Optimistic Investors Push CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) Shares Up 35% But Growth Is Lacking

CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) shareholders would be excited to see that the share price has had a great month, posting a 35% gain and recovering from prior weakness. The bad news is that even after the stocks recovery in the last 30 days, shareholders are still underwater by about 10.0% over the last year.

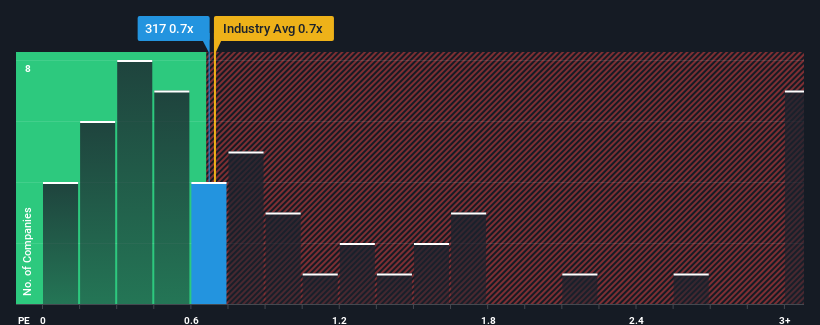

In spite of the firm bounce in price, it's still not a stretch to say that CSSC Offshore & Marine Engineering (Group)'s price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Machinery industry in Hong Kong, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for CSSC Offshore & Marine Engineering (Group)

What Does CSSC Offshore & Marine Engineering (Group)'s Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, CSSC Offshore & Marine Engineering (Group) has been doing relatively well. It might be that many expect the strong revenue performance to wane, which has kept the P/S ratio from rising. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Want the full picture on analyst estimates for the company? Then our free report on CSSC Offshore & Marine Engineering (Group) will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For CSSC Offshore & Marine Engineering (Group)?

The only time you'd be comfortable seeing a P/S like CSSC Offshore & Marine Engineering (Group)'s is when the company's growth is tracking the industry closely.

Retrospectively, the last year delivered an exceptional 19% gain to the company's top line. The strong recent performance means it was also able to grow revenue by 84% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 9.9% over the next year. Meanwhile, the rest of the industry is forecast to expand by 15%, which is noticeably more attractive.

In light of this, it's curious that CSSC Offshore & Marine Engineering (Group)'s P/S sits in line with the majority of other companies. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Final Word

Its shares have lifted substantially and now CSSC Offshore & Marine Engineering (Group)'s P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Given that CSSC Offshore & Marine Engineering (Group)'s revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. When we see companies with a relatively weaker revenue outlook compared to the industry, we suspect the share price is at risk of declining, sending the moderate P/S lower. A positive change is needed in order to justify the current price-to-sales ratio.

Many other vital risk factors can be found on the company's balance sheet. Our free balance sheet analysis for CSSC Offshore & Marine Engineering (Group) with six simple checks will allow you to discover any risks that could be an issue.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives