- Hong Kong

- /

- Industrials

- /

- SEHK:267

CITIC (SEHK:267) Earnings Forecast: Profit Growth to Outpace Market Despite Revenue Decline

Reviewed by Simply Wall St

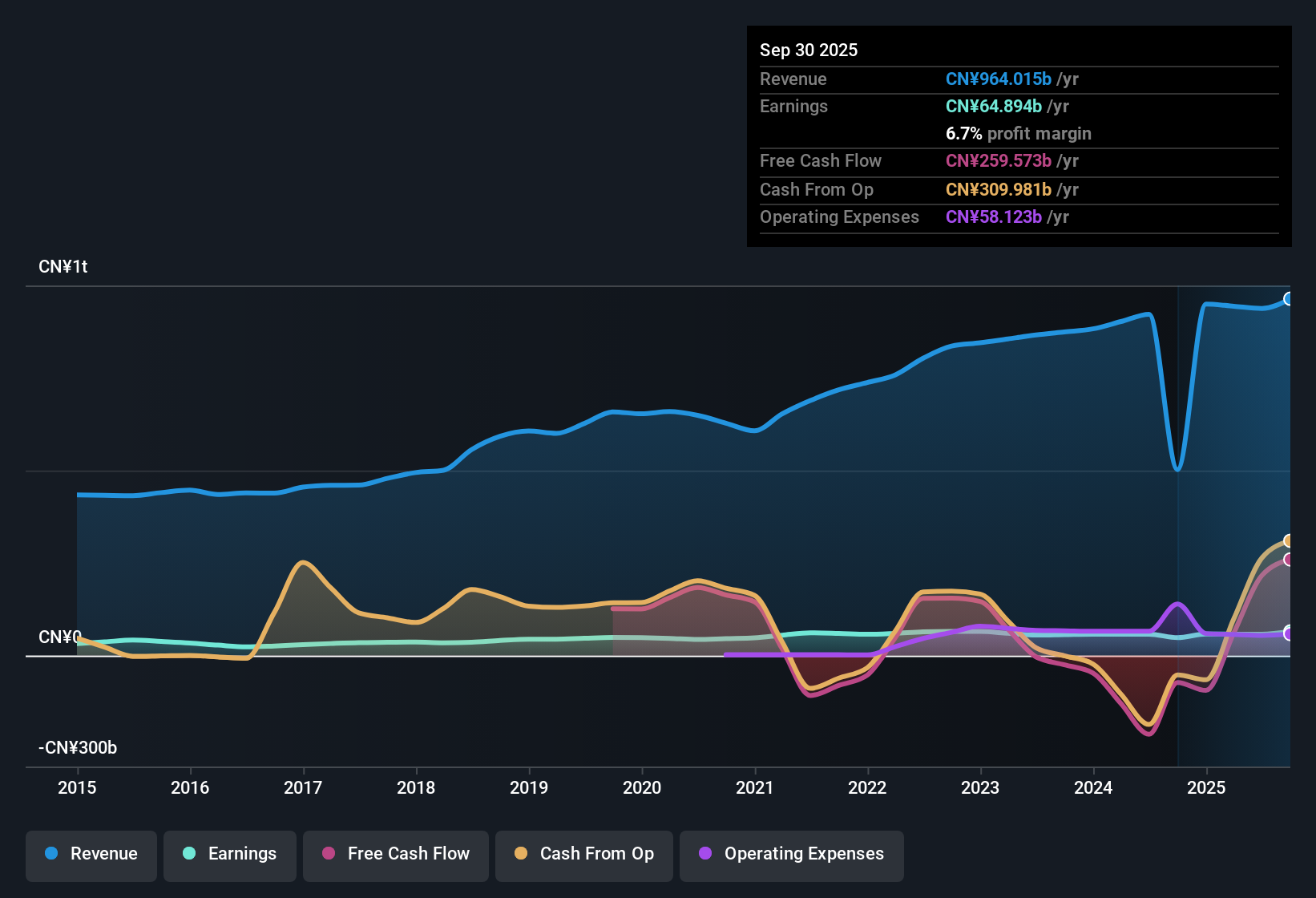

CITIC (SEHK:267) posted a net profit margin of 6.1%, just below last year’s 6.2%, while earnings grew 1.9% over the past year, beating its five-year average growth of 1.4% per year. Despite forecasts for revenue to fall by 6.1% per year over the next three years, the company’s earnings are projected to rise by 12.93% per year, edging out the broader Hong Kong market’s 12% growth forecast. With shares trading at HK$12.02, which is markedly below the estimated fair value, investors are likely to focus on CITIC's favorable valuation and sustained profit growth as key drivers this earnings season.

See our full analysis for CITIC.Next up, we will see how all these metrics stack up when measured against the most widely held market narratives, and whether the numbers support or challenge current sentiment around CITIC.

See what the community is saying about CITIC

Profit Margins Expected to Climb

- Analysts see net profit margins rebounding from 6.1% today to 9.9% within three years, even as revenue is projected to drop 6.1% annually in that period.

- According to the analysts' consensus view, margin expansion is set to be powered by several factors:

- Investments in technology and smart manufacturing are expected to boost efficiencies and profitability. This is projected to support higher net margins over time.

- Strategic international expansion, especially along the Belt and Road, is anticipated to solidify global revenue streams and offset pressure from shrinking domestic sales.

- For investors eager to see how rising margins stack up against market expectations, the latest consensus narrative for CITIC lays it out in full detail. 📊 Read the full CITIC Consensus Narrative.

Dividend Appeal Gains Traction

- The company aims to increase its dividend payout ratio to at least 30% by 2026. This target is intended to provide a more attractive yield for income-focused shareholders.

- In the analysts' consensus view, this dividend strategy brings a few key themes into play:

- Higher payouts could attract income-seeking investors and underpin a more supportive shareholder base. This may help stabilize the stock price despite sector headwinds.

- Consistent earnings growth forecasts, with profits expected to reach CN¥72.5 billion in 2028 (up from CN¥57.3 billion), further bolster the foundation for reliable dividend growth.

Shares Trade at Unexpected Discount

- CITIC's current share price of HK$12.02 sits dramatically below its DCF fair value of HK$493.99 and also trails peer and sector price/earnings ratios. CITIC is at 5.4x versus the industry at 12.5x and peers at 29.6x.

- Analysts’ consensus narrative highlights a rare window for value-focused investors:

- Even with projected revenue declines, CITIC is forecast to deliver profit growth outpacing the greater Hong Kong market at 12.93% per year. This anchors the case for a price rerating.

- The analyst target price for CITIC is HK$13.17, slightly above today’s price, reflecting cautious optimism baked into the valuation gap.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for CITIC on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a unique take on these figures? Share your own perspective by building a custom narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding CITIC.

See What Else Is Out There

Although CITIC’s profit growth and margins are forecast to improve, declining revenue remains a significant weakness and could weigh on future results.

If reliable expansion is your priority, check out stable growth stocks screener (2087 results) to find companies that consistently grow revenue and earnings even as markets change.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:267

CITIC

Operates in the financial services, advanced intelligent manufacturing, advanced materials, consumption, and urbanization businesses in the Mainland of China, Hong Kong, Macau, Taiwan, and internationally.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives