- Hong Kong

- /

- Aerospace & Defense

- /

- SEHK:2507

Could Warranty Standardization Shape Cirrus Aircraft's (SEHK:2507) Competitive Edge in Customer Support?

Reviewed by Sasha Jovanovic

- Cirrus Aircraft Limited recently announced that its subsidiary, Cirrus Design, has entered into an Extended Warranty Master Supply Agreement with Continental Aerospace Technologies, allowing the purchase of extended warranty coverage for engines to meet customer demand.

- This agreement supports Cirrus Aircraft’s ongoing efforts to enhance product support and customer protection while standardizing warranty arrangements across its offerings.

- We’ll explore how Cirrus Aircraft’s focus on standardizing warranties could shape its investment narrative moving forward.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Cirrus Aircraft's Investment Narrative?

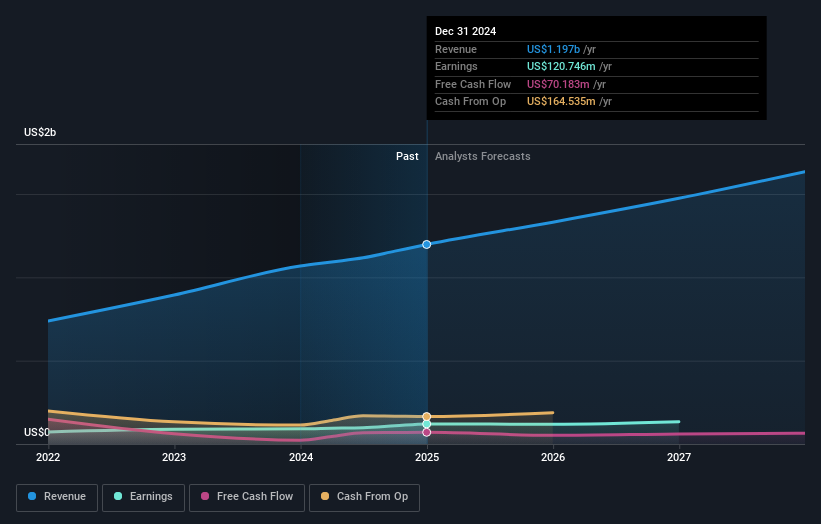

To own Cirrus Aircraft, you need to believe that its position in general aviation can be defended through strong technology, product innovation, and premium customer support. The recently announced engine warranty agreement with Continental Aerospace Technologies fits directly into this narrative, as it aims to improve customer retention and experience by standardizing protection across the Cirrus product line. While this move supports a recurring theme of enhancing lifetime value for customers, it is not likely to dramatically change the main short term catalysts, which continue to be delivery volumes, manufacturing expansion, and the market appetite for personal aviation. The risks haven’t disappeared: board turnover and low board experience levels remain, along with a relatively low return on equity that could limit capital efficiency. Still, new product introductions and growing fleet deliveries could help offset these factors, with the warranty agreement acting more as a support to the existing story rather than a game-changer.

But some caution is needed, especially around board experience and leadership changes. Despite retreating, Cirrus Aircraft's shares might still be trading 8% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Cirrus Aircraft - why the stock might be worth just HK$57.74!

Build Your Own Cirrus Aircraft Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cirrus Aircraft research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Cirrus Aircraft research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cirrus Aircraft's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2507

Cirrus Aircraft

Manufactures and sells piston aircraft and single-engine turbine jets worldwide.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives