- Hong Kong

- /

- Construction

- /

- SEHK:1757

Should You Be Adding Affluent Foundation Holdings (HKG:1757) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Affluent Foundation Holdings (HKG:1757). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Affluent Foundation Holdings with the means to add long-term value to shareholders.

View our latest analysis for Affluent Foundation Holdings

How Fast Is Affluent Foundation Holdings Growing Its Earnings Per Share?

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Affluent Foundation Holdings grew its EPS from HK$0.00054 to HK$0.0025, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement.

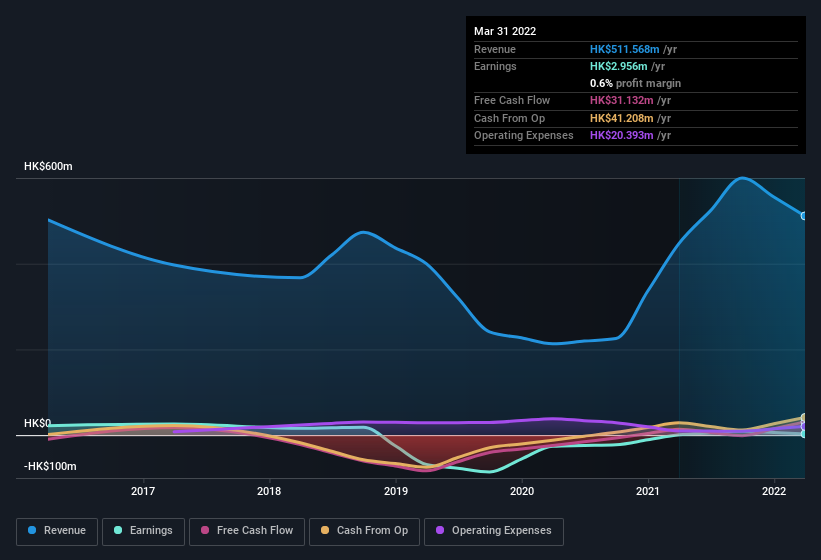

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. While we note Affluent Foundation Holdings achieved similar EBIT margins to last year, revenue grew by a solid 14% to HK$512m. That's encouraging news for the company!

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

Affluent Foundation Holdings isn't a huge company, given its market capitalisation of HK$293m. That makes it extra important to check on its balance sheet strength.

Are Affluent Foundation Holdings Insiders Aligned With All Shareholders?

Seeing insiders owning a large portion of the shares on issue is often a good sign. Their incentives will be aligned with the investors and there's less of a probability in a sudden sell-off that would impact the share price. So those who are interested in Affluent Foundation Holdings will be delighted to know that insiders have shown their belief, holding a large proportion of the company's shares. Indeed, with a collective holding of 75%, company insiders are in control and have plenty of capital behind the venture. Intuition will tell you this is a good sign because it suggests they will be incentivised to build value for shareholders over the long term. With that sort of holding, insiders have about HK$220m riding on the stock, at current prices. So there's plenty there to keep them focused!

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? Well, based on the CEO pay, you'd argue that they are indeed. For companies with market capitalisations under HK$1.6b, like Affluent Foundation Holdings, the median CEO pay is around HK$1.9m.

Affluent Foundation Holdings' CEO took home a total compensation package worth HK$1.4m in the year leading up to March 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of a culture of integrity, in a broader sense.

Is Affluent Foundation Holdings Worth Keeping An Eye On?

Affluent Foundation Holdings' earnings per share growth have been climbing higher at an appreciable rate. The cherry on top is that insiders own a bucket-load of shares, and the CEO pay seems really quite reasonable. The sharp increase in earnings could signal good business momentum. Big growth can make big winners, so the writing on the wall tells us that Affluent Foundation Holdings is worth considering carefully. Don't forget that there may still be risks. For instance, we've identified 2 warning signs for Affluent Foundation Holdings that you should be aware of.

Although Affluent Foundation Holdings certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:1757

Affluent Foundation Holdings

An investment holding company, provides services related to foundation works in Hong Kong.

Excellent balance sheet with low risk.

Market Insights

Community Narratives