Investors can approximate the average market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the China Energy Engineering Corporation Limited (HKG:3996) share price is down 32% in the last year. That contrasts poorly with the market return of -5.0%. Longer term shareholders haven't suffered as badly, since the stock is down a comparatively less painful 19% in three years.

See our latest analysis for China Energy Engineering

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Even though the China Energy Engineering share price is down over the year, its EPS actually improved. It could be that the share price was previously over-hyped. It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's easy to justify a look at some other metrics.

On the other hand, we're certainly perturbed by the 7.5% decline in China Energy Engineering's revenue. Many investors see falling revenue as a likely precursor to lower earnings, so this could well explain the weak share price.

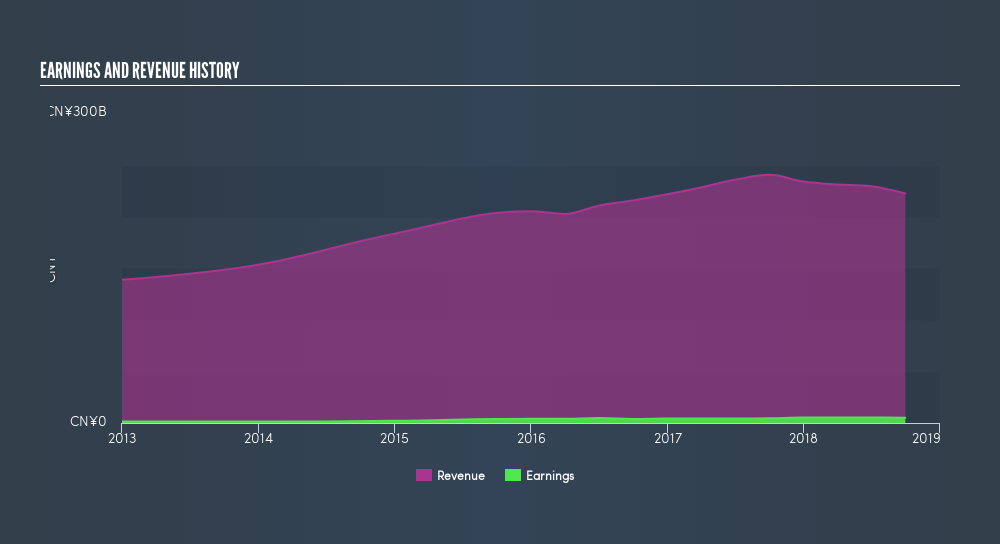

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

It's probably worth noting that the CEO is paid less than the median at similar sized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. You can see what analysts are predicting for China Energy Engineering in this interactivegraph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of China Energy Engineering, it has a TSR of -30% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The last twelve months weren't great for China Energy Engineering shares, which performed worse than the market, costing holders 30%, including dividends. The market shed around 5.0%, no doubt weighing on the stock price. The three-year loss of 4.9% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. We would be wary of buying into a company with unsolved problems, although some investors will buy into struggling stocks if they believe the price is sufficiently attractive. Keeping this in mind, a solid next step might be to take a look at China Energy Engineering's dividend track record. This freeinteractive graph is a great place to start.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this freelist of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on HK exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:3996

China Energy Engineering

Provides solutions and services in the energy, power and infrastructure sectors in the People’s Republic of China and internationally.

Fair value with acceptable track record.

Similar Companies

Market Insights

Community Narratives