Do CSSC Offshore & Marine Engineering (Group)'s (HKG:317) Earnings Warrant Your Attention?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like CSSC Offshore & Marine Engineering (Group) (HKG:317). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

How Fast Is CSSC Offshore & Marine Engineering (Group) Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that CSSC Offshore & Marine Engineering (Group) grew its EPS from CN¥0.064 to CN¥0.39, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

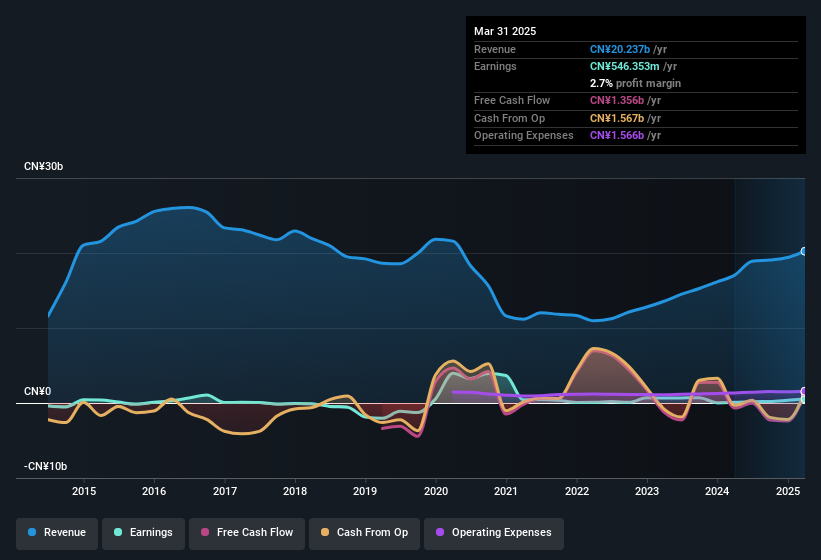

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for CSSC Offshore & Marine Engineering (Group) remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 19% to CN¥20b. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

See our latest analysis for CSSC Offshore & Marine Engineering (Group)

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check CSSC Offshore & Marine Engineering (Group)'s balance sheet strength, before getting too excited.

Are CSSC Offshore & Marine Engineering (Group) Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to CSSC Offshore & Marine Engineering (Group), with market caps between CN¥14b and CN¥46b, is around CN¥3.3m.

CSSC Offshore & Marine Engineering (Group)'s CEO took home a total compensation package of CN¥1.0m in the year prior to December 2024. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is CSSC Offshore & Marine Engineering (Group) Worth Keeping An Eye On?

CSSC Offshore & Marine Engineering (Group)'s earnings per share have been soaring, with growth rates sky high. Such fast EPS growth prompts the question: has the business reached an inflection point? What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. It will definitely require further research to be sure, but it does seem that CSSC Offshore & Marine Engineering (Group) has the hallmarks of a quality business; and that would make it well worth watching. Now, you could try to make up your mind on CSSC Offshore & Marine Engineering (Group) by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

Although CSSC Offshore & Marine Engineering (Group) certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Hong Kong companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:317

CSSC Offshore & Marine Engineering (Group)

Manufactures and sells marine and defense equipment in the People’s Republic of China, other regions in Asia, Europe, Oceania, North America, South America, and Africa.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives