- Hong Kong

- /

- Industrials

- /

- SEHK:53

Top Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets react to cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded strongly, with value stocks leading the charge amid rising oil prices and profit-taking in tech sectors. This environment of cautious optimism highlights the appeal of dividend stocks, which can offer investors a combination of income stability and potential for capital appreciation during times of economic transition.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.06% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.16% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.52% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.67% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.06% | ★★★★★★ |

Click here to see the full list of 1975 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

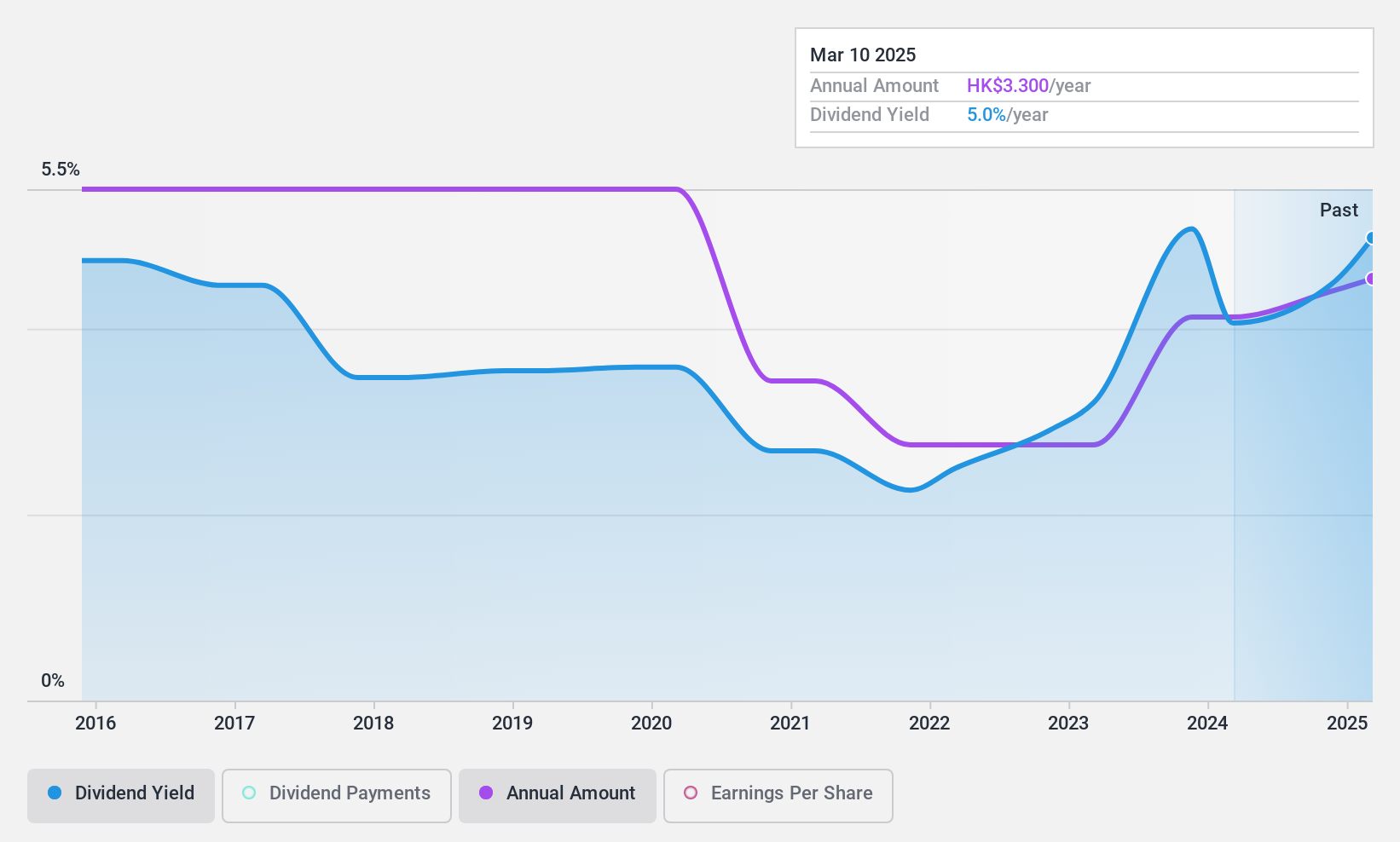

Guoco Group (SEHK:53)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Guoco Group Limited is an investment holding company involved in principal investment, property investment and development, hospitality and leisure, and financial services across Hong Kong, the People's Republic of China, the United Kingdom, Continental Europe, Singapore, Australasia, and internationally with a market cap of approximately HK$23.17 billion.

Operations: Guoco Group Limited generates its revenue primarily from hospitality and leisure ($1.34 billion), property development and investment ($1.33 billion), and principal investment ($163.81 million).

Dividend Yield: 4.5%

Guoco Group's dividend stability is mixed, with payments historically volatile and unreliable over the past decade. However, recent approval of a HK$2.70 per share final dividend signals improvement. The company's dividends are well-covered by both earnings and cash flows, indicating sustainability despite past volatility. Recent board changes, including the appointment of Ms. Melissa Wu as an independent director, may influence future governance and financial strategy positively for investors seeking stable dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Guoco Group.

- Our expertly prepared valuation report Guoco Group implies its share price may be lower than expected.

