Yuanda China Holdings (HKG:2789) soars 11% this week, taking three-year gains to 990%

Investing can be hard but the potential fo an individual stock to pay off big time inspires us. You won't get it right every time, but when you do, the returns can be truly splendid. For example, the Yuanda China Holdings Limited (HKG:2789) share price is up a whopping 604% in the last three years, a handsome return for long term holders. On top of that, the share price is up 120% in about a quarter. Anyone who held for that rewarding ride would probably be keen to talk about it.

Since the stock has added HK$112m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Yuanda China Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally hope to see good revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

Yuanda China Holdings actually saw its revenue drop by 12% per year over three years. This is in stark contrast to the strong share price growth of 92%, compound, per year. This clear lack of correlation between revenue and share price is surprising to see in a money losing company. At the risk of upsetting holders, this does suggest that hope for a better future is playing a significant role in the share price action.

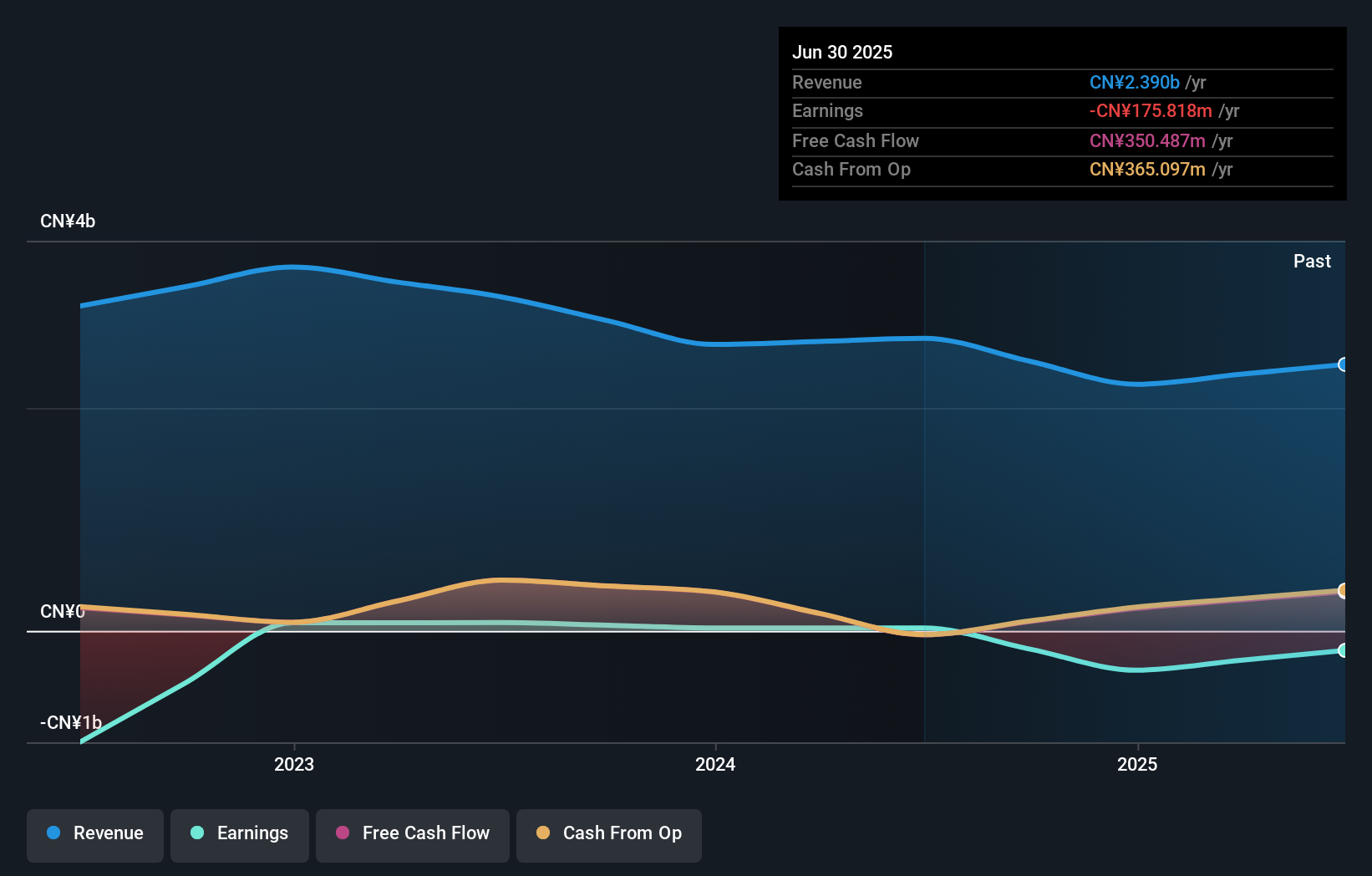

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. Dive deeper into the earnings by checking this interactive graph of Yuanda China Holdings' earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Yuanda China Holdings' total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Yuanda China Holdings' TSR of 990% over the last 3 years is better than the share price return.

A Different Perspective

It's good to see that Yuanda China Holdings has rewarded shareholders with a total shareholder return of 844% in the last twelve months. That's better than the annualised return of 38% over half a decade, implying that the company is doing better recently. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Yuanda China Holdings that you should be aware of before investing here.

Yuanda China Holdings is not the only stock that insiders are buying. For those who like to find lesser know companies this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2789

Yuanda China Holdings

An investment holding company, engages in the design, procurement, production, assembling, sale, and installation of curtain wall systems in Mainland China, the United States, the United Kingdom, Qatar, and internationally.

Good value with mediocre balance sheet.

Market Insights

Community Narratives