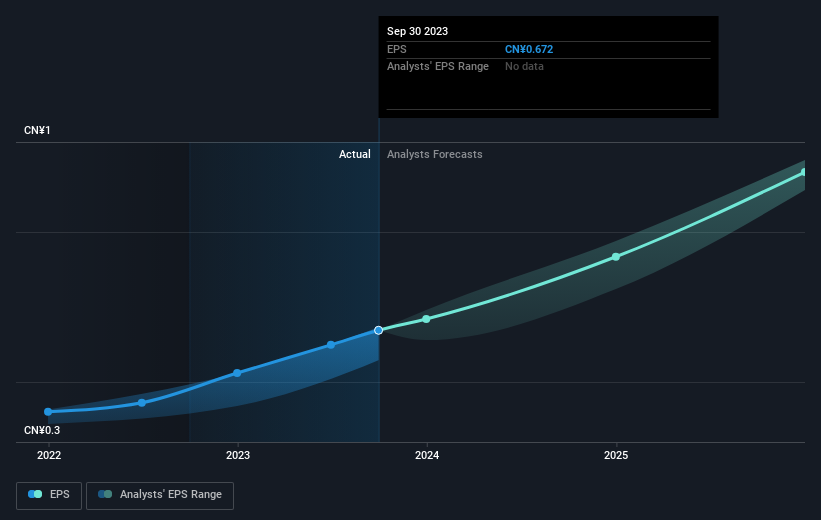

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the last half decade, Sany Heavy Equipment International Holdings became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Sany Heavy Equipment International Holdings, it has a TSR of 189% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

While it's never nice to take a loss, Sany Heavy Equipment International Holdings shareholders can take comfort that , including dividends,their trailing twelve month loss of 14% wasn't as bad as the market loss of around 16%. Longer term investors wouldn't be so upset, since they would have made 24%, each year, over five years. In the best case scenario the last year is just a temporary blip on the journey to a brighter future. It is all well and good that insiders have been buying shares, but we suggest you check here to see what price insiders were buying at.

Sany Heavy Equipment International Holdings is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether Sany Heavy Equipment International Holdings is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:631

Sany Heavy Equipment International Holdings

Sany Heavy Equipment International Holdings Company Limited, an investment holding company, engages in the manufacture and sale of mining equipment, logistics equipment, robotic, smart mine products, and spare parts.

Exceptional growth potential with excellent balance sheet.