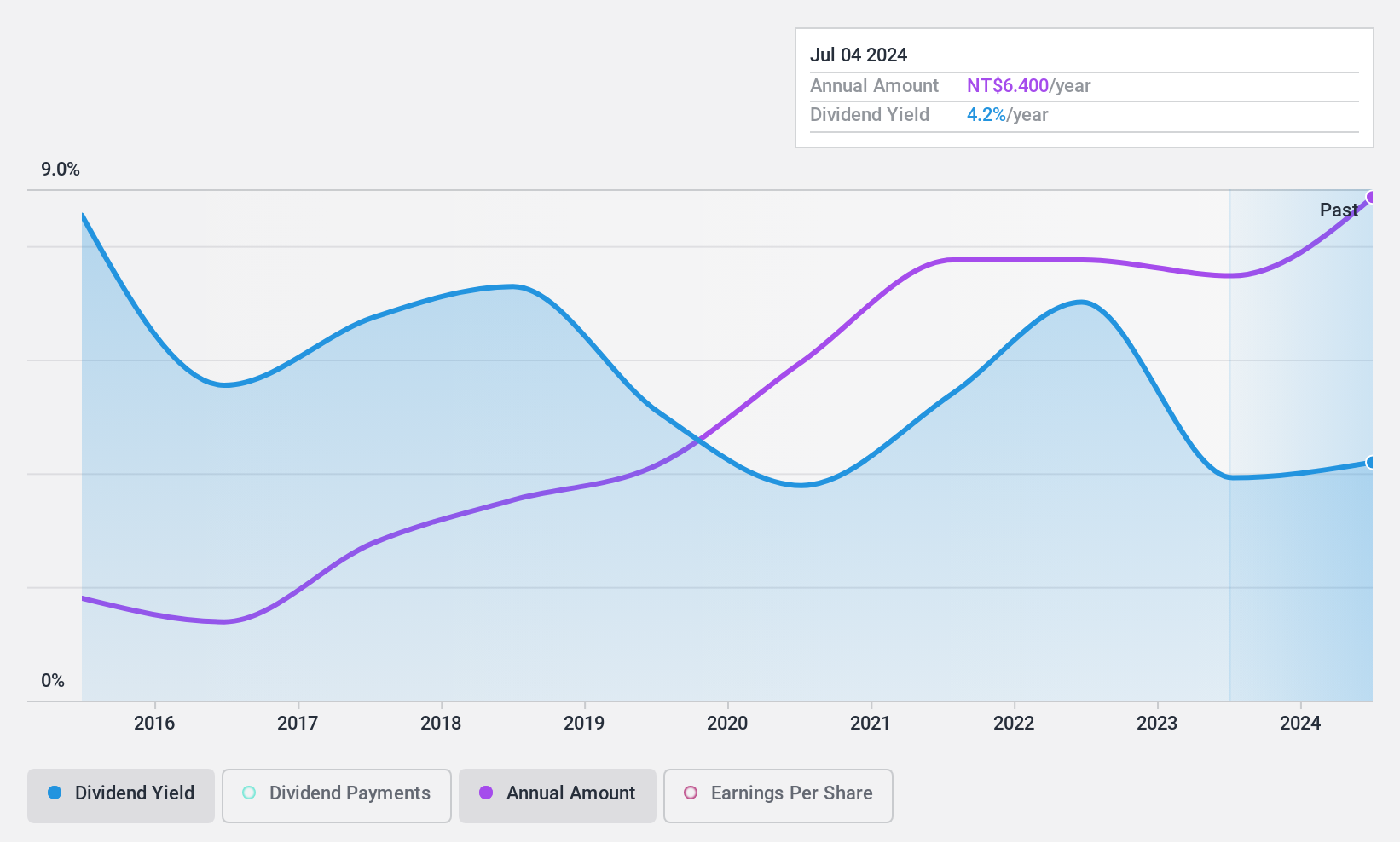

Argosy Research (TPEX:3217)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Argosy Research Inc. manufactures and sells electronic components and connectors in Asia, the United States, and internationally, with a market cap of NT$13.16 billion.

Operations: Argosy Research Inc. generates revenue of NT$3.32 billion from its manufacturing and sales of electronic component products.

Dividend Yield: 4.4%

Argosy Research's dividend history is marked by volatility, yet recent growth in earnings and cash flow coverage (77.1%) suggest improved sustainability. The payout ratio stands at a reasonable 62.3%, indicating dividends are well-supported by earnings. Despite trading at 45.3% below estimated fair value, its dividend yield (4.38%) remains slightly lower than the top quartile in Taiwan's market. Recent governance changes could impact future financial strategies and potentially enhance dividend reliability for investors.

- Navigate through the intricacies of Argosy Research with our comprehensive dividend report here.

- Our valuation report unveils the possibility Argosy Research's shares may be trading at a discount.

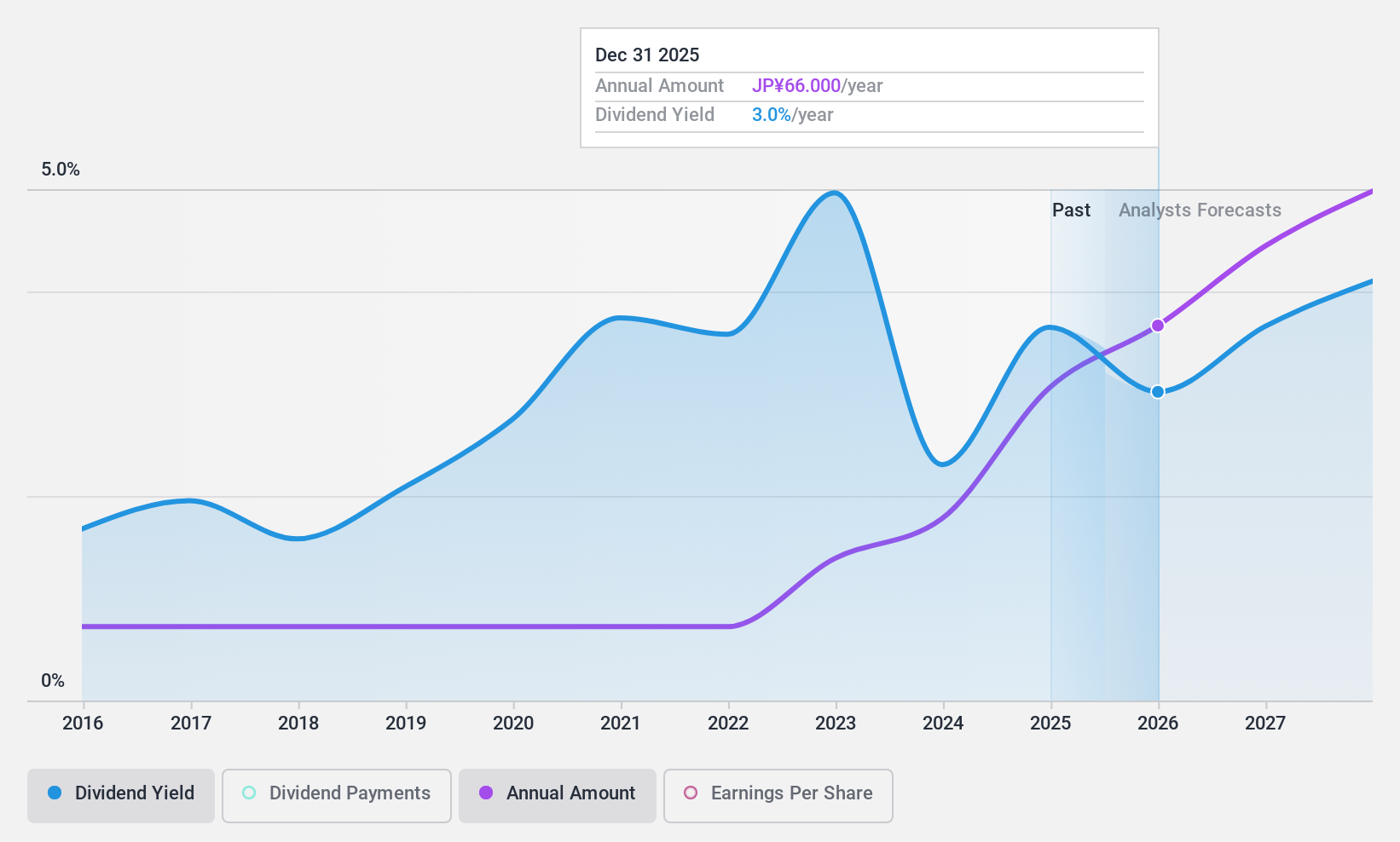

Itoki (TSE:7972)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Itoki Corporation is involved in the manufacture and sale of office and equipment-related products and services both in Japan and internationally, with a market cap of ¥77.25 billion.

Operations: Itoki Corporation's revenue is primarily derived from its Workplace Business segment, contributing ¥100.51 billion, and its Equipment and Public Works-Related Business segment, which adds ¥36.10 billion.

Dividend Yield: 3.5%

Itoki's dividend outlook shows promise with a recent increase from JPY 42.00 to JPY 55.00 per share, supported by a low payout ratio of 29.6%. Despite trading at 62.1% below its estimated fair value, the dividend yield of 3.5% lags behind Japan's top quartile payers (3.83%). Earnings growth has been robust at 56.7% annually over five years, yet dividends are not backed by free cash flow, raising sustainability concerns despite stable payments over the past decade.

- Unlock comprehensive insights into our analysis of Itoki stock in this dividend report.

- The valuation report we've compiled suggests that Itoki's current price could be quite moderate.

Taking Advantage

- Unlock our comprehensive list of 1975 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:53

Guoco Group

An investment holding company, engages in the principal investment, property investment and development, hospitality and leisure, and financial service businesses in Hong Kong, the People’s Republic of China, the United Kingdom, Continental Europe, Singapore, Australasia, and internationally.

Excellent balance sheet and good value.

Market Insights

Community Narratives