- Hong Kong

- /

- Construction

- /

- SEHK:1783

A Look at Envision Greenwise Holdings (SEHK:1783) Valuation Following Its Net Profit Turnaround

Reviewed by Simply Wall St

Envision Greenwise Holdings (SEHK:1783) has drawn investor attention after announcing a turnaround to net profit for the half year ended September 30, 2025. The results reflect clear momentum in its financial performance.

See our latest analysis for Envision Greenwise Holdings.

Envision Greenwise Holdings’ shares have faced turbulence recently, with a 90-day share price return of -27.15% and a year-to-date slide of -17.91%. However, the stock’s 1-year total shareholder return stands out at 8.46%, and those who have held the stock for the long run are sitting on eye-popping gains. Its three-year total shareholder return is close to 900%. With momentum shifting after the turnaround news and renewed growth in core segments, investors’ risk appetite may be on the rise again.

If you’re curious about what else is catching attention beyond this turnaround story, it’s the perfect time to broaden your perspective and discover fast growing stocks with high insider ownership

With share prices still lagging and new profitability milestones reached, the key question is whether Envision Greenwise Holdings is trading at a discount or if the recent turnaround has already been fully reflected in its valuation.

Price-to-Sales of 6.2x: Is it justified?

Envision Greenwise Holdings currently trades at a price-to-sales (P/S) ratio of 6.2x, making it appear expensive relative to both its sector and broad market peers. At its last close of HK$3.14, this valuation metric considerably overshoots key industry benchmarks.

The price-to-sales ratio reflects what investors are willing to pay for each HK$1 of company sales. For a business in the construction and environmental services sector, this ratio helps signal whether investors expect sustainable growth, profitability, or unique market advantages. In this context, it suggests that market expectations for future revenue or margin expansion might be quite high.

When compared to the Hong Kong Construction industry average of just 0.4x and a peer group average of 5.8x, Envision Greenwise Holdings stands out as richly valued. This substantial premium raises the question of whether its recent turnaround and new profitability are enough to justify the added optimism, or whether market enthusiasm has run ahead of fundamentals.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Sales of 6.2x (OVERVALUED)

However, slowdowns in construction demand or unforeseen regulatory shifts could quickly challenge the current optimism around Envision Greenwise Holdings’ turnaround story.

Find out about the key risks to this Envision Greenwise Holdings narrative.

Another View: What Does the SWS DCF Model Say?

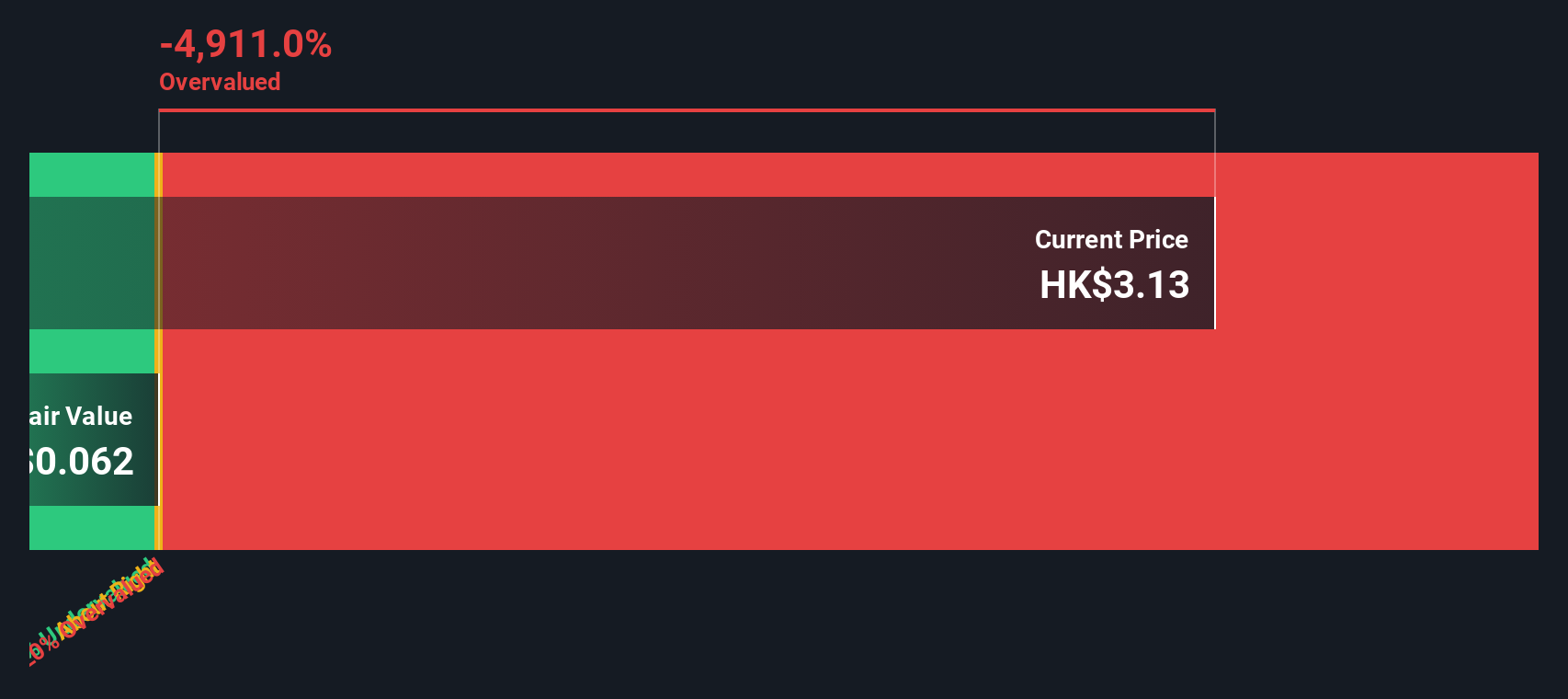

Taking a step back from sales ratios, our DCF model provides a different perspective on Envision Greenwise Holdings’ valuation. According to the SWS DCF model, the shares are trading well above the estimated fair value of HK$0.14, which indicates significant overvaluation from a long-term cash flow perspective. Is market optimism the sole driver of the higher price, or is there a story yet to unfold?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Envision Greenwise Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 920 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Envision Greenwise Holdings Narrative

If you want to weigh the data differently or dig deeper on your own terms, you can easily build your personal take in a few short minutes. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Envision Greenwise Holdings.

Looking for more investment ideas?

Don’t let hidden opportunities pass you by. Use the Simply Wall Street Screener to target unique growth stories, untapped sectors, and potential future winners with just a few clicks.

- Access the potential of emerging artificial intelligence trends by checking out these 25 AI penny stocks, which feature rapid growth and innovation.

- Strengthen your search for steady income by reviewing these 15 dividend stocks with yields > 3%, which offer robust yields above 3% and solid fundamentals.

- Get ahead of the curve in digital finance by checking out these 81 cryptocurrency and blockchain stocks, which are positioned at the forefront of blockchain and cryptocurrency advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Envision Greenwise Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1783

Envision Greenwise Holdings

An investment holding company, operates in the construction business in Hong Kong and the People’s Republic of China.

Excellent balance sheet with acceptable track record.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026