As global markets navigate the aftermath of the longest U.S. government shutdown in history and face ongoing concerns about elevated valuations, investors are seeking stability amid mixed performances across major indices. In this environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive option for those looking to balance risk with steady returns.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 5.29% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.83% | ★★★★★★ |

| Torigoe (TSE:2009) | 4.01% | ★★★★★★ |

| SAN Holdings (TSE:9628) | 4.39% | ★★★★★★ |

| NCD (TSE:4783) | 4.60% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.64% | ★★★★★★ |

| Changjiang Publishing & MediaLtd (SHSE:600757) | 4.67% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.88% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.78% | ★★★★★★ |

| Binggrae (KOSE:A005180) | 4.41% | ★★★★★★ |

Click here to see the full list of 1388 stocks from our Top Global Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

CIMC Enric Holdings (SEHK:3899)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CIMC Enric Holdings Limited offers transportation, storage, and processing equipment and services for the clean energy, chemicals, environmental, and liquid food sectors globally with a market cap of HK$16.11 billion.

Operations: CIMC Enric Holdings Limited's revenue is primarily derived from its Clean Energy segment at CN¥18.93 billion, followed by the Liquid Food segment at CN¥4.02 billion, and the Chemical and Environmental segment at CN¥2.98 billion.

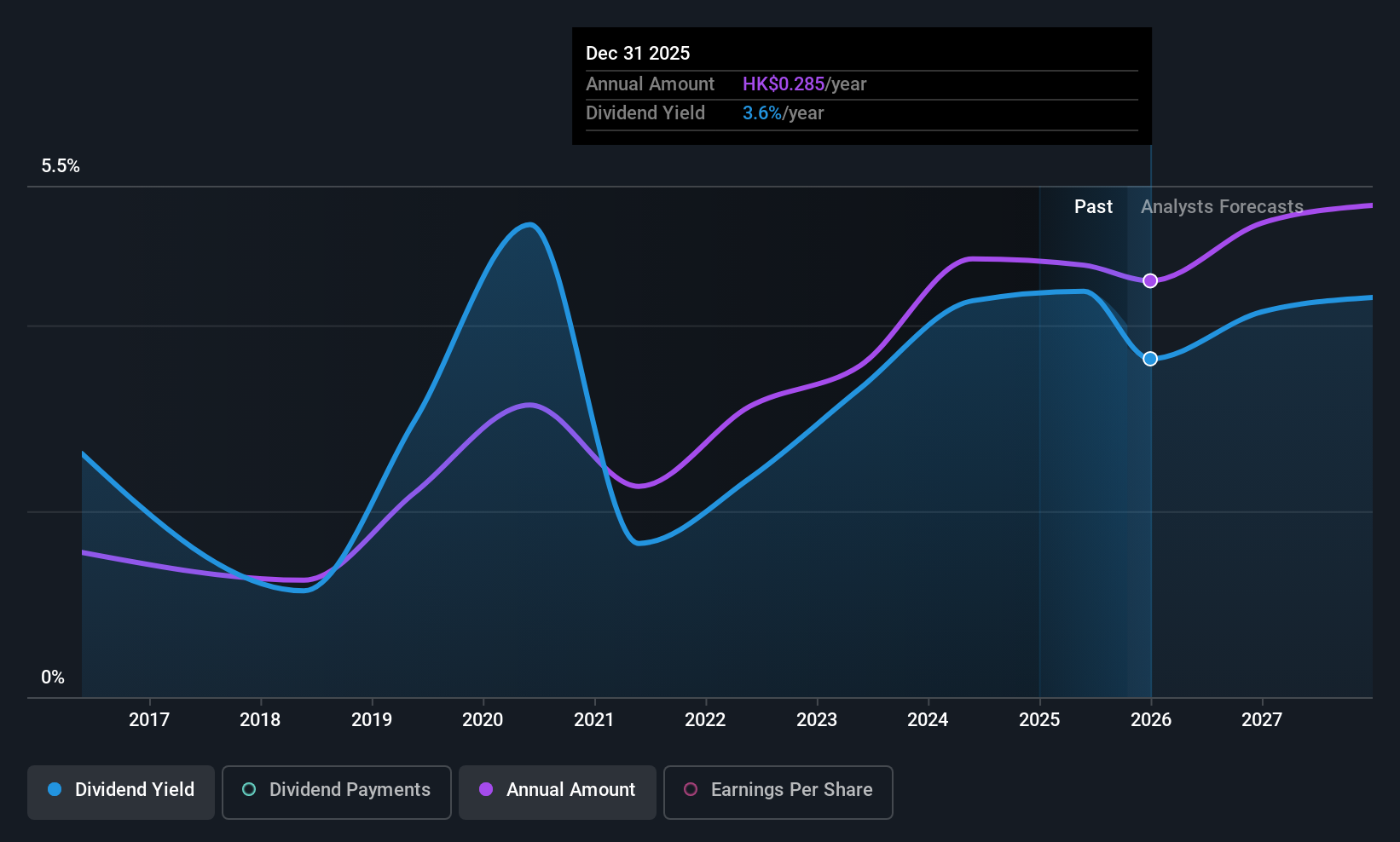

Dividend Yield: 3.7%

CIMC Enric Holdings has shown a growing dividend over the past decade, with a payout ratio of 46.7% and cash payout ratio of 65.5%, indicating dividends are well-covered by earnings and cash flows. However, the dividend yield of 3.72% is below the top quartile in Hong Kong, and payments have been volatile historically. Recent earnings growth supports potential future payouts, but investors should note past instability in dividend reliability.

- Get an in-depth perspective on CIMC Enric Holdings' performance by reading our dividend report here.

- Our valuation report unveils the possibility CIMC Enric Holdings' shares may be trading at a premium.

Jinhong Fashion GroupLtd (SHSE:603518)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Jinhong Fashion Group Co., Ltd. operates in China, focusing on the design, development, manufacturing, and sale of apparel and accessories for women, men, and children with a market cap of CN¥3.46 billion.

Operations: Jinhong Fashion Group Co., Ltd. generates revenue through its apparel and accessories offerings for women, men, and children in China.

