- Hong Kong

- /

- Construction

- /

- SEHK:3996

China Energy Engineering (SEHK:3996): Assessing Valuation Following Major Leadership Changes

Reviewed by Simply Wall St

China Energy Engineering (SEHK:3996) is undergoing a big leadership shuffle, with Mr. Song Hailiang stepping down from several top positions, including chairman and executive director. Mr. Ni Zhen is temporarily taking over these key roles.

See our latest analysis for China Energy Engineering.

The sudden leadership shakeup comes after a strong run for China Energy Engineering’s shareholders. The stock’s year-to-date price return sits at 15.3%, and the one-year total shareholder return has reached an impressive 21.3%. Despite some weakness over the past month, which saw an 8.9% slide in the share price, investors have continued to benefit over the long term. This is reflected in a robust 36% three-year and 60% five-year total return. It seems that recent management changes have not derailed the broader upward momentum, though short-term volatility may persist as the market digests this news.

If shifts at the top have you thinking about other opportunities, now’s a smart moment to broaden your search and discover fast growing stocks with high insider ownership

With all this recent upheaval, the question becomes: are markets underestimating China Energy Engineering’s long-term prospects, or is the current share price already reflecting expectations for future growth and stability?

Price-to-Earnings of 5.4x: Is it justified?

China Energy Engineering’s shares are trading at a price-to-earnings (PE) ratio of 5.4x as of the last close at HK$1.13, which is a notable discount compared to peers and industry benchmarks. This low PE may signal that the market is undervaluing its current earnings power.

The price-to-earnings ratio tells investors how much they are paying today for each dollar of earnings generated by the company. For construction and capital goods companies like China Energy Engineering, the PE ratio is a key indicator of how the market values its underlying profitability relative to competitors.

With China Energy Engineering’s PE at just 5.4x, the stock stands out as attractively priced. The company is trading well below the industry average of 10.8x and even further below the peer group average of 10.2x. Compared with the estimated fair PE of 12x, it suggests significant potential for the market to re-rate the stock if its earnings profile strengthens or expectations shift.

Explore the SWS fair ratio for China Energy Engineering

Result: Price-to-Earnings of 5.4x (UNDERVALUED)

However, risks such as prolonged leadership uncertainty or slower than expected earnings growth could quickly change investor sentiment and pressure the attractive valuation.

Find out about the key risks to this China Energy Engineering narrative.

Another View: What Does the SWS DCF Model Say?

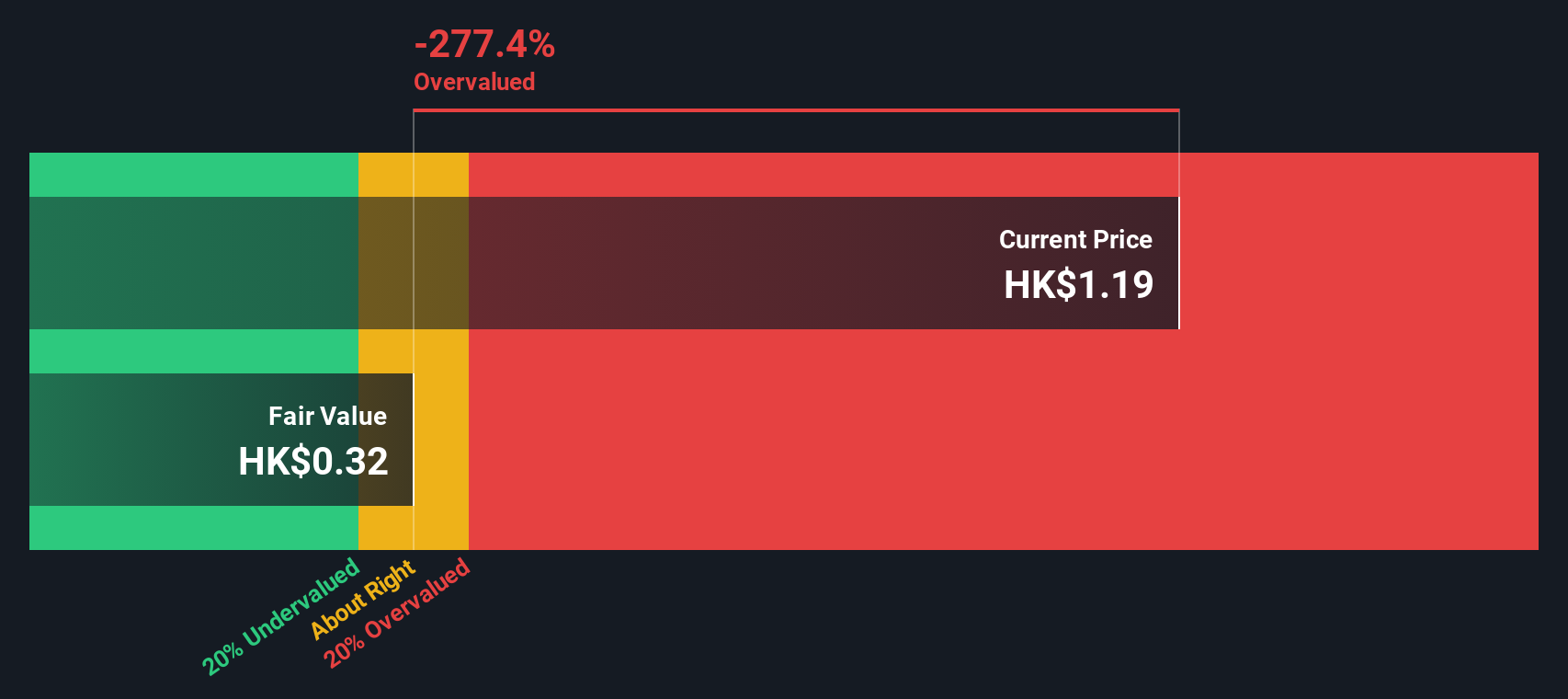

While price-to-earnings suggests the shares are cheap, our SWS DCF model offers a different angle. According to the DCF, China Energy Engineering's current share price of HK$1.13 stands well above its estimated fair value of HK$0.32. This implies the stock could be overvalued. Which approach tells the real story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out China Energy Engineering for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 921 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own China Energy Engineering Narrative

If you see things differently or want to form your own view, you can dive into the numbers and build your own story in just a few minutes. Start with Do it your way.

A great starting point for your China Energy Engineering research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for More Smart Stock Ideas?

Smart investors know there is always another opportunity waiting. Why settle for ordinary when you could be uncovering tomorrow’s market leaders? Don’t let great investment ideas pass you by. Set your strategy apart with these powerful tools:

- Uncover high-yield potential when you jump into these 15 dividend stocks with yields > 3% and find companies rewarding their shareholders with above-average income.

- Tap into cutting-edge innovation by searching through these 26 AI penny stocks and connect with businesses pushing the boundaries of artificial intelligence.

- Fuel your watchlist with value by tracking these 921 undervalued stocks based on cash flows shining with attractive fundamentals and strong cash flow prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3996

China Energy Engineering

Provides solutions and services in the energy, power and infrastructure sectors in the People’s Republic of China and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives