- Hong Kong

- /

- Trade Distributors

- /

- SEHK:2098

More Unpleasant Surprises Could Be In Store For Zall Smart Commerce Group Ltd.'s (HKG:2098) Shares After Tumbling 26%

Zall Smart Commerce Group Ltd. (HKG:2098) shares have had a horrible month, losing 26% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 42% share price drop.

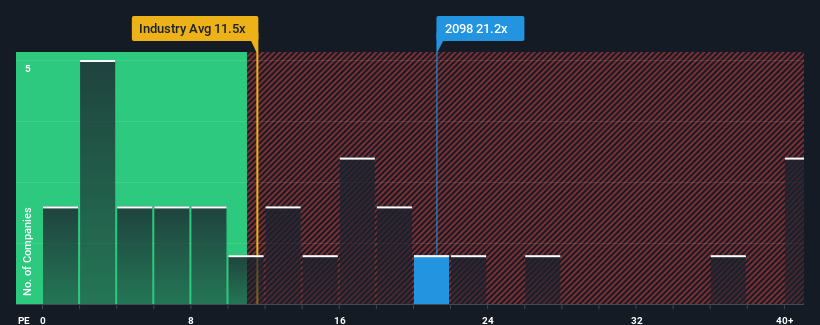

Although its price has dipped substantially, Zall Smart Commerce Group may still be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 21.2x, since almost half of all companies in Hong Kong have P/E ratios under 10x and even P/E's lower than 5x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

We've discovered 4 warning signs about Zall Smart Commerce Group. View them for free.With earnings growth that's exceedingly strong of late, Zall Smart Commerce Group has been doing very well. It seems that many are expecting the strong earnings performance to beat most other companies over the coming period, which has increased investors’ willingness to pay up for the stock. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Zall Smart Commerce Group

Is There Enough Growth For Zall Smart Commerce Group?

The only time you'd be truly comfortable seeing a P/E as steep as Zall Smart Commerce Group's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 153% last year. Still, EPS has barely risen at all from three years ago in total, which is not ideal. Therefore, it's fair to say that earnings growth has been inconsistent recently for the company.

This is in contrast to the rest of the market, which is expected to grow by 18% over the next year, materially higher than the company's recent medium-term annualised growth rates.

With this information, we find it concerning that Zall Smart Commerce Group is trading at a P/E higher than the market. It seems most investors are ignoring the fairly limited recent growth rates and are hoping for a turnaround in the company's business prospects. There's a good chance existing shareholders are setting themselves up for future disappointment if the P/E falls to levels more in line with recent growth rates.

What We Can Learn From Zall Smart Commerce Group's P/E?

Even after such a strong price drop, Zall Smart Commerce Group's P/E still exceeds the rest of the market significantly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Zall Smart Commerce Group currently trades on a much higher than expected P/E since its recent three-year growth is lower than the wider market forecast. When we see weak earnings with slower than market growth, we suspect the share price is at risk of declining, sending the high P/E lower. If recent medium-term earnings trends continue, it will place shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Zall Smart Commerce Group (of which 2 are concerning!) you should know about.

If these risks are making you reconsider your opinion on Zall Smart Commerce Group, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zall Smart Commerce Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:2098

Zall Smart Commerce Group

An investment holding company, engages in the supply chain management and trading businesses in the People’s Republic of China and Singapore.

Slight with acceptable track record.

Market Insights

Community Narratives