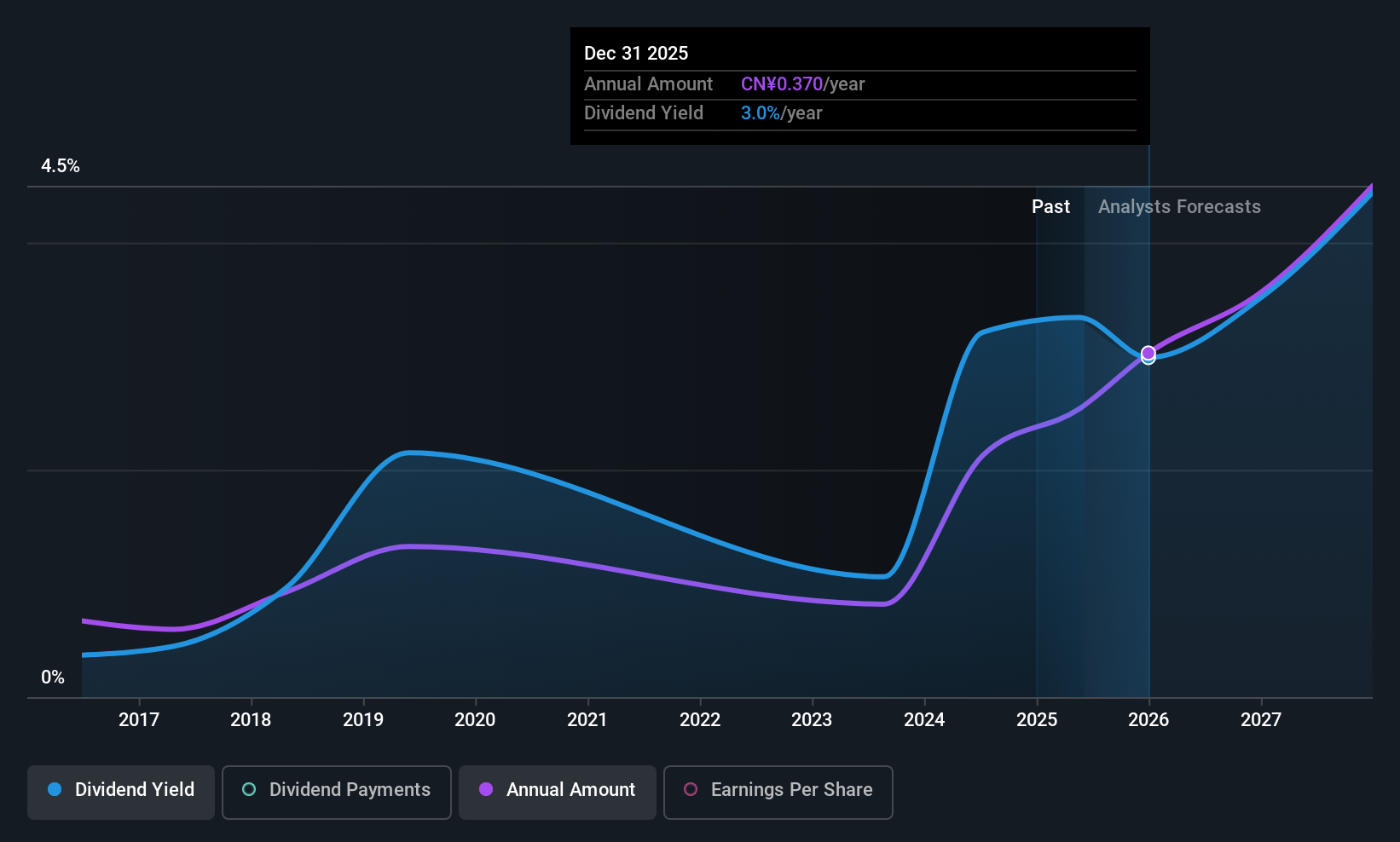

Dividend Yield: 3.1%

Jinhong Fashion Group Ltd. offers a dividend yield of 3.08%, placing it in the top 25% of dividend payers in China. The company's dividends are well-covered by earnings and cash flows, with payout ratios at 41.4% and 26%, respectively, suggesting sustainability despite a volatile track record over the past decade. Recent financial results show declining sales and net income, which may impact future dividend stability despite historical growth in payments over ten years.

- Click here to discover the nuances of Jinhong Fashion GroupLtd with our detailed analytical dividend report.

- Our valuation report unveils the possibility Jinhong Fashion GroupLtd's shares may be trading at a discount.

Denyo (TSE:6517)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Denyo Co., Ltd. manufactures and sells engine-driven generators, welders, air compressors, and other special machinery across Japan, the United States, Asia, and internationally with a market cap of ¥63.26 billion.

Operations: Denyo Co., Ltd.'s revenue segments are comprised of ¥55.92 billion from Japan, ¥13.25 billion from the U.S.A., ¥8.77 billion from Asia, and ¥368 million from Europe.

