- Hong Kong

- /

- Electrical

- /

- SEHK:2727

Shanghai Electric Group Co., Ltd.'s (HKG:2727) 28% Share Price Surge Not Quite Adding Up

Shanghai Electric Group Co., Ltd. (HKG:2727) shares have continued their recent momentum with a 28% gain in the last month alone. Looking back a bit further, it's encouraging to see the stock is up 72% in the last year.

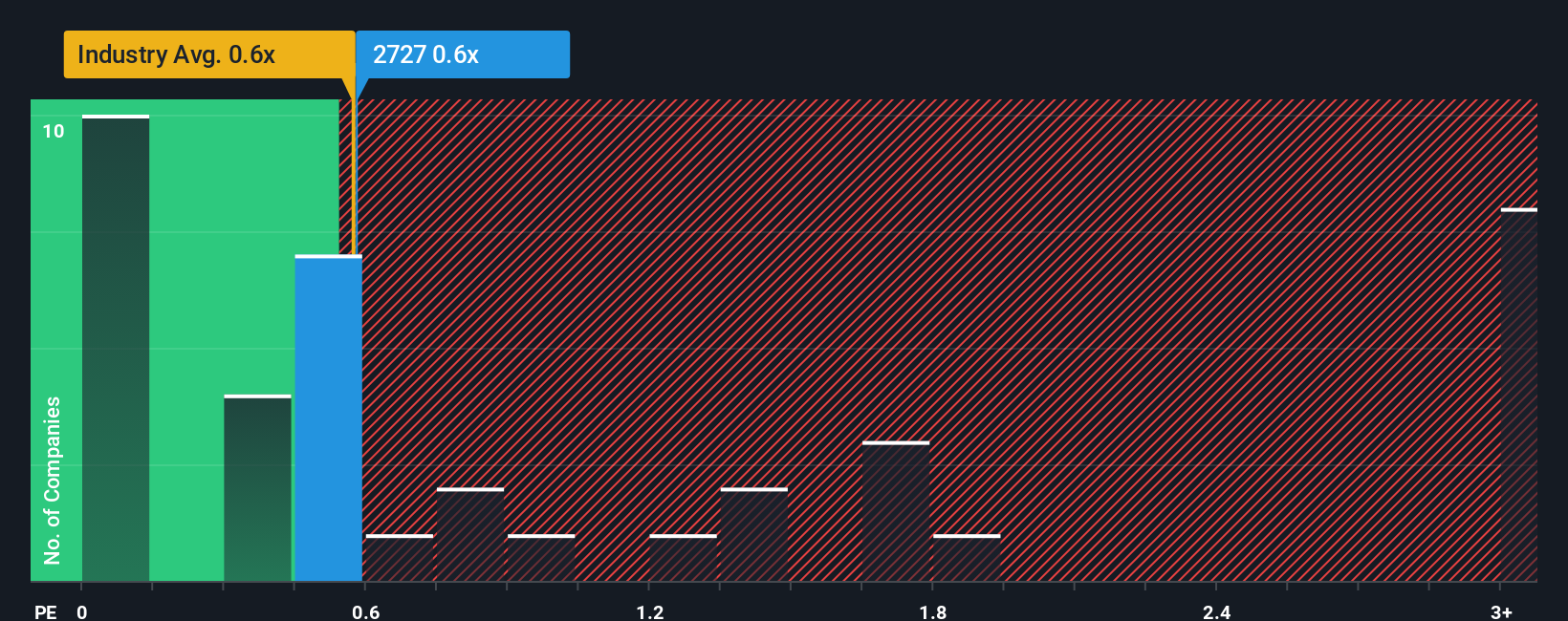

Although its price has surged higher, you could still be forgiven for feeling indifferent about Shanghai Electric Group's P/S ratio of 0.6x, since the median price-to-sales (or "P/S") ratio for the Electrical industry in Hong Kong is about the same. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Shanghai Electric Group

What Does Shanghai Electric Group's Recent Performance Look Like?

With revenue growth that's inferior to most other companies of late, Shanghai Electric Group has been relatively sluggish. Perhaps the market is expecting future revenue performance to lift, which has kept the P/S from declining. If not, then existing shareholders may be a little nervous about the viability of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Shanghai Electric Group will help you uncover what's on the horizon.Is There Some Revenue Growth Forecasted For Shanghai Electric Group?

Shanghai Electric Group's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a decent 8.1% gain to the company's revenues. Although, the latest three year period in total hasn't been as good as it didn't manage to provide any growth at all. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next year should generate growth of 5.4% as estimated by the two analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 17%, which is noticeably more attractive.

With this information, we find it interesting that Shanghai Electric Group is trading at a fairly similar P/S compared to the industry. It seems most investors are ignoring the fairly limited growth expectations and are willing to pay up for exposure to the stock. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

The Key Takeaway

Its shares have lifted substantially and now Shanghai Electric Group's P/S is back within range of the industry median. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Given that Shanghai Electric Group's revenue growth projections are relatively subdued in comparison to the wider industry, it comes as a surprise to see it trading at its current P/S ratio. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Shanghai Electric Group with six simple checks.

If you're unsure about the strength of Shanghai Electric Group's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2727

Shanghai Electric Group

Manufactures and sells industrial and energy equipment in Mainland China and internationally.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives