- Hong Kong

- /

- Healthcare Services

- /

- SEHK:2522

3 SEHK Stocks Estimated To Be Trading Below Intrinsic Value By Up To 40.9%

Reviewed by Simply Wall St

In recent weeks, the Hong Kong market has seen fluctuations, with the Hang Seng Index experiencing a decline of 2.11% as concerns over deflationary pressures in China persist. Amid these conditions, investors are increasingly on the lookout for stocks that may be undervalued relative to their intrinsic worth, presenting potential opportunities for those who can identify companies trading below their estimated value by significant margins.

Top 10 Undervalued Stocks Based On Cash Flows In Hong Kong

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| BYD Electronic (International) (SEHK:285) | HK$34.50 | HK$63.78 | 45.9% |

| Giant Biogene Holding (SEHK:2367) | HK$50.70 | HK$98.23 | 48.4% |

| Kuaishou Technology (SEHK:1024) | HK$46.25 | HK$88.50 | 47.7% |

| MicroPort NeuroScientific (SEHK:2172) | HK$9.72 | HK$18.83 | 48.4% |

| Yadea Group Holdings (SEHK:1585) | HK$12.32 | HK$23.21 | 46.9% |

| Shanghai INT Medical Instruments (SEHK:1501) | HK$28.50 | HK$55.69 | 48.8% |

| Hangzhou SF Intra-city Industrial (SEHK:9699) | HK$10.24 | HK$19.48 | 47.4% |

| Semiconductor Manufacturing International (SEHK:981) | HK$29.60 | HK$54.85 | 46% |

| CSC Financial (SEHK:6066) | HK$9.36 | HK$17.19 | 45.5% |

| Akeso (SEHK:9926) | HK$67.00 | HK$127.77 | 47.6% |

Let's review some notable picks from our screened stocks.

Hua Hong Semiconductor (SEHK:1347)

Overview: Hua Hong Semiconductor Limited is an investment holding company that manufactures and sells semiconductor products, with a market capitalization of HK$50.34 billion.

Operations: Revenue segments for Hua Hong Semiconductor Limited include manufacturing and selling semiconductor products.

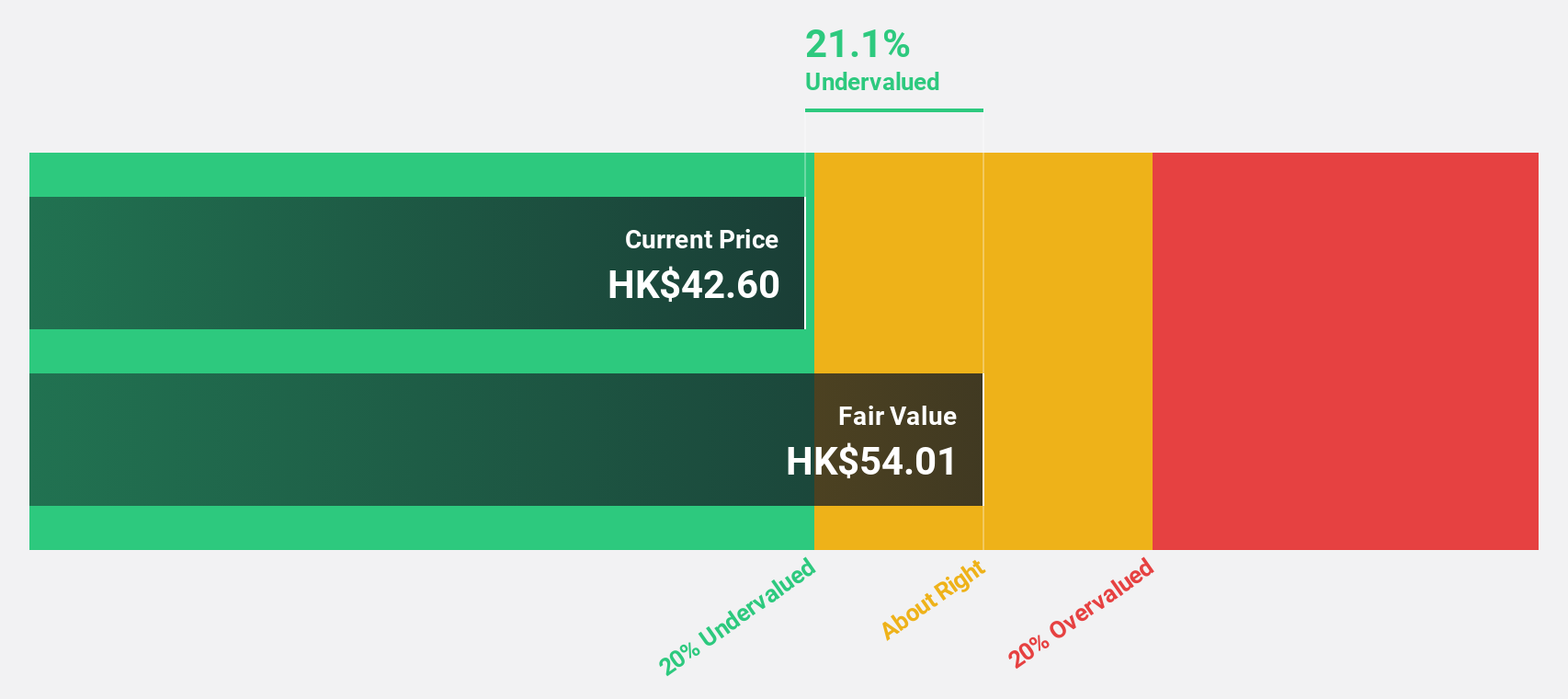

Estimated Discount To Fair Value: 40.9%

Hua Hong Semiconductor is trading at HK$23.3, significantly below its estimated fair value of HK$39.44, suggesting it may be undervalued based on cash flows. Despite a drop in second-quarter sales to US$478.52 million from US$631.38 million last year and lower profit margins, earnings are expected to grow significantly by 33.33% annually over the next three years, outpacing the Hong Kong market's growth rate of 12.1%.

- According our earnings growth report, there's an indication that Hua Hong Semiconductor might be ready to expand.

- Dive into the specifics of Hua Hong Semiconductor here with our thorough financial health report.

AviChina Industry & Technology (SEHK:2357)

Overview: AviChina Industry & Technology Company Limited develops, manufactures, and sells civil aviation and defense products in Hong Kong and internationally, with a market cap of HK$31.81 billion.

Operations: The company's revenue segments include Aviation Entire Aircraft at CN¥20.16 billion, Aviation Engineering Services at CN¥11.05 billion, and Aviation Ancillary System and Related Business at CN¥53.01 billion.

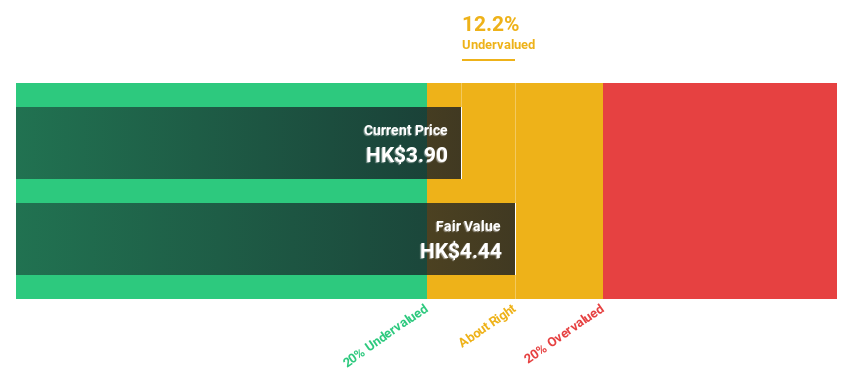

Estimated Discount To Fair Value: 10.5%

AviChina Industry & Technology is trading at HK$3.99, slightly below its estimated fair value of HK$4.46, indicating potential undervaluation based on cash flows. Despite a decrease in half-year revenue to CNY 33.62 billion from CNY 40.87 billion last year, earnings are projected to grow significantly by over 20% annually for the next three years, surpassing the Hong Kong market's growth rate of 12.1%.

- Our growth report here indicates AviChina Industry & Technology may be poised for an improving outlook.

- Click here to discover the nuances of AviChina Industry & Technology with our detailed financial health report.

Jiangxi Rimag Group (SEHK:2522)

Overview: Jiangxi Rimag Group Co., Ltd. operates medical imaging centers in China with a market cap of HK$11.69 billion.

Operations: The company generates revenue of CN¥812.85 million from its Medical Labs & Research segment.

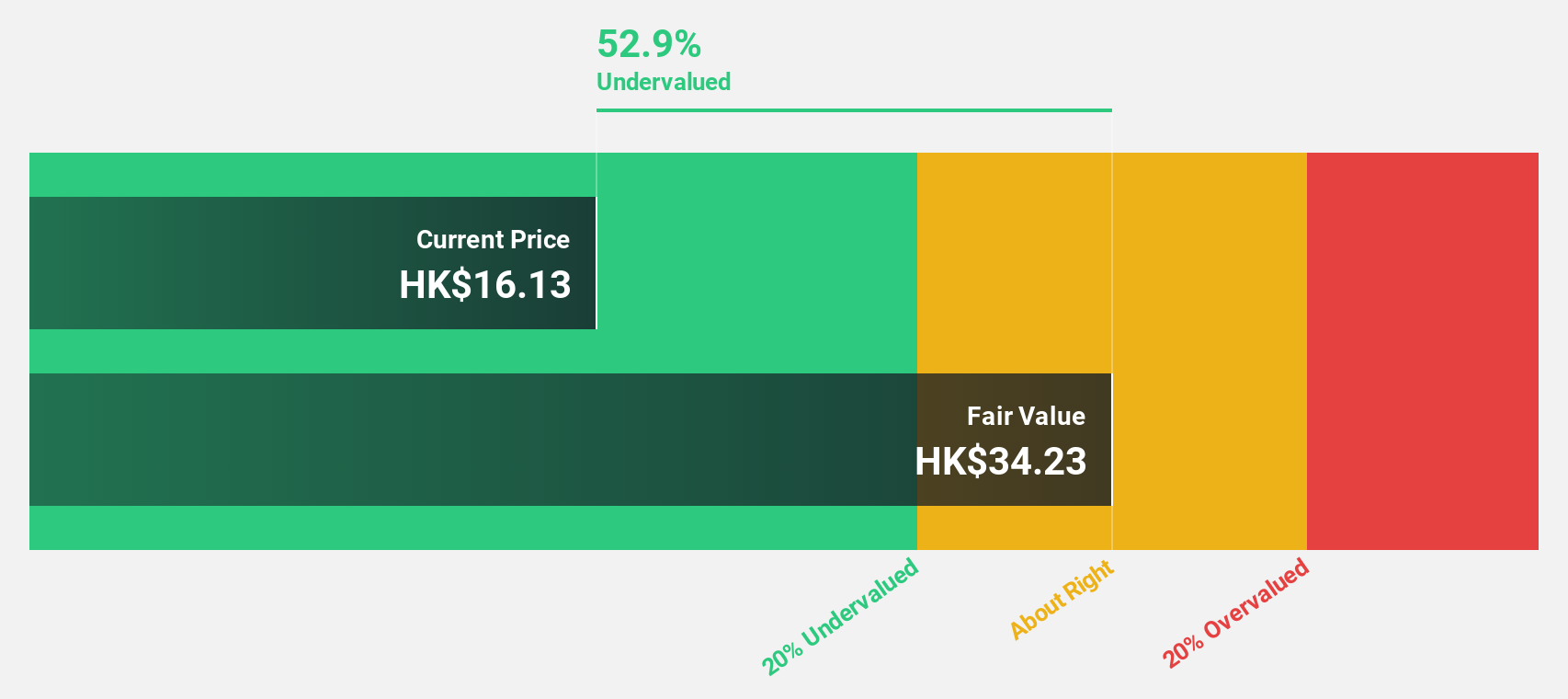

Estimated Discount To Fair Value: 33%

Jiangxi Rimag Group, trading at HK$32.8, is significantly undervalued compared to its fair value estimate of HK$48.94. Despite a drop in half-year sales from CNY 529.78 million to CNY 413.71 million and net income from CNY 42.98 million to CNY 3.84 million, earnings are forecasted to grow by over 70% annually for the next three years, outpacing the Hong Kong market's growth rate of 12.1%.

- Our expertly prepared growth report on Jiangxi Rimag Group implies its future financial outlook may be stronger than recent results.

- Click to explore a detailed breakdown of our findings in Jiangxi Rimag Group's balance sheet health report.

Where To Now?

- Unlock more gems! Our Undervalued SEHK Stocks Based On Cash Flows screener has unearthed 36 more companies for you to explore.Click here to unveil our expertly curated list of 39 Undervalued SEHK Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2522

High growth potential with adequate balance sheet.