How the Launch of Haitian's Serbian Facility (SEHK:1882) Might Shift Its European Investment Narrative

Reviewed by Sasha Jovanovic

- Earlier this month, Haitian International Holdings held an internal Open House event at its new production facility in Ruma, Serbia, a site that will focus on manufacturing injection molding machines and supplying spare parts tailored to the European market.

- This move marks a significant step in Haitian's commitment to localized production, R&D, and customer support across Europe, with built-in capacity for further expansion as regional demand evolves.

- We'll explore how the localization of manufacturing and R&D through the Serbian facility shapes Haitian International Holdings' investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Haitian International Holdings' Investment Narrative?

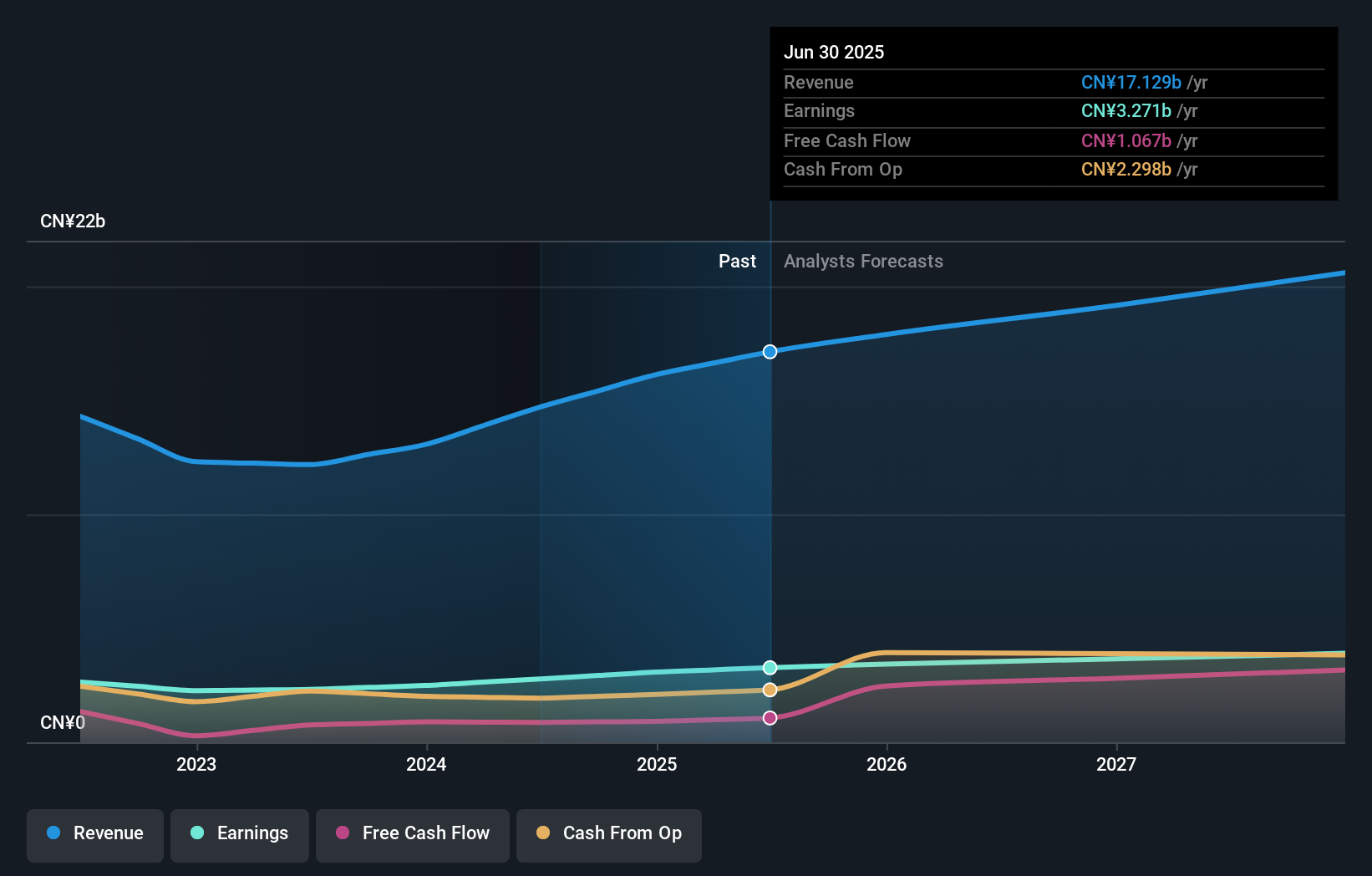

For investors considering Haitian International Holdings, the central question remains how effectively the company can balance slower growth forecasts with moves to reinforce its position in key markets. The recent inauguration of the Serbian facility could alter near-term catalysts by offering Haitian greater access to European demand, supply chain efficiency and new R&D talent, supporting the company’s aim to localize production closer to important customers. This may reduce some immediate risks tied to logistics, while also strengthening ties within Europe’s plastics industry. However, given consensus views from before this announcement, such as muted expected profit growth and the stock’s discount against analyst price targets, the magnitude of positive impact from the Serbian expansion isn’t yet clear from recent share price movements. Short-term risks like competitive pricing pressure and below-market profit growth remain important, even as operational upgrades may support longer-term resilience. On the other hand, board independence remains a point investors should be aware of.

Despite retreating, Haitian International Holdings' shares might still be trading 48% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore another fair value estimate on Haitian International Holdings - why the stock might be worth just HK$42.43!

Build Your Own Haitian International Holdings Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Haitian International Holdings research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Haitian International Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Haitian International Holdings' overall financial health at a glance.

Ready For A Different Approach?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haitian International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1882

Haitian International Holdings

An investment holding company, engages in the manufacture, distribution, and sale of plastic injection molding machines and related products in Mainland China, Hong Kong, and internationally.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success