- Hong Kong

- /

- Construction

- /

- SEHK:368

Subdued Growth No Barrier To Superland Group Holdings Limited (HKG:368) With Shares Advancing 26%

The Superland Group Holdings Limited (HKG:368) share price has done very well over the last month, posting an excellent gain of 26%. The last 30 days bring the annual gain to a very sharp 48%.

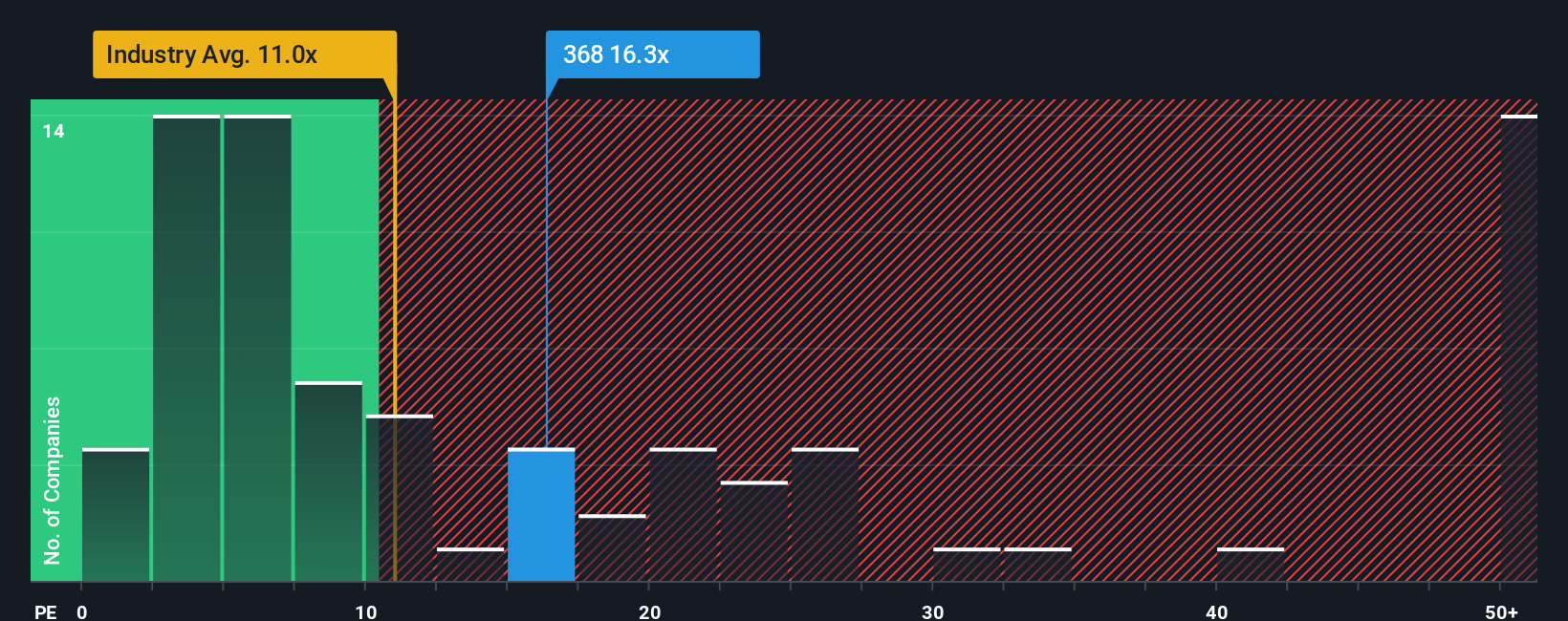

Following the firm bounce in price, given around half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 12x, you may consider Superland Group Holdings as a stock to potentially avoid with its 16.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

It looks like earnings growth has deserted Superland Group Holdings recently, which is not something to boast about. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Superland Group Holdings

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Superland Group Holdings would need to produce impressive growth in excess of the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 69% overall rise in EPS, in spite of its uninspiring short-term performance. Accordingly, shareholders would have probably welcomed those medium-term rates of earnings growth.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 20% shows it's about the same on an annualised basis.

With this information, we find it interesting that Superland Group Holdings is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average recent growth rates and are willing to pay up for exposure to the stock. Nevertheless, they may be setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

The Key Takeaway

The large bounce in Superland Group Holdings' shares has lifted the company's P/E to a fairly high level. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Superland Group Holdings revealed its three-year earnings trends aren't impacting its high P/E as much as we would have predicted, given they look similar to current market expectations. Right now we are uncomfortable with the high P/E as this earnings performance isn't likely to support such positive sentiment for long. If recent medium-term earnings trends continue, it will place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

It is also worth noting that we have found 2 warning signs for Superland Group Holdings (1 doesn't sit too well with us!) that you need to take into consideration.

Of course, you might also be able to find a better stock than Superland Group Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:368

Superland Group Holdings

An investment holding company, provides fitting-out, and repair and maintenance services in Hong Kong.

Mediocre balance sheet with questionable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success