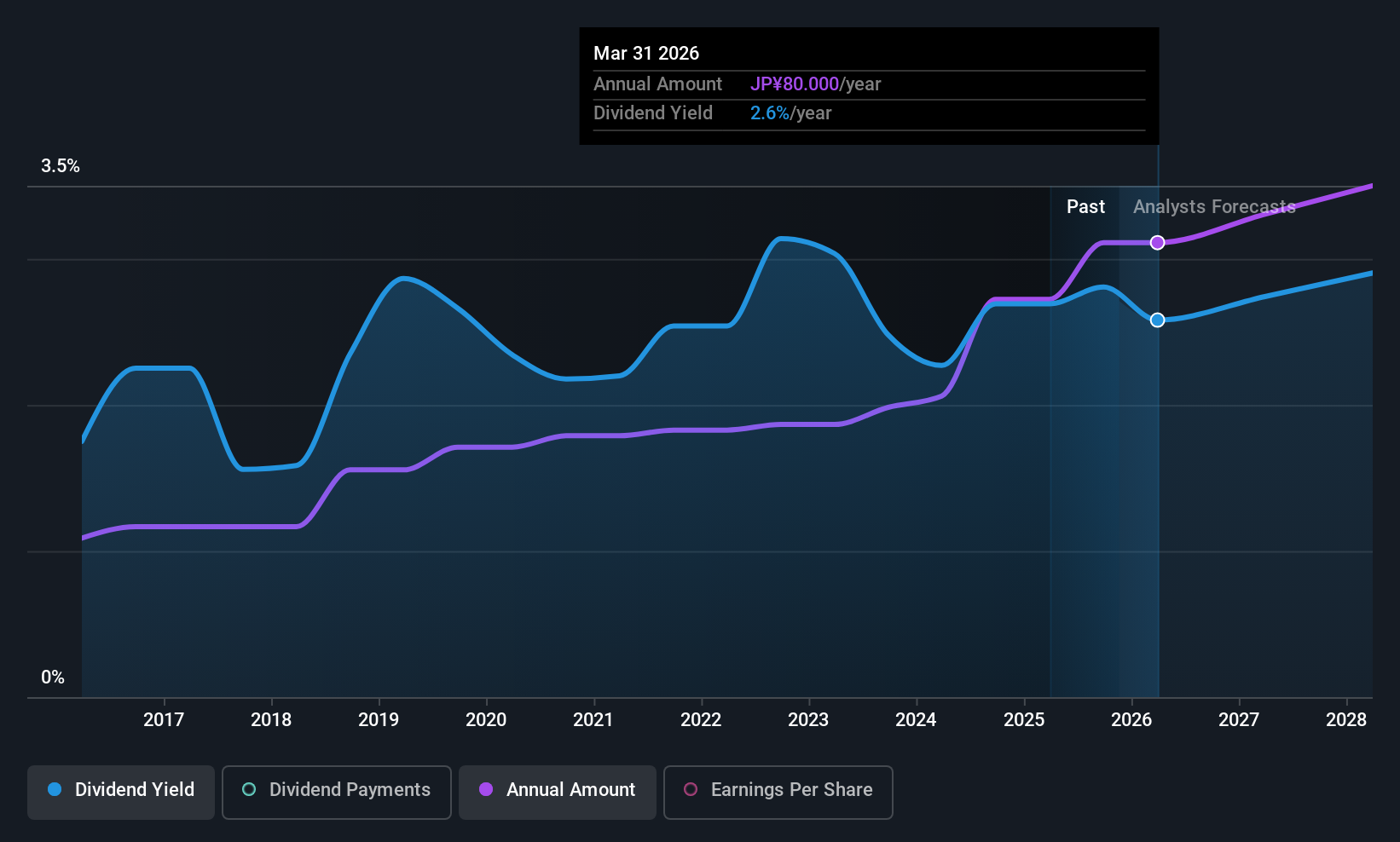

Dividend Yield: 3.6%

Denyo Co., Ltd. maintains a dividend yield of 3.59%, slightly below the top 25% in Japan, yet it offers stability with consistent growth over the past decade. The company’s dividends are well-covered by earnings (payout ratio: 18.6%) and cash flows (cash payout ratio: 74.9%), indicating sustainability. Recent announcements of a ¥1 billion share buyback aim to enhance shareholder returns, reflecting a strategic focus on capital efficiency and flexible financial management moving forward.

- Click to explore a detailed breakdown of our findings in Denyo's dividend report.

- Our comprehensive valuation report raises the possibility that Denyo is priced higher than what may be justified by its financials.

Next Steps

- Click through to start exploring the rest of the 1385 Top Global Dividend Stocks now.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603518

Jinhong Fashion GroupLtd

Engages in the design, development, manufacturing, and sale of apparels and accessories for women, men, and children in China.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives