- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2588

BOC Aviation (HKG:2588) earnings and shareholder returns have been trending downwards for the last three years, but the stock advances 4.3% this past week

Investors are understandably disappointed when a stock they own declines in value. But no-one can make money on every call, especially in a declining market. While the BOC Aviation Limited (HKG:2588) share price is down 26% in the last three years, the total return to shareholders (which includes dividends) was -18%. And that total return actually beats the market decline of 26%.

While the stock has risen 4.3% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

See our latest analysis for BOC Aviation

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, BOC Aviation moved from a loss to profitability. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

With revenue flat over three years, it seems unlikely that the share price is reflecting the top line. We're not entirely sure why the share price is dropped, but it does seem likely investors have become less optimistic about the business.

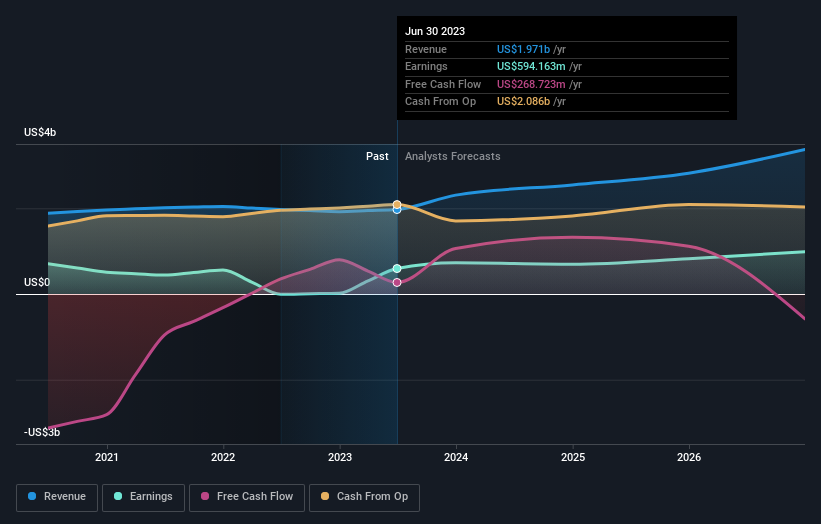

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

BOC Aviation is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for BOC Aviation in this interactive graph of future profit estimates.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of BOC Aviation, it has a TSR of -18% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that BOC Aviation shareholders have received a total shareholder return of 2.8% over the last year. That's including the dividend. That gain is better than the annual TSR over five years, which is 3%. Therefore it seems like sentiment around the company has been positive lately. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - BOC Aviation has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

We will like BOC Aviation better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

Valuation is complex, but we're here to simplify it.

Discover if BOC Aviation might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2588

BOC Aviation

Operates as an aircraft operating leasing company in Mainland China, Hong Kong, Macau, Taiwan, rest of the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Very undervalued slight.