Is CSSC Offshore & Marine Engineering (Group) (HKG:317) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. As with many other companies CSSC Offshore & Marine Engineering (Group) Company Limited (HKG:317) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

See our latest analysis for CSSC Offshore & Marine Engineering (Group)

How Much Debt Does CSSC Offshore & Marine Engineering (Group) Carry?

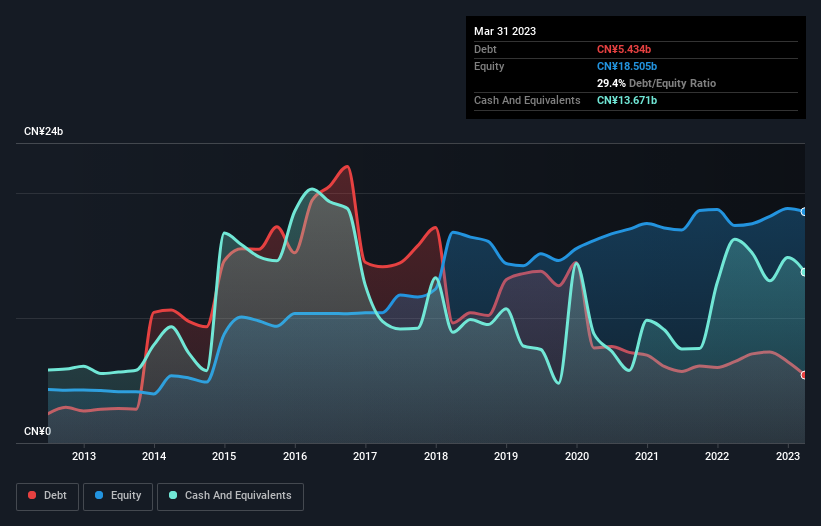

As you can see below, CSSC Offshore & Marine Engineering (Group) had CN¥5.43b of debt at March 2023, down from CN¥6.50b a year prior. However, its balance sheet shows it holds CN¥13.7b in cash, so it actually has CN¥8.24b net cash.

A Look At CSSC Offshore & Marine Engineering (Group)'s Liabilities

The latest balance sheet data shows that CSSC Offshore & Marine Engineering (Group) had liabilities of CN¥24.5b due within a year, and liabilities of CN¥3.17b falling due after that. Offsetting this, it had CN¥13.7b in cash and CN¥3.81b in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by CN¥10.2b.

This deficit isn't so bad because CSSC Offshore & Marine Engineering (Group) is worth CN¥30.3b, and thus could probably raise enough capital to shore up its balance sheet, if the need arose. But it's clear that we should definitely closely examine whether it can manage its debt without dilution. Despite its noteworthy liabilities, CSSC Offshore & Marine Engineering (Group) boasts net cash, so it's fair to say it does not have a heavy debt load! There's no doubt that we learn most about debt from the balance sheet. But it is CSSC Offshore & Marine Engineering (Group)'s earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Over 12 months, CSSC Offshore & Marine Engineering (Group) reported revenue of CN¥14b, which is a gain of 24%, although it did not report any earnings before interest and tax. With any luck the company will be able to grow its way to profitability.

So How Risky Is CSSC Offshore & Marine Engineering (Group)?

Although CSSC Offshore & Marine Engineering (Group) had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of CN¥674m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. The good news for CSSC Offshore & Marine Engineering (Group) shareholders is that its revenue growth is strong, making it easier to raise capital if need be. But that doesn't change our opinion that the stock is risky. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Be aware that CSSC Offshore & Marine Engineering (Group) is showing 1 warning sign in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives