Weichai Power (SEHK:2338) Is Up 6.6% After Reporting Higher Nine-Month Sales and Earnings—What's Changed

Reviewed by Sasha Jovanovic

- Weichai Power Co., Ltd. reported earnings for the nine months ended September 30, 2025, posting sales of CNY 170.57 billion and net income of CNY 8.88 billion, both higher than the same period last year.

- The results showed an increase in both revenue and basic earnings per share from continuing operations, highlighting ongoing improvement in profitability and operational scale.

- With solid gains in sales and earnings, we'll examine how Weichai Power's consistent financial growth impacts its investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

What Is Weichai Power's Investment Narrative?

Weichai Power’s latest results reinforce the importance of its growth story, which has attracted attention with steady revenue and profit rises even as the dividend track record remains unstable. The stronger sales and net income reported for the nine months to September 2025 provide more confidence around short-term catalysts such as continued market demand and execution of the ongoing share buyback, both of which have helped sentiment and supported recent positive share price momentum. However, the scale of these gains does not fundamentally alter the most important risks, such as board transition and governance concerns, as the board’s experience and independence have not improved. The recent news is encouraging for operational scale and margin trends, but for most investors, the material risks and growth outlook remain largely unchanged by these numbers, especially relative to consensus price targets and forecasted growth rates.

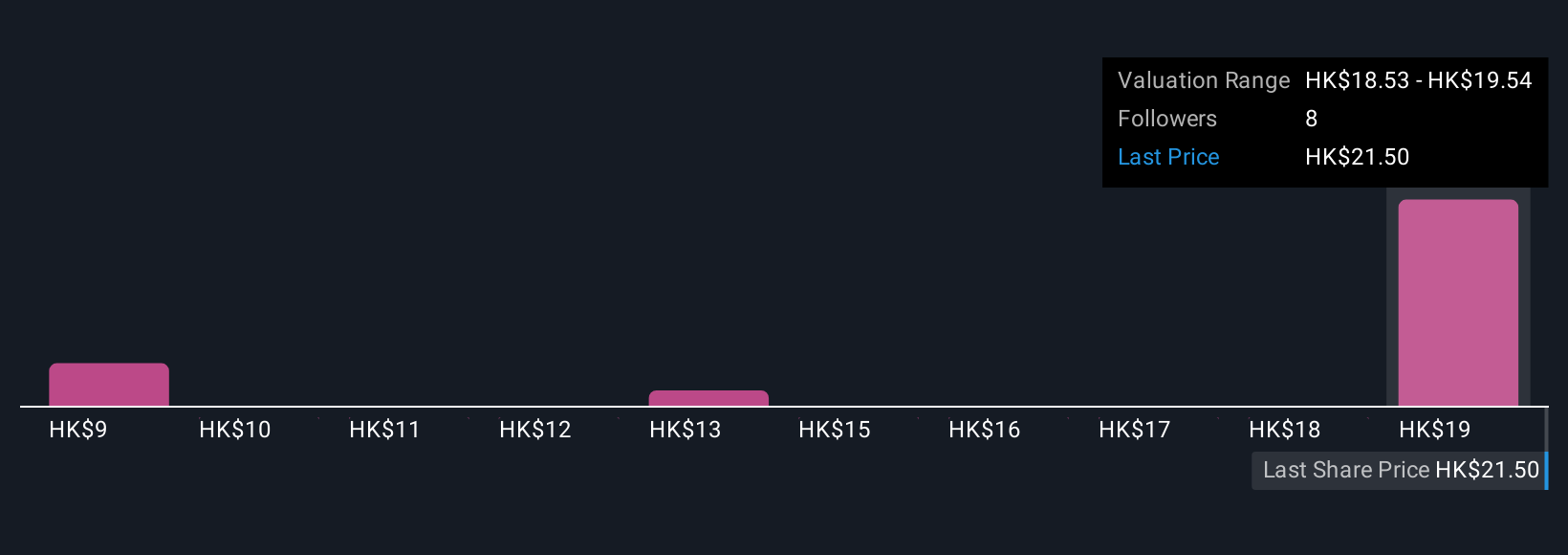

But unlike those strong headline numbers, board experience remains a key concern for investors. Weichai Power's shares have been on the rise but are still potentially undervalued by 14%. Find out what it's worth.Exploring Other Perspectives

Explore 5 other fair value estimates on Weichai Power - why the stock might be worth as much as 20% more than the current price!

Build Your Own Weichai Power Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Weichai Power research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Weichai Power research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Weichai Power's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Weichai Power might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2338

Weichai Power

Engages in the automobile and equipment manufacturing industry in China